Greif Inc's Dividend Analysis

Assessing the Sustainability and Growth of Greif Inc's Dividends

Greif Inc (NYSE:GEF) recently announced a dividend of $0.52 per share, payable on 2024-01-01, with the ex-dividend date set for 2023-12-15. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Greif Inc's dividend performance and assess its sustainability.

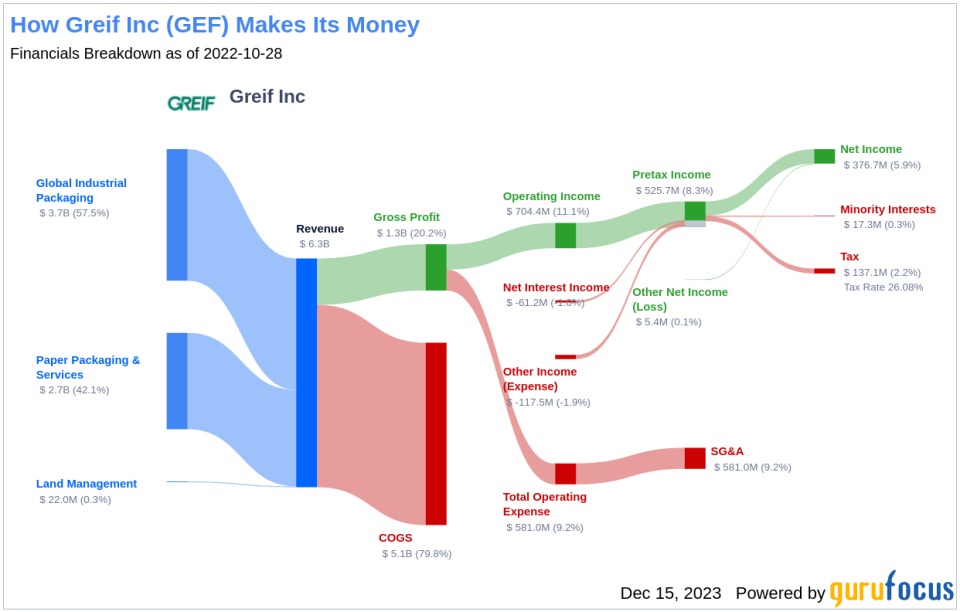

What Does Greif Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Greif Inc is a global leader in industrial packaging products and services with a diverse portfolio that includes steel, fiber, and plastic drums, among other products. The company's operations are segmented into Global Industrial Packaging, Paper Packaging and Services, and Land Management. With a broad range of services like container life cycle management and logistics, Greif Inc caters to various industries, ensuring its presence in the global market.

A Glimpse at Greif Inc's Dividend History

Greif Inc has a long-standing history of consistent dividend payments, dating back to 1989, with quarterly distributions to shareholders. The company's commitment to increasing dividends is evident, as it has done so annually since 1995, earning it the prestigious title of a dividend aristocrat. This consistent growth underscores Greif Inc's financial stability and dedication to shareholder returns.

Below is a chart showing the annual Dividends Per Share for tracking historical trends.

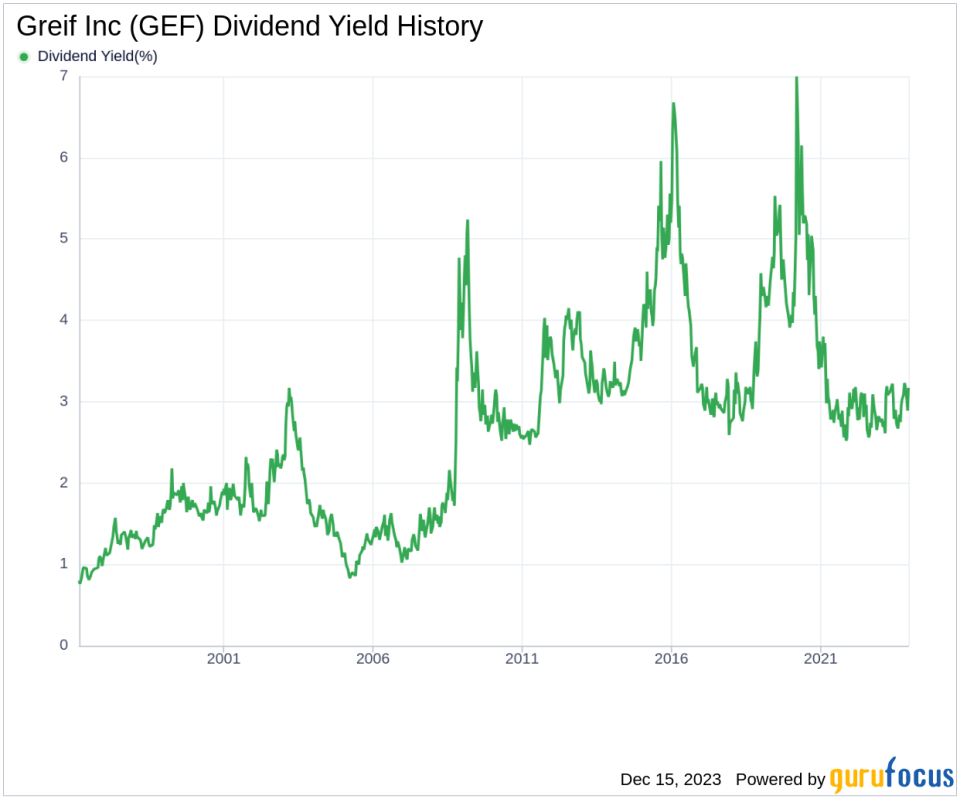

Breaking Down Greif Inc's Dividend Yield and Growth

As of today, Greif Inc boasts a trailing dividend yield of 3.07% and a forward dividend yield of 3.17%, indicating market expectations of increased dividend payments over the next year. Over the last three years, the annual dividend growth rate was 4.70%, which slowed to 3.10% over a five-year period, and to 1.50% over the past decade. These figures reflect a steady, although slowing, dividend growth trajectory for Greif Inc.

The 5-year yield on cost for Greif Inc stock is approximately 3.58%, based on the dividend yield and the five-year growth rate, providing investors with a measure of the return they can expect on their investment.

The Sustainability Question: Payout Ratio and Profitability

To gauge the sustainability of its dividends, we look at Greif Inc's dividend payout ratio, which currently stands at 0.33. This indicates a balanced approach to dividend distribution and earnings retention, which is crucial for the company's long-term growth and resilience. Furthermore, Greif Inc's profitability rank of 8 out of 10, coupled with a consistent record of positive net income over the past decade, showcases the company's strong financial health and earnings capability.

Growth Metrics: The Future Outlook

Greif Inc's growth rank of 8 out of 10 points to a favorable growth outlook compared to its competitors. The company's revenue per share and 3-year revenue growth rate indicate a robust revenue model, with a 5.60% average annual increase outperforming approximately 67.03% of global competitors. Additionally, Greif Inc's 3-year EPS growth rate and 5-year EBITDA growth rate surpass the performance of a majority of its global peers, emphasizing the company's potential for continued dividend sustainability.

Next Steps

Considering Greif Inc's consistent dividend payments, growth in dividend rates, reasonable payout ratio, strong profitability, and solid growth metrics, the company presents an attractive proposition for investors seeking stable and growing dividends. As Greif Inc continues to navigate the industrial packaging market, its strategic initiatives and financial discipline are likely to support and possibly enhance its dividend distribution in the future. For investors seeking to diversify their portfolio with high-dividend yield stocks, Greif Inc warrants consideration, and further analysis can be conducted using tools like the High Dividend Yield Screener available to GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.