Will Grocery Outlet's (GO) Plan of Growing Store Presence Aid?

Grocery Outlet Holding Corp. GO benefits from its growth efforts and strong product offerings in a challenging business environment. The company's ability to capitalize on supply opportunities, provide a wide-ranging product selection, expand its store network and engage customers effectively stands out as significant strengths that underpin its success.

Expanding Footprint

Grocery Outlet's opportunistic purchasing strategy, effective marketing campaigns, continued store expansion and dedication to improving the online shopping experience are noteworthy. These holds promise for expanding the company’s customer base. GO is proactive in opening stores and optimizing operational capabilities.

In the second quarter of 2023, Grocery Outlet reported 12.5% growth year-over-year in net sales, reaching $1.01 billion. This impressive performance was primarily driven by a remarkable 9.2% increase in comparable store sales, complemented by the positive contributions from store openings since the second quarter of 2022.

With plans to expand its national footprint to 4,000 locations, Grocery Outlet opened four stores and closed one, ending the second quarter of 2023 with 447 stores in eight states. The company expects the pace of store openings to accelerate to a 10% annualized growth rate. It intends to open 25-28 net new stores in 2023. Strategic investments in technology and operational improvements further highlight the company's commitment to sustainable expansion.

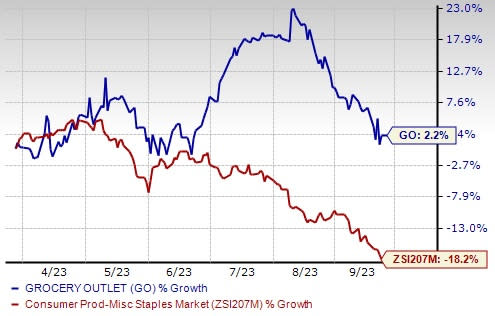

Image Source: Zacks Investment Research

Adapting to Customer Preferences

The company's focus on convenience through partnerships with Instacart, DoorDash and Uber Eats for same-day delivery attracts bargain-seekers and fosters repeat business. Recognizing the demand for fresh and healthy options, Grocery Outlet now includes Natural, Organic, Specialty, and Healthy products, showcasing its commitment to meet evolving customer preferences.

The company's unique business model is also a distinguishing feature, which is centered around flexible sourcing and distribution, allowing it to provide high-quality, name-brand products at exceptional prices. The ever-evolving product assortment, featuring special deals and everyday staples, sets it apart from traditional retailers. The company provides customers with substantial savings, averaging 40% compared with traditional grocery retailers, while its exceptional WOW! items offer savings of 70% or more.

Wrapping Up

These strategies have resulted in a positive financial outcome for Grocery Outlet. In the second quarter of 2023, the company surpassed projections, achieving year-over-year growth in revenues and profits. The impressive performance of comparable store sales in this quarter highlights the resilience of Grocery Outlet's current store locations and its capacity to attract customers and boost sales. (Read More: Grocery Outlet Q2 Earnings Beat, FY23 Outlook Raised)

Following these positive results, management raised its 2023 view at its second-quarter earnings release, projecting net sales of $3.95 billion, accompanied by comparable store sales growth of 7-8%. The company earlier projected 2023 net sales of $3.90 billion, and comparable store sales growth between 5% and 6%.

The Zacks Rank #2 (Buy) stock has rallied 2.2% in the past six months against the industry’s decline of 18.2%.

3 Other Promising Stocks

We have highlighted three other top-ranked stocks, namely Ollie's Bargain Outlet Holdings, Inc. OLLI, Ross Stores Inc. ROST and Walmart Inc. WMT.

Ollie's Bargain Outlet is a value retailer of brand-name merchandise at drastically reduced prices. The company currently has a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ollie's Bargain Outlet’s current fiscal-year sales and EPS suggests growth of 19.6% and 67.3%, respectively, from the year-ago reported figures. OLLI has a trailing four-quarter earnings surprise of 1.3%, on average.

Ross Stores is an off-price retailer of apparel and home accessories. The company currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Ross Stores’ current fiscal-year sales and EPS suggests growth of 8.1% and 19.4%, respectively, from the year-ago reported figures. ROST has a trailing four-quarter earnings surprise of 11.4%, on average.

Walmart, which operates a chain of hypermarkets, discount department stores and grocery stores, currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Walmart’s current fiscal-year sales and earnings suggests growth of 9.2% and 2.2%, respectively, from the year-ago reported numbers. WMT has a trailing four-quarter earnings surprise of 11.6%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

Ross Stores, Inc. (ROST) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report

Grocery Outlet Holding Corp. (GO) : Free Stock Analysis Report