Grocery Outlet Holding Corp (GO) Reports Mixed Fiscal 2023 Results Amid Tech Disruptions

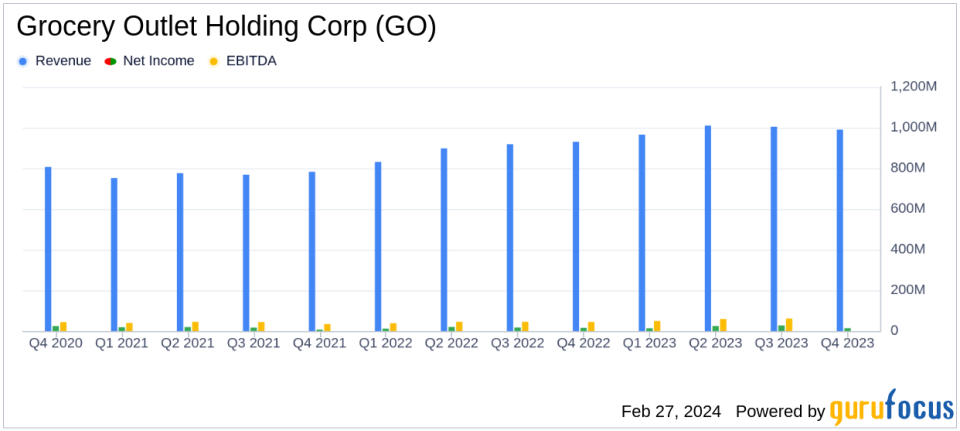

Net Sales Growth: Q4 net sales increased by 6.3% to $989.8 million, and full-year sales rose by 10.9% to $3.97 billion.

Comparable Store Sales: Q4 saw a 2.7% increase, while the full year experienced a 7.5% rise, driven by higher transaction counts.

Gross Margin: Remained flat at 30.2% for Q4 but increased by 80 basis points to 31.3% for the full year.

Net Income: Q4 net income decreased by 11.2% to $14.1 million, while full-year net income grew by 22.1% to $79.4 million.

Adjusted EBITDA: Q4 adjusted EBITDA fell by 6.3% to $50.9 million, but increased by 17.7% to $252.6 million for the full year.

Store Expansion: 13 new stores opened in Q4, bringing the total to 468 stores. The company also announced the pending acquisition of United Grocery Outlet.

Outlook for Fiscal 2024: Projected net sales of $4.30 to $4.35 billion and a comparable store sales increase of 3.0% to 4.0%.

Grocery Outlet Holding Corp (NASDAQ:GO) released its 8-K filing on February 27, 2024, disclosing its financial results for the fourth quarter and full fiscal year 2023. The company, known for its extreme value retail model and network of independently operated stores, faced both achievements and challenges during the year.

In the fourth quarter, Grocery Outlet saw a 6.3% increase in net sales, reaching $989.8 million, and a 2.7% rise in comparable store sales, attributed to a 7.5% increase in transactions. However, the average transaction size decreased by 4.5%. The company's gross margin remained flat at 30.2%, and net income fell by 11.2% to $14.1 million, or $0.14 per diluted share. Adjusted EBITDA also decreased by 6.3% to $50.9 million, or 5.1% of net sales, and adjusted net income dropped by 19.6% to $18.2 million, or $0.18 per adjusted diluted share.

Annual Performance and Technological Disruptions

For the full fiscal year, Grocery Outlet reported a 10.9% increase in net sales to $3.97 billion and a 7.5% increase in comparable store sales. The company's gross margin improved by 80 basis points to 31.3%. Despite technological disruptions that negatively impacted sales and gross margin, net income for the year increased by 22.1% to $79.4 million, or $0.79 per diluted share. Adjusted EBITDA grew by 17.7% to $252.6 million, or 6.4% of net sales, and adjusted net income rose by 15.2% to $108.1 million, or $1.07 per adjusted diluted share.

CEO RJ Sheedy commented on the year's performance, stating,

Our value proposition continues to resonate with consumers resulting in strong traffic and transaction count growth. During 2023, we increased our market share, achieved record sales of $4 billion, and grew Adjusted EBITDA by 18%,"

and expressed optimism about the acquisition of United Grocery Outlet.

Financial Health and Future Outlook

The balance sheet shows $115.0 million in cash and cash equivalents, with total debt at $292.7 million, net of unamortized debt issuance costs. The company generated $303.4 million in net cash from operating activities and invested $192.0 million in capital expenditures before tenant improvement allowances.

Looking ahead to fiscal 2024, Grocery Outlet anticipates net sales between $4.30 billion and $4.35 billion, with a comparable store sales increase of 3.0% to 4.0%. The company expects to maintain a gross margin of approximately 31.3% and projects adjusted EBITDA to be between $275 million and $283 million, with adjusted earnings per share diluted between $1.14 and $1.20. Capital expenditures, net of tenant improvement allowances, are estimated to be around $170 million.

The company's performance, particularly the increase in net sales and adjusted EBITDA, highlights the resilience of the value retail segment in a challenging economic environment. The acquisition of United Grocery Outlet is poised to further expand Grocery Outlet's footprint, signaling strategic growth in the competitive retail landscape.

Investors and analysts can glean from these results that Grocery Outlet is navigating market disruptions while maintaining a focus on growth and operational efficiency. The company's ability to attract customers through its value proposition and expand its store network bodes well for its future prospects, despite the short-term challenges posed by technology implementations and the competitive retail market.

For a more detailed analysis of Grocery Outlet's financial performance and future outlook, interested parties can access the full earnings call transcript and additional financial data on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Grocery Outlet Holding Corp for further details.

This article first appeared on GuruFocus.