Group 1 Automotive Inc (GPI) Reports Record Revenues in 2023 Despite Challenges

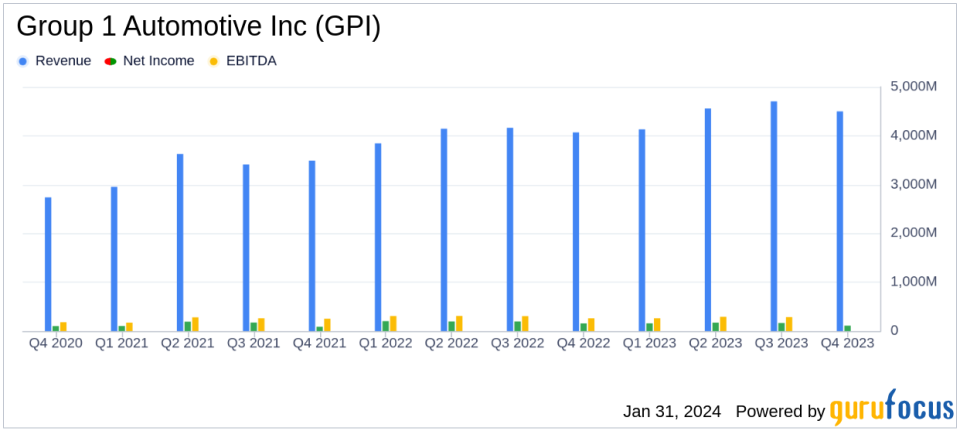

Revenue Growth: Full year revenues reached a record $17.9 billion, a 10.2% increase over the previous year.

New Vehicle Sales: New vehicle units sold increased by 14.8% in the current quarter.

Earnings Per Share: Diluted earnings per common share from continuing operations were $7.87 for the quarter and $42.75 for the full year.

Parts and Service Growth: Parts and service business gross profit reached $1.2 billion, contributing to an all-time high total gross profit exceeding $3.0 billion.

Cost Challenges: SG&A expenses as a percentage of gross profit increased, particularly in the U.K., due to higher expenses and lower vehicle margins.

Share Repurchases: The company repurchased 729,582 shares at an average price of $236.78 during the current year.

Acquisitions and Dispositions: Acquired dealership operations expected to generate $1.1 billion in annual revenues; disposed of dealerships with $45.0 million in annual revenues.

On January 31, 2024, Group 1 Automotive Inc (NYSE:GPI) released its 8-K filing, announcing its financial results for the fourth quarter and full year of 2023. The company, which owns and operates 199 automotive dealerships and 41 collision centers across the U.S. and U.K., reported a significant increase in revenues, reaching an all-time high of $17.9 billion for the year, up 10.2% from the previous year. This growth was driven by increases across all lines of business, with the parts and service segment gross profit hitting $1.2 billion.

Despite the revenue growth, Group 1 Automotive faced challenges, particularly in the U.K. market, where used vehicle sales and cost management became areas of concern. The company's President and Chief Executive Officer, Daryl Kenningham, acknowledged these challenges and outlined plans to reduce costs, including a headcount reduction in the U.K. by approximately 10%.

The company's financial achievements, including record new and used vehicle units sold, are significant in the context of the Vehicles & Parts industry, which has been navigating a complex market environment. Group 1's ability to achieve growth in such a climate demonstrates the strength of its business model and the demand for its services.

Key financial details from the income statement include a net income from continuing operations of $108.8 million for the quarter, down 30.6% from the prior year quarter. The balance sheet shows a healthy cash position and a significant increase in inventories. The cash flow statement highlights the company's share repurchase activities, with $172.8 million spent on repurchases during the year.

Important metrics for the company include a 14.8% increase in new vehicle units sold and a 10.2% increase in total revenues for the year. These metrics are vital as they reflect the company's sales volume and revenue generation capabilities, which are crucial for profitability and growth.

Our U.S. team produced another strong quarter and full year results. We continue to execute well in this evolving U.S. market. We experienced challenges in our U.K. operations during the current quarter with used vehicles and recognize we have some work ahead of us to bring our costs back in-line with recent trends," said Daryl Kenningham, Group 1s President and Chief Executive Officer.

Group 1 Automotive's performance in 2023, while mixed due to challenges in the U.K., still reflects a robust business capable of achieving record revenues. The company's strategic acquisitions and focus on parts and service growth have bolstered its financial position, even as it navigates market headwinds and prepares for cost-cutting measures.

For more detailed information on Group 1 Automotive Inc's financial performance, investors and interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Group 1 Automotive Inc for further details.

This article first appeared on GuruFocus.