Grocery Outlet (GO) Rides on Value Proposition, Customer Reach

Grocery Outlet Holding Corp. GO benefits from its adaptable approach to sourcing and distributing products, enabling it to provide exceptional value to customers. The company's strategic purchasing approach, effective marketing campaigns, expansion of stores, and efforts to enhance online shopping experiences are extending its customer reach.

Gains from the company’s focus on growth efforts are well-reflected in its price performance, and earnings and sales trends.

The Zacks Consensus Estimate for the company’s 2023 and 2024 sales is pegged at $3.96 billion and $4.33 billion, respectively, suggesting year-over-year increases of 10.6% and 9.3%, respectively. Also, the company’s 2023 and 2024 earnings are pegged at $1.05 and $1.18, respectively, suggesting year-over-year increases of 2.9% and 11.8%, respectively.

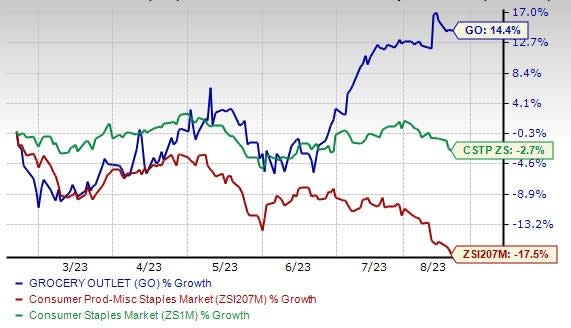

The Zacks Rank #1 (Strong Buy) stock has rallied 14.4% in the past six months against the industry’s decline of 17.5%. GO has also outpaced the Consumer Staples sector’s dip of 2.7%.

Image Source: Zacks Investment Research

Let’s Dig Deeper

Grocery Outlet is successfully navigating through a challenging business environment by focusing on its strategic growth efforts and strong product offerings. The company’s core strengths, including its ability to seize supply opportunities, curate a diverse product range and effectively engage with customers and independent operators, have been driving its success.

Grocery Outlet's approach of providing convenience to customers has been a key growth driver. The company has established partnerships with Instacart, DoorDash and Uber Eats to bolster customer experiences. Through these collaborations, it offers same-day delivery of essential everyday items and groceries. This convenience factor not only attracts bargain-seekers but also encourages repeat visits and larger purchases.

Recognizing the growing demand for fresh and healthy options, the company has shifted its focus to include Natural, Organic, Specialty, and Healthy (NOSH) products. This adaptability to changing preferences demonstrates the company's commitment to meeting customer needs.

A key factor that sets Grocery Outlet apart from traditional retailers is its unique business model. The model, centered around flexible sourcing and distribution, enables the company to provide high-quality, name-brand products at exceptional prices. The company's product assortment is ever-evolving, with a constant rotation of special deals and everyday staple items.

The company is actively opening stores and enhancing its operational capabilities. With plans to expand its national footprint to potentially 4,000 locations, Grocery Outlet opened four stores and closed one, ending the second quarter of fiscal 2023 with 447 stores in eight states. It expects to accelerate its pace of store openings in the coming months, aiming for a 10% annualized growth rate. Strategic investments in technology and operational improvements further highlight the company's commitment to sustainable expansion.

Wrapping Up

These strategies have translated into a favorable financial performance for Grocery Outlet. In the second quarter of 2023, the company exceeded expectations, with its top and bottom-line figures seeing year-over-year growth. The solid comparable store sales performance in the quarter reflects the strength of Grocery Outlet's existing store network, and its ability to drive customer traffic and sales. (Read More: Grocery Outlet Q2 Earnings Beat, FY23 Outlook Raised)

Following these positive results, management raised its 2023 view at its second-quarter earnings release, projecting net sales of $3.95 billion, accompanied by comparable store sales growth of 7-8%. The company earlier projected 2023 net sales of $3.90 billion and comparable store sales growth between 5% and 6%.

3 Other Promising Staple Stocks

Here we have highlighted three other top-ranked stocks, namely J&J Snack Foods Corporation JJSF, MGP Ingredients, Inc. MGPI and Celsius Holdings CELH.

J&J Snack Foods is an American manufacturer, marketer and distributor of branded niche snack foods and frozen beverages for the food service and retail supermarket industries. It currently sports a Zacks Rank #1. JJSF has a trailing four-quarter earnings surprise of 4.7%, on average.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for J&J Snack Foods’ current fiscal-year sales and earnings suggests growth of 11.1% and 62.3%, respectively, from the year-ago reported figures.

MGP Ingredients produces and markets ingredients and distillery products to the packaged goods industry. The company currently flaunts a Zacks Rank #1. The expected EPS growth rate for three to five years is 11%.

The Zacks Consensus Estimate for MGP Ingredients’ current financial-year sales and earnings suggests growth of 5.8% and 10.4%, respectively, from the year-ago reported numbers. MGPI has a trailing four-quarter earnings surprise of 18%, on average.

Celsius Holdings, which offers functional drinks and liquid supplements, currently has a Zacks Rank #2 (Buy). CELH delivered an earnings surprise of 100% in the last reported quarter.

The Zacks Consensus Estimate for Celsius Holdings’ current financial-year sales and earnings suggests growth of 87.6% and 168.8%, respectively, from the year-ago reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

J & J Snack Foods Corp. (JJSF) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report