Greenbrier Companies Inc's Meteoric Rise: Unpacking the 29% Surge in Just 3 Months

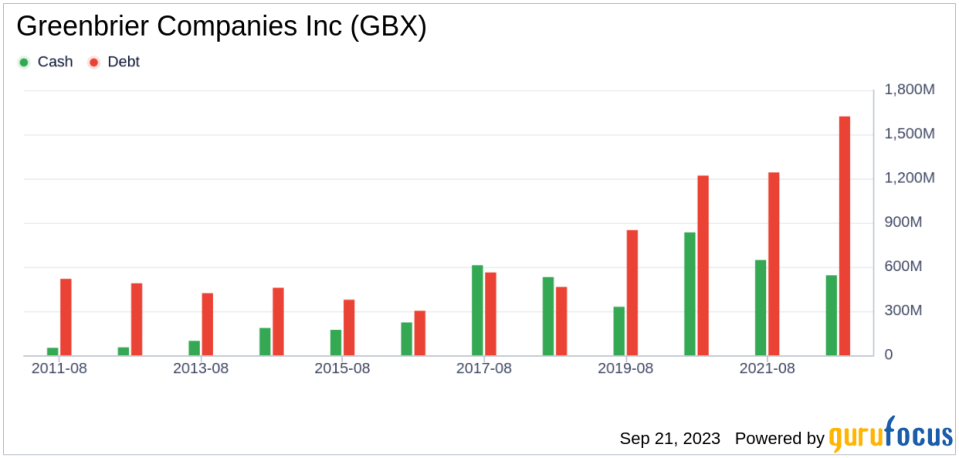

Greenbrier Companies Inc (NYSE:GBX), a prominent player in the transportation industry, has seen a significant surge in its stock price over the past three months. As of September 21, 2023, the company's stock price stands at $41.33, marking a 29.36% increase over the past quarter. This impressive performance is further highlighted by a 3.65% gain in the past week alone. With a market cap of $1.28 billion, Greenbrier's current valuation is a testament to its robust financial health and promising future prospects.

According to the GF Value, a metric defined by GuruFocus.com that calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates, Greenbrier is currently modestly undervalued. The GF Value stands at $51.31, compared to $48.06 three months ago, indicating a positive trend. Three months ago, the company was significantly undervalued, suggesting that the recent price surge is a market correction towards the stock's intrinsic value.

Company Overview

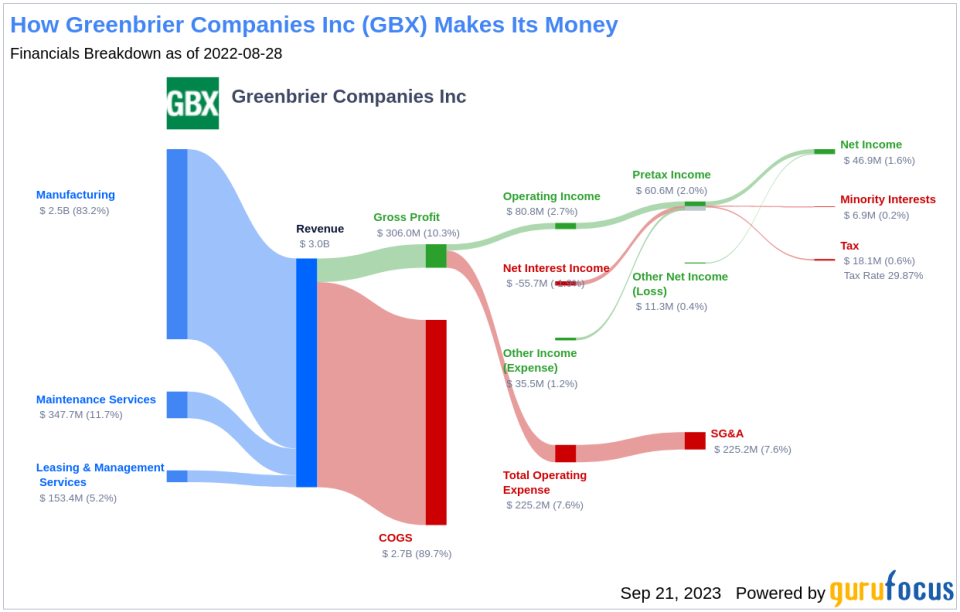

Greenbrier Companies Inc operates in the transportation industry, primarily focusing on the design, manufacture, and marketing of railroad freight car equipment in North America and Europe. The company also produces marine barges in North America and provides wheel services, railcar refurbishment, parts, leasing, and other services to the railroad industry. The majority of its revenue is generated from the manufacturing segment and the United States.

