Greenlight Capital Re Ltd Reports Record Underwriting Income for 2023

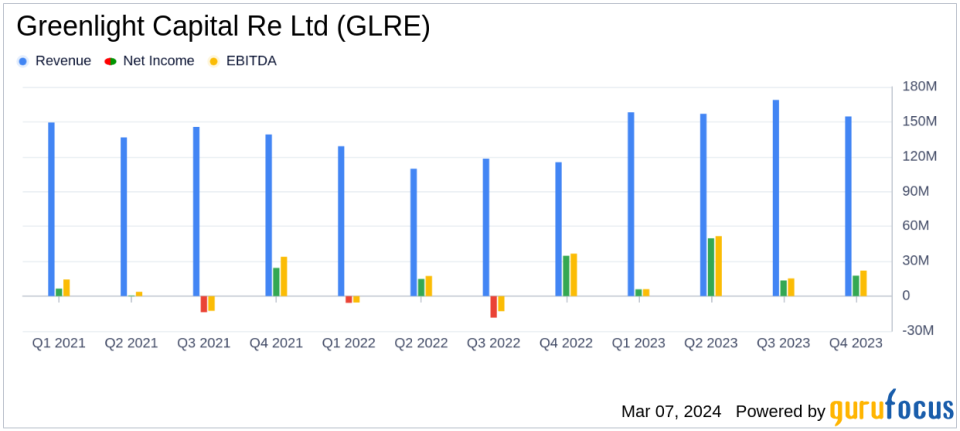

Gross Premiums Written: Increased by 13.1% to $636.8 million for the full year 2023.

Net Premiums Earned: Rose by 24.2% to $583.1 million for the full year 2023.

Underwriting Income: Achieved a record $32.0 million for the full year, a significant turnaround from the previous year's underwriting loss.

Net Income: Reported at $86.8 million, or $2.50 per diluted ordinary share, up from $25.3 million in the previous year.

Combined Ratio: Improved to 94.5% for the full year 2023 from 102.3% in 2022.

Total Investment Income: Totaled $66.1 million for the full year, slightly down from $69.0 million in the previous year.

Fully Diluted Book Value Per Share: Increased by 16.8% to $16.74 at the end of 2023.

On March 5, 2024, Greenlight Capital Re Ltd (NASDAQ:GLRE) released its 8-K filing, announcing its financial results for the fourth quarter and year-ended December 31, 2023. The company, known for its property and casualty reinsurance services, has reported a year of strong financial performance, marked by record underwriting income and significant growth in net premiums earned.

Company Overview

Greenlight Capital Re Ltd operates in the property and casualty reinsurance sector, taking on risks from insurers in exchange for premiums. The company's unique approach combines underwriting with a non-traditional investment strategy, aiming to generate higher long-term returns than those employing conventional methods.

Performance and Challenges

The company's performance in 2023 was noteworthy, with a 13.1% increase in gross premiums written and a 24.2% rise in net premiums earned. The underwriting income reached a record $32.0 million, a stark contrast to the previous year's underwriting loss of $10.7 million. This turnaround is attributed to improved pricing and lower catastrophe losses. However, the company did face challenges, including a decrease in gross premiums written in the fourth quarter due to timing-related premium adjustments and a slight decrease in total investment income for the year.

Financial Achievements

GLRE's financial achievements in 2023 are significant for the insurance industry, which often faces volatility due to unpredictable events. The company's improved combined ratio, from 102.3% to 94.5%, indicates a more efficient use of capital and better underwriting discipline. Additionally, the increase in fully diluted book value per share by 16.8% reflects the company's ability to create shareholder value.

Key Financial Metrics

Important metrics from GLRE's financial statements include the combined ratio, which improved both quarterly and annually, signaling better underwriting profitability. Net income for the year was substantial at $86.8 million, contributing to the increase in fully diluted book value per share to $16.74. These metrics are crucial as they demonstrate the company's profitability and financial stability.

"The Company ended the year with robust growth in fully diluted book value per share, driven by strong performance on both sides of the balance sheet," said Greg Richardson, Chief Executive Officer of Greenlight Re.

"2023 was a milestone year for the company with solid returns on both our underwriting and investing activities," commented David Einhorn (Trades, Portfolio), Chairman of the Board of Directors.

Analysis of Performance

GLRE's strategic focus on underwriting and investment has paid off, as evidenced by the record underwriting income and the growth in net premiums earned. The company's ability to navigate the complexities of the reinsurance market while maintaining a disciplined investment strategy has been a key factor in its success. Despite a competitive environment and economic uncertainties, GLRE's results demonstrate resilience and a strong foundation for continued growth.

For a more detailed analysis of Greenlight Capital Re Ltd's financial results and to listen to the earnings call, investors and interested parties are encouraged to visit the company's website.

Value investors and potential GuruFocus.com members seeking comprehensive insights into Greenlight Capital Re Ltd's financial health can find the full earnings report and expert analysis on GuruFocus.com.

Explore the complete 8-K earnings release (here) from Greenlight Capital Re Ltd for further details.

This article first appeared on GuruFocus.