Greif (GEF) Completes Ipackchem Acquisition, Boosts Portfolio

Greif, Inc. GEF has closed the previously announced acquisition of Ipackchem Group SAS, a global leader in premium barrier and non-barrier jerrycans and small plastic containers. This strategic acquisition is set to unlock substantial new capabilities and market opportunities, and also fortify Greif's position as a leading provider of high-performance small plastic containers and jerrycans worldwide. This buyout is expected to immediately boost GEF’s EBITDA.

Based in Paris, France, Ipackchem has 13 operating facilities spread across eight countries and has around 1,400 employees. Ipackchem generated sales of approximately $235 million and adjusted EBITDA of approximately $57 million in the twelve months ended Sep 30, 2023. Ipackchem's financial results will be consolidated within Greif's Global Industrial Packaging segment.

Ipackchem’s exposure to secular growth markets in agriculture, specialty chemicals, flavor & fragrances, and pharmaceutical & medical diagnostics makes it a solid fit with Greif’s growth plans. Greif has an ongoing strategy of growing into margin-accretive, resin-based products with strong circularity characteristics serving multiple end markets. The company will also be able to leverage Ipackchem’s unique barrier technology, best-in-class facilities and strong technical and operational management. Grief has estimated synergies of $7 million within 18 months of planned ownership.

The deal was closed with cash totaling $538 million, with an additional $38 million allocated for a ticking fee to compensate Ipackchem’s owner SK Capital Partners for earnings accruing to Greif, alongside customary debt/cash adjustments and currency impact. The funding was secured through Greif's existing credit facility.

The company has been active on the acquisition front since last year. In October 2023, GEF acquired Reliance Products, a leading producer of high-performance barrier and conventional blow-molded jerrycans and small plastic containers in Canada. With this buyout, Greif added to its portfolio of barrier technologies.

In August 2023, GEF acquired 51% of the ownership interest in ColePak, the second-largest supplier of paper partitions in North America. This added a completely new product offering to the company’s paper-converting portfolio, and offered incremental integration benefits to its containerboard and uncoated recycled board mills. In April 2023, Greif increased its stake in Centurion Container from approximately 10% to 80%, enhancing its resin-based offering and the Intermediate Bulk Containers business in North America. The company’s M&A pipeline remains solid and it plans to continue to deploy capital toward value-accretive targets.

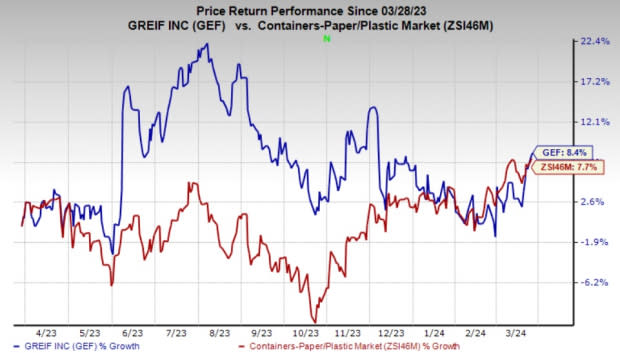

Price Performance

Greif’s shares have gained 8.4% in a year compared with the industry’s 7.7% growth.

Image Source: Zacks Investment Research

Zacks Rank & Other Stocks to Consider

Greif currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks from the Industrial Products sector are Cadre Holdings, Inc. CDRE, Applied Industrial Technologies AIT and AptarGroup ATR. CDRE currently sports a Zacks Rank #1 (Strong Buy), and AIT and PRLB carry a Zacks Rank of 2. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Cadre Holdings’ 2024 earnings is pegged at $1.15 per share. The consensus estimate for 2024 earnings has moved 6% north in the past 60 days and suggests year-over-year growth of 16.7%. The company has a trailing four-quarter average earnings surprise of 33%. CDRE shares have gained 80% in the past year.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2024 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have been unchanged in the past 60 days. The company’s shares have gained 41% in the past year.

The Zacks Consensus Estimate for AptarGroup 2024 earnings is pegged at $5.19 per share. The consensus estimate for 2024 earnings has moved 3% north in the past 60 days and suggests year-over-year growth of 8.6%. The company has a trailing four-quarter average earnings surprise of 7.8%. ATR’s shares have gained 25% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

AptarGroup, Inc. (ATR) : Free Stock Analysis Report

Greif, Inc. (GEF) : Free Stock Analysis Report

Cadre Holdings, Inc. (CDRE) : Free Stock Analysis Report