Profitability Analysis

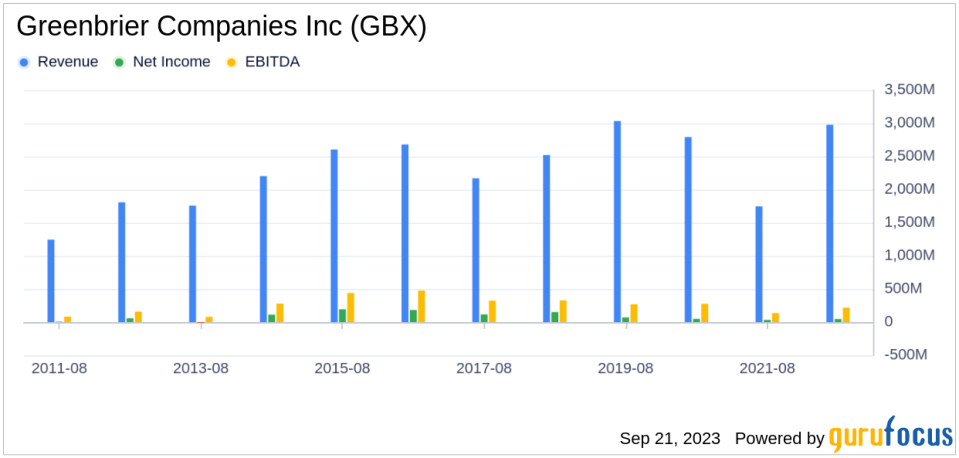

Greenbrier's profitability is commendable, with a Profitability Rank of 7/10 as of May 31, 2023. The company's Operating Margin stands at 5.09%, better than 38% of 950 companies in the same industry. The ROE and ROA are 4.58% and 1.50% respectively, outperforming a significant portion of industry peers. The ROIC of 4.97% indicates that the company generates a healthy cash flow relative to the capital invested in its business. Greenbrier has maintained profitability for 9 out of the past 10 years, better than 70.01% of 927 companies in the same industry.

Growth Prospects

Despite the impressive profitability, Greenbrier's growth prospects appear to be somewhat subdued. The company's Growth Rank is 3/10, indicating a relatively slow growth rate. The 3-Year Revenue Growth Rate per Share is -1.10%, while the 5-Year Revenue Growth Rate per Share is 0.50%. The 3-Year and 5-Year EPS without NRI Growth Rates are -13.20% and -24.70% respectively, suggesting a decline in earnings per share over the past few years.

Major Shareholders

Greenbrier's stock is held by several prominent investors. Barrow, Hanley, Mewhinney & Strauss is the largest shareholder, holding 1,725,778 shares, which constitutes 5.59% of the total shares. HOTCHKIS & WILEY and Ken Fisher (Trades, Portfolio) hold 1,015,390 and 631,406 shares respectively, accounting for 3.29% and 2.04% of the total shares.

Competitive Landscape

Greenbrier operates in a competitive industry, with Trinity Industries Inc(NYSE:TRN), L.B. Foster Co(NASDAQ:FSTR), and FreightCar America Inc(NASDAQ:RAIL) being its main competitors. Trinity Industries Inc, with a market cap of $2.03 billion, is the largest competitor, while L.B. Foster Co and FreightCar America Inc have market caps of $204.076 million and $49.233 million respectively.

Conclusion

In conclusion, Greenbrier Companies Inc has demonstrated strong financial performance, with a significant surge in its stock price over the past quarter. The company's profitability is commendable, and it has maintained profitability for 9 out of the past 10 years. However, the company's growth prospects appear to be somewhat subdued, with a relatively slow growth rate. Despite the competitive landscape, Greenbrier's strong financial health and promising future prospects make it a compelling investment option.

This article first appeared on GuruFocus.