Gritstone Bio Inc (GRTS) Reports Fiscal Year 2023 Financial Results and Corporate Updates

Financial Position: Cash, cash equivalents, marketable securities, and restricted cash totaled $86.9 million as of December 31, 2023.

Research and Development Expenses: Increased to $127.2 million for the year ended December 31, 2023, from $111.4 million in the previous year.

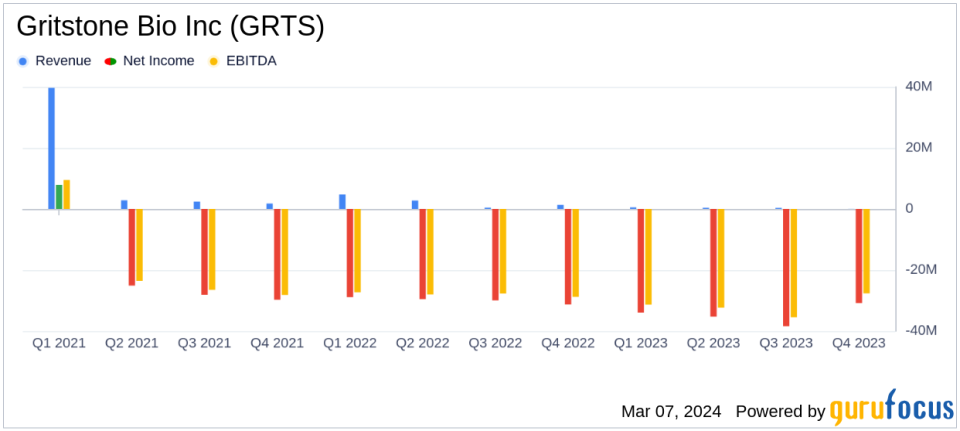

Revenue: Collaboration, license, and grant revenues were $16.3 million for the year ended December 31, 2023, a decrease from $19.9 million in 2022.

Net Loss: Reported a net loss of $(138.5) million, or $(1.20) per share for the year ended December 31, 2023.

Workforce Reduction: Reduced workforce by approximately 40% to reduce costs and preserve capital.

Corporate and Clinical Updates: Progress in GRANITE and SLATE oncology programs, with preliminary Phase 2 data expected in Q1 2024.

On March 5, 2024, Gritstone Bio Inc (NASDAQ:GRTS) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023, and providing updates on its corporate and clinical activities. Gritstone Bio Inc is a biotechnology company focused on developing personalized cancer immunotherapies and vaccines for infectious diseases.

Fiscal Summary and Corporate Developments

As of December 31, 2023, Gritstone Bio Inc reported cash, cash equivalents, marketable securities, and restricted cash of $86.9 million, a significant decrease from the $185.2 million reported at the end of the previous year. The company's research and development expenses rose to $127.2 million, up from $111.4 million in 2022, primarily due to increased personnel-related costs and clinical trial expenses.

General and administrative expenses slightly decreased to $28.8 million, compared to $29.0 million in the previous year. The company's collaboration, license, and grant revenues decreased to $16.3 million for the year, down from $19.9 million in 2022.

Gritstone Bio Inc reported a net loss of $(138.5) million, or $(1.20) per share, for the year ended December 31, 2023. This loss is attributed to increased operating expenses and a decrease in revenue.

Strategic Workforce Reduction

In a strategic move to reduce costs and preserve capital, Gritstone Bio Inc reduced its workforce by approximately 40% in February 2024. The reduction primarily affected employees associated with vaccine manufacturing and clinical infectious disease operations.

Oncology and Infectious Disease Program Highlights

The company continues to make progress in its oncology programs, with the Phase 2 portion of the Phase 2/3 study evaluating GRANITE as a front-line maintenance therapy in metastatic MSS-CRC ongoing. Preliminary efficacy data from the Phase 2 portion are expected in the first quarter of 2024. Additionally, a collaboration with the National Cancer Institute to evaluate an autologous mutant KRAS-directed TCR-T cell therapy in combination with Gritstones SLATE-KRAS vaccine is underway.

In the infectious disease arena, Gritstone is preparing to launch a Phase 2b study for its self-amplifying mRNA (samRNA) vaccine candidate for COVID-19 in Fall 2024, after incorporating GMP-grade materials into its manufacture. The company also continues its collaboration with Gilead to research and develop a vaccine-based HIV immunotherapy treatment.

Analysis of Financial Health

The financial results of Gritstone Bio Inc reflect the challenges of advancing clinical programs in a capital-intensive industry. The increased R&D expenses underscore the company's commitment to its clinical trials, which are essential for the development of its vaccine candidates. However, the reduction in workforce and the decrease in revenues highlight the financial pressures faced by the company.

The anticipated data from the GRANITE and SLATE programs could be pivotal for the company's future, potentially unlocking opportunities in both adjuvant and metastatic solid tumors. The strategic decisions made by the company, including the workforce reduction and the delay in the CORAL Phase 2b study, are aimed at preserving capital and focusing resources on the most promising programs.

Value investors may find interest in Gritstone Bio Inc's efforts to streamline operations and focus on key clinical milestones. The company's innovative approach to vaccine development, coupled with its strategic collaborations, positions it as a potential player in the oncology and infectious disease sectors.

For a more detailed analysis of Gritstone Bio Inc's financial results and corporate updates, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Gritstone Bio Inc for further details.

This article first appeared on GuruFocus.