'Groundhog Day' in Crypto as Bitcoin Again Plunges Following New Record

Bitcoin's latest attempt at all-time highs met with large selling pressure on exchanges Friday, capping the rally beyond $70,000.

The decline mirrored Tuesday's correction from $69,200, but wasn't as severe.

Liquidations of leveraged derivatives trades reached $240 million during the day, less than Tuesday's $1.2 billion wipe out.

It's deja vu all over again for bitcoin {{BTC}} bulls, who for the second time this week barely had a few seconds to celebrate a surge to a new-all time high before prices quickly reversed sharply lower.

In the morning hours of U.S. trading, bitcoin took out the Tuesday record of about $69,200 and rose to $70,136, CoinDesk Bitcoin Index (XBX) data shows. But within seconds, selling took hold and less than one hour later, the price had tumbled about 5% to as low as $66,500.

At press time, bitcoin was trading at $66,950, down marginally for the day. The broader CoinDesk 20 Index (CD20) was modestly in the green.

Friday's decline from all-time highs liquidated $240 million worth of leveraged derivatives trading positions across all digital assets, much less than Tuesday's nearly $1.2 billion, according to CoinGlass. This was likely due to that the market wasn't as frothy with leverage as before the flush earlier this week.

Read more: Bitcoin Tumbles 10% After Hitting Record High; Triggers $1B Crypto Liquidations

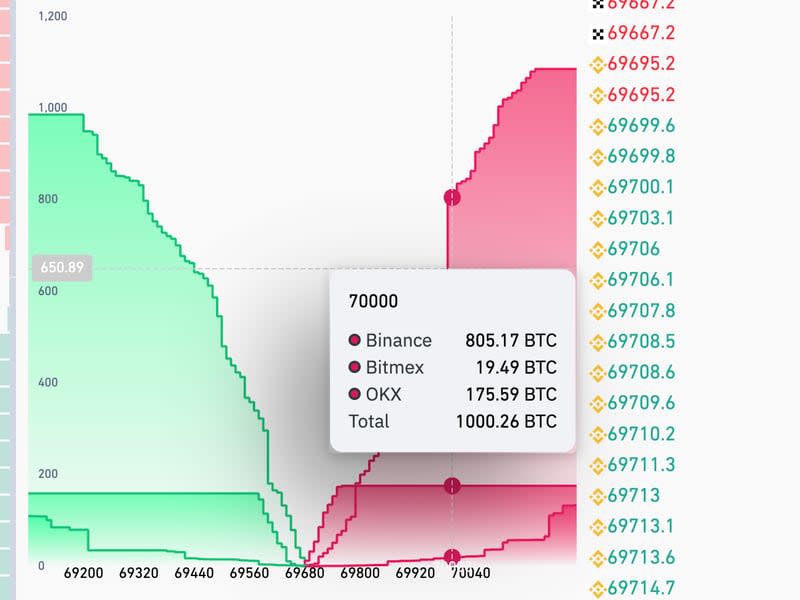

Nearly 1,000 BTC of sell orders on Binance and OKX, worth some $70 million, posed an insurmountable resistance for further gains once bitcoin topped $70,000, quickly pushing the price lower.

To this point, today's reversal isn't as severe as the action on Tuesday, when bitcoin for the first time this week notched a new record high. Then, the price ended up tumbling as much as 14% before bottoming at around the $59,000 level.

UPDATE (March 8, 16:59): Adds liquidation data.