Greif (GEF) Buys Reliance Products to Boost Packaging Portfolio

Greif, Inc. GEF announced that it acquired Reliance Products, Ltd., a Canada-based manufacturer of high-performance barrier, and conventional blow-molded jerrycans and small plastic containers. The acquisition will boost Greif’s geographical footprint and provide an exciting new barrier technology to its jerrycan and small plastic container offering.

Reliance's operations are strategically positioned to serve the key agriculture markets in North America, with a single operating base in Winnipeg, Canada. Reliance products employ an advanced in-mold fluorination barrier (IMF) technique, adding a compelling capability to Greif's range of barrier technologies.

The deal was fixed at an all-cash transaction, which represents 6.75X proforma adjusted EBITDA. Greif funded the transaction using its existing credit facility.

Greif will report the results of operations for Reliance within its Global Industrial Packaging segment.

In February 2019, the company completed the acquisition of Caraustar Industries, Inc., which strengthened its leadership in industrial packaging and significantly bolstered its margins, free cash flow and profitability.

In 2022, Greif completed the acquisition of Lee Container Corporation, Inc. for $300 million. Lee Container is a leading manufacturer of high-performance barrier and conventional blow-molded containers. The acquisition provided Greif with immediate scale in jerry cans and small plastic bottles in North America.

Greif reported adjusted earnings per share of $1.75 in third-quarter fiscal 2022 (ended Jul 31, 2023), surpassing the Zacks Consensus Estimate of $1.56. The bottom line fell 26% year over year.

Sales were down 18% year over year to $1.33 billion. The top line missed the Zacks Consensus Estimate of $1,335 million. The downfall was mainly due to a decline in volumes, lower selling prices, an unfavorable product mix, and the impacts of changes in foreign currencies against the U.S. Dollar.

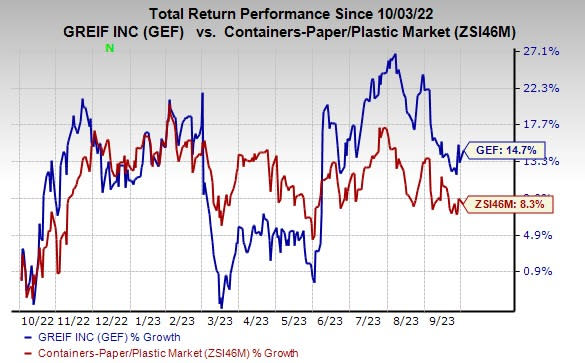

Price Performance

The company’s shares have gained 14.7% in the past year compared with industry’s growth of 8.3%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Greif currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Caterpillar Inc. CAT, Astec Industries, Inc. ASTE and Eaton Corporation plc. ETN. CAT and ASTE sport a Zacks Rank #1 (Strong Buy), and ETN has a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has an average trailing four-quarter earnings surprise of 18.5%. The Zacks Consensus Estimate for CAT’s 2023 earnings is pegged at $19.81 per share. The consensus estimate for 2023 earnings has moved north by 11.4% in the past 60 days. Its shares gained 51.6% in the last year.

Astec has an average trailing four-quarter earnings surprise of 20%. The Zacks Consensus Estimate for ASTE’s 2023 earnings is pegged at $2.81 per share. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. ASTE’s shares gained 22.8% in the last year.

The Zacks Consensus Estimate for Eaton’s 2023 earnings per share is pegged at $8.80. The consensus estimate for 2023 earnings has moved 4% north in the past 60 days. It has a trailing four-quarter average earnings surprise of 3%. Shares of ETN rallied 68.8% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Astec Industries, Inc. (ASTE) : Free Stock Analysis Report

Eaton Corporation, PLC (ETN) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report