Grindr Inc (GRND) Reports Robust Revenue Growth and Solid User Engagement in FY 2023

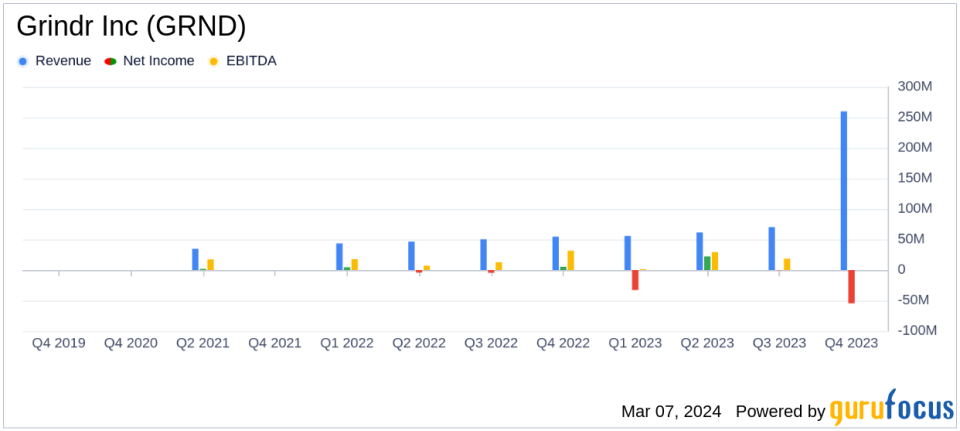

Revenue: Grindr Inc (NYSE:GRND) reported a significant increase in revenue, reaching $260 million for the fiscal year 2023.

Operating Income: The company achieved an operating income of $55 million.

Net Loss Margin: Despite revenue growth, Grindr Inc (NYSE:GRND) experienced a net loss margin of 21%.

Adjusted EBITDA Margin: The Adjusted EBITDA margin stood strong at 42%.

User Engagement: The platform saw over 121 billion chats sent in 2023, indicating high user engagement.

Guidance: Grindr Inc (NYSE:GRND) projects over 23% revenue growth and an Adjusted EBITDA margin of 40%+ for 2024.

On March 7, 2024, Grindr Inc (NYSE:GRND) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full fiscal year of 2023. As the world's largest social network and dating app for the LGBTQ community, Grindr Inc (NYSE:GRND) has demonstrated a robust fiscal performance with a 33% year-over-year revenue increase, amounting to $260 million. Despite this growth, the company reported a net loss margin of 21%, reflecting the challenges faced in achieving profitability.

Grindr Inc (NYSE:GRND) has attributed its financial success to the introduction of new products like Weeklies, a weekly subscription offering, and enhancements in user experience. These initiatives have led to a remarkable 38% increase in revenue from paying users and an average of one hour spent on the app per user per day. CEO George Arison expressed confidence in the company's momentum and future, citing a strong product roadmap and an expanding team.

Financial Performance Analysis

Grindr Inc (NYSE:GRND)'s financial achievements are particularly noteworthy in the competitive landscape of software and social networking apps. The company's ability to grow its paying user base and maintain high user engagement are critical indicators of its market position and potential for sustained growth. The Adjusted EBITDA margin of 42% underscores the company's operational efficiency and its ability to generate earnings before interest, taxes, depreciation, and amortization.

The company's balance sheet and cash flow statements reflect the strategic investments and cost management measures undertaken throughout the year. While the net loss margin presents a challenge, the strong Adjusted EBITDA suggests that Grindr Inc (NYSE:GRND) is on a path to overcoming these hurdles, especially with the positive revenue growth guidance for 2024.

"The Grindr team delivered an outstanding first full year as a public company. Our results came in well ahead of our financial guidance; we generated solid growth in paying users supported by the launch of Weeklies, our popular weekly subscription product; and we drove best-in-class user engagement through our improved user experience," said George Arison, Chief Executive Officer of Grindr.

Grindr Inc (NYSE:GRND) is navigating a complex regulatory environment and competitive market dynamics. The company's focus on user privacy, data protection, and compliance with evolving regulations is essential for maintaining user trust and avoiding potential legal and financial repercussions. As the company plans for its first-ever Investor Day event in June, stakeholders are anticipating further insights into the strategies that will drive future growth and address the net loss margin.

Looking Ahead

Grindr Inc (NYSE:GRND) has set forth an optimistic guidance for 2024, projecting a revenue growth of 23% or greater and an Adjusted EBITDA margin of over 40%. This outlook is based on the company's current trajectory and the anticipated impact of its product innovations and market expansion efforts. The upcoming Investor Day event will likely provide additional clarity on Grindr Inc (NYSE:GRND)'s strategic priorities and investment plans.

Value investors and potential GuruFocus.com members interested in the software and social networking sectors may find Grindr Inc (NYSE:GRND)'s growth narrative and future prospects compelling. The company's performance, despite the net loss margin, indicates a strong foundation for potential value creation. As Grindr Inc (NYSE:GRND) continues to evolve and adapt to market demands, it remains a company to watch in the dynamic landscape of digital social platforms.

For more detailed financial information and future updates on Grindr Inc (NYSE:GRND), investors and analysts are encouraged to visit the company's Investor Relations website and stay tuned for the webcast of the earnings conference call.

Explore the complete 8-K earnings release (here) from Grindr Inc for further details.

This article first appeared on GuruFocus.