Grid Dynamics (GDYN) Acquires Mutual Mobile to Broaden Portfolio

Grid Dynamics GDYN announced the acquisition of Mutual Mobile, which is headquartered in Austin, TX, and operates out of India.

Mutual Mobile offers customers solutions, such as native cloud development, product design and custom software engineering for technology startups and Fortune 500 enterprises.

The acquisition of Mutual Mobile will broaden Grid Dynamics' digital transformation portfolio and help address megatrends such as augmented, virtual, mixed reality, and cloud edge and Internet of Things solutions.

The acquisition of Mutual Mobile will help GDYN in its strategic expansion strategy into the India engineering market and boost its global talent base.

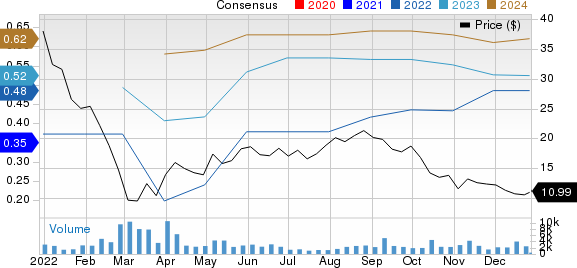

Grid Dynamics Holdings, Inc. Price and Consensus

Grid Dynamics Holdings, Inc. price-consensus-chart | Grid Dynamics Holdings, Inc. Quote

Grid Dynamics Expanding Operations in India to Boost Prospects

Grid Dynamics, which currently carries Zacks Rank #3 (Hold), planned to invest in acquisitions and partnerships to boost prospects in the emerging India market. Prior to its acquisition of Mutual Mobile, GDYN partnered with Sigma Infotech to boost delivery operations in India. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Grid Dynamics recently opened its first engineering center in Hyderabad, India, to reinforce the company’s strategy toward its global growth by harnessing the country’s engineering workforce to support clients across industries like Technology, Healthcare, Automotive and Financial Services globally.

Also, to grow operations globally by winning market share against competitors, and boosting top- and bottom-line growth, Grid Dynamics has been banking on its strong partnerships. The company has been strategically partnering with cloud providers like Alphabet’s GOOGL Google, Amazon AMZN and Microsoft’s MSFT Microsoft Azure.

Grid Dynamics is attracting more customers via its partnership with Alphabet’s Google Cloud Platform ("GCP"). Using the GCP, Grid Dynamics has been providing customers with new solutions to accelerate delivery at a reduced cost.

Grid Dynamics is available on the Amazon marketplace and is attracting top-tier enterprise companies globally as the company is targeting to spread operations across various geographies. This is expected to have increased Grid Dynamics’ revenue sources.

Grid Dynamics recently launched its Pricing and Promotion Optimization Starter Kit on Microsoft Azure to help reduce operating costs, timelines and risks associated with the development of price management solutions. The recent product launch is Grid Dynamics' ongoing work as a Microsoft partner and is expected to attract customers to the platform.

For the fourth quarter of 2022, GDYN expects revenues of $77-$78 million. The Zacks Consensus Estimate for revenues is pegged at $77.53 million, suggesting year-over-year growth of 16.52%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Grid Dynamics Holdings, Inc. (GDYN) : Free Stock Analysis Report