Grid Dynamics Holdings Inc (GDYN) Reports Modest Revenue Growth Amidst Industry Diversification

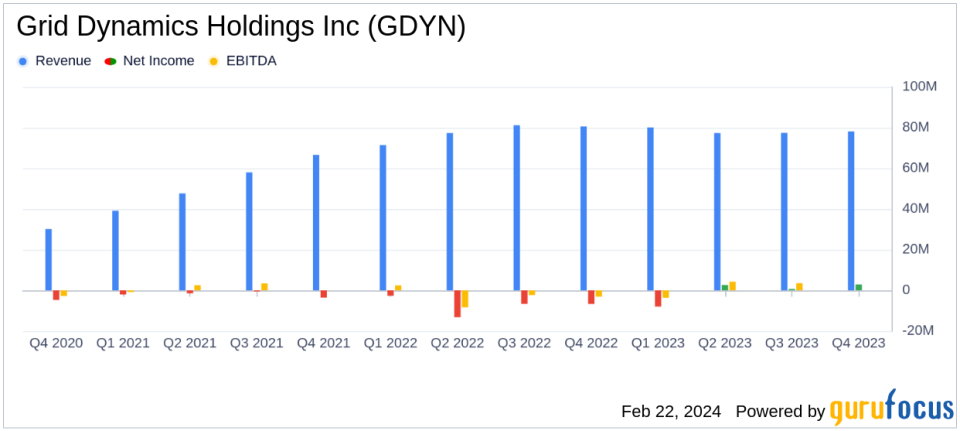

Revenue: Fourth quarter revenue reached $78.1 million, exceeding outlook and contributing to a full year revenue of $312.9 million.

Net Income: GAAP net income for Q4 stood at $2.9 million, a significant improvement from the net loss of $6.7 million in Q4 of the previous year.

Gross Profit: GAAP gross profit was $28.1 million in Q4, with a margin of 36.0%, compared to 40.1% in the same quarter last year.

EBITDA: Non-GAAP EBITDA for Q4 was $10.7 million, down from $16.5 million in Q4 2022.

Cash Flow: Operating activities generated $41.1 million in cash for the year, an increase from $31.7 million in the previous year.

Headcount: Total headcount increased to 3,920 by the end of 2023, up from 3,798 at the end of 2022.

Financial Outlook: Q1 2024 revenue is projected to be between $77 million and $79 million, with Non-GAAP EBITDA expected to be between $9.5 million and $10.5 million.

On February 22, 2024, Grid Dynamics Holdings Inc (NASDAQ:GDYN), a leader in enterprise-level digital transformation, released its 8-K filing, detailing financial results for the fourth quarter and full year ended December 31, 2023. The company, known for providing tailored digital solutions to Fortune 1000 companies, reported a slight year-over-year revenue increase, signaling resilience in a challenging economic landscape.

Performance and Industry Diversification

GDYN's fourth-quarter revenue of $78.1 million surpassed the company's outlook, contributing to a full-year revenue of $312.9 million, a modest increase from $310.5 million in 2022. The company's strategic diversification across various industry verticals has been a focal point, with notable growth in the Technology, Media and Telecom (TMT), Finance, and Other verticals, which include life sciences and pharmaceutical customers. This diversification has reduced the company's reliance on the Retail vertical, which now represents a smaller portion of the quarterly revenue.

CEO Leonard Livschitz commented on the company's adaptability and strategic growth, stating,

The last twelve months have proven that the company is adept in navigating uncertainties as we executed across multiple areas of our business."

Livschitz also highlighted the addition of 33 enterprise customers and the expansion of delivery locations, which are strategic to the company's "follow-the-sun" model.

Financial Achievements and Challenges

Despite the revenue growth, GDYN faced a decrease in year-over-year gross profit margins, with GAAP gross profit for the fourth quarter at 36.0% of revenue, down from 40.1% in the same period last year. The company also reported a GAAP net income of $2.9 million for Q4, a significant turnaround from the net loss of $6.7 million in the fourth quarter of 2022. However, Non-GAAP EBITDA for the fourth quarter decreased to $10.7 million from $16.5 million in the prior year's quarter.

The company's balance sheet remains strong, with cash and cash equivalents totaling $257.2 million as of December 31, 2023. The cash flow from operating activities also saw an increase, indicating healthy liquidity and operational efficiency.

Outlook and Expansion

Looking ahead, GDYN expects first-quarter 2024 revenue to be in the range of $77 million to $79 million, with Non-GAAP EBITDA projected between $9.5 million and $10.5 million. The company's expansion plans include opening a third office in Bengaluru, India, to complement its existing offices in Hyderabad and Chennai, reflecting growth in the region and recognition of Grid Dynamics' engineering quality.

The company's strategic partnerships and AI capabilities were recognized by major hyperscalers such as Google, Amazon, and Microsoft, with partnership-influenced business reaching 13% of total revenue. This achievement underscores the company's commitment to leveraging advanced technologies to drive business transformation for its clients.

Grid Dynamics' financial results reflect a company that is navigating the complexities of digital transformation with strategic diversification and expansion. While facing margin pressures, the company's growth in key verticals and strong cash flow position it well for the future. Investors and stakeholders will be watching closely as GDYN continues to execute on its strategic initiatives in the dynamic technology services industry.

Explore the complete 8-K earnings release (here) from Grid Dynamics Holdings Inc for further details.

This article first appeared on GuruFocus.