Greenbrier (GBX): A Closer Look at Its Modestly Undervalued Market Position

Greenbrier Companies Inc (NYSE:GBX) experienced a daily gain of 4.27% and a 3-month gain of 26.92%. Its Earnings Per Share (EPS) stands at 1.71. Are these figures indicative of an undervalued stock? This article aims to answer this question by diving deep into the valuation analysis of Greenbrier. Stick around for an in-depth exploration of the company's financial strength, profitability, growth, and more.

Company Introduction

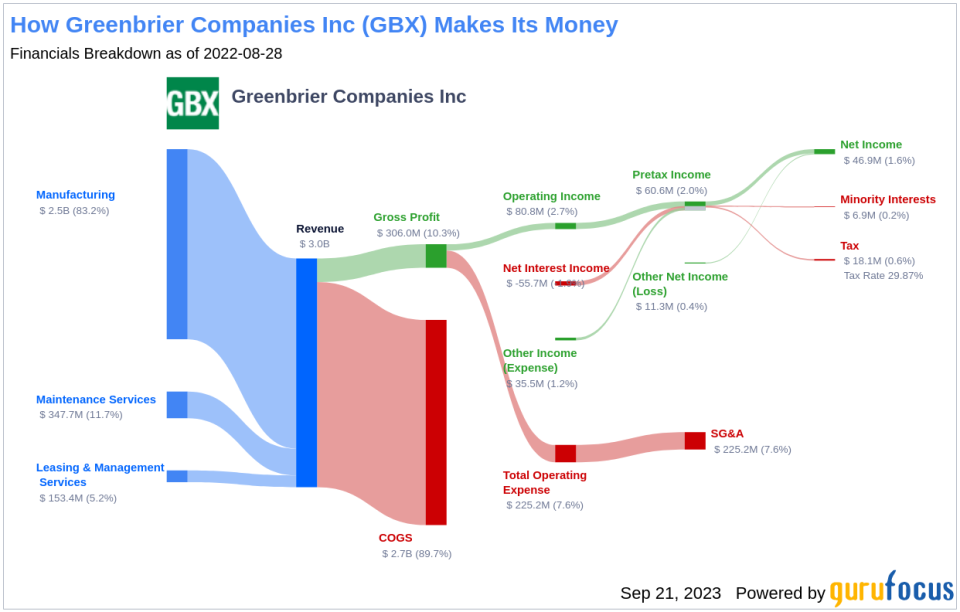

Greenbrier Companies Inc designs, manufactures, and markets railroad freight car equipment in North America and Europe. It also offers marine barges in North America and provides wheel services, railcar refurbishment, and parts, leasing, and other services to the railroad. The company's segments include Manufacturing, Wheels, Repair and Parts, and Leasing and Services, with the manufacturing segment generating a majority of its revenue. Greenbrier's geographical revenue majority comes from the United States.

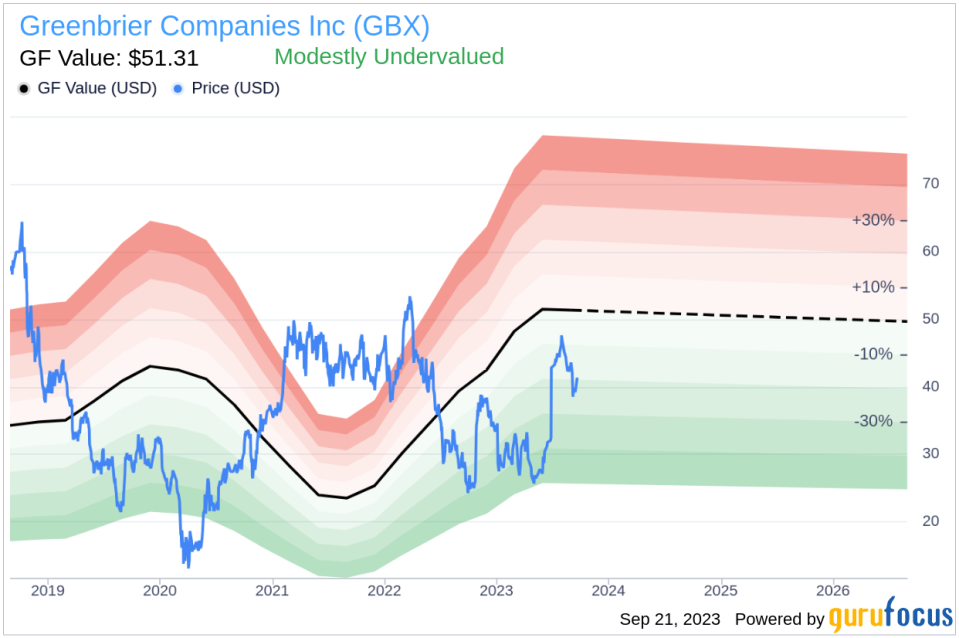

With a stock price of $40.99 and a market cap of $1.30 billion, a comparison with the GF Value, an estimation of fair value, is crucial. This comparison paves the way for a profound exploration of the company's value, integrating financial assessment with essential company details.

Summarizing GF Value

The GF Value is a proprietary measure that represents the current intrinsic value of a stock. It is calculated based on historical multiples (PE Ratio, PS Ratio, PB Ratio, and Price-to-Free-Cash-Flow), a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates. The GF Value Line provides an overview of the fair value at which the stock should ideally be traded.

Greenbrier (NYSE:GBX) is believed to be modestly undervalued according to the GuruFocus Value calculation. This is based on the historical multiples that the stock has traded at, past business growth, and analyst estimates of future business performance. If the price of a stock is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

Given that Greenbrier is relatively undervalued, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliver higher future returns at reduced risk.[...rest of the article...]This article first appeared on GuruFocus.