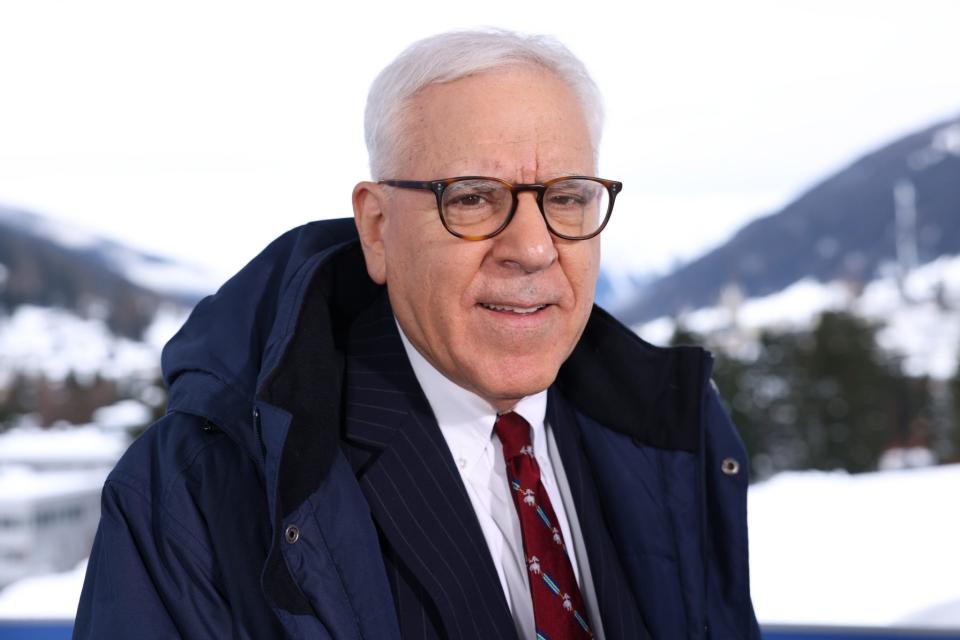

Group led by Carlyle’s David Rubenstein, a Baltimore native, agrees to buy the Orioles for more than $1.7 billion

David Rubenstein, a Carlyle Group cofounder, has agreed to acquire Baltimore’s Major League Baseball franchise for $1.725 billion, becoming the latest private equity executive to make a big splash in professional sports.

Rubenstein has assembled a group of investors that includes Michael Arougheti, cofounder, CEO, and president of Ares, as well as Maryland leaders, philanthropists, and sports legends, a person familiar with the situation said. Rubenstein will be the team’s control person, they added. The proposed sale, first reported by Puck, still must be approved by Major League Baseball.

Peter Angelos acquired the Orioles in 1993 for $173 million. In recent years, he’s become incapacitated and his son, John, has become the face of the franchise, CBS Sports reported. Initially, Rubenstein’s group intends to buy just shy of 40% of the franchise, with plans to buy the remaining stake after the elder Angelos passes away, the person familiar with the sale told Fortune. John Angelos has agreed to remain with the team as an advisor to the new owners.

“David is a Baltimore native and a lifelong fan of the Orioles,” the person familiar added.

Rubenstein played Little League baseball and even swung an imaginary bat during a PBS Iconic America episode about baseball. This is his first major investment in a professional sports franchise.

Rubenstein is one of the most recognizable figures in the world of finance. He cofounded Carlyle Group, along with William Conway and Daniel D’Aniello, in 1987. The firm was one of several PE firms to go public in the last 20 years. Carlyle, now known as a global investment firm, had $382 billion of assets under management as of Sept. 30.

As previously reported by Fortune, financial titans have taken to scooping up teams. Josh Harris, cofounder of Apollo Global Management, led a group to buy the Washington Commanders for a record $6.05 billion in May. Harris also owns stakes in the NBA’s Philadelphia 76ers and the NHL’s New Jersey Devils. Tom Gores, chairman and CEO of Platinum Equity, owns the NBA’s Detroit Pistons, while Joe Lacob, a former managing partner of Kleiner Perkins, led a group to buy the Golden State Warriors in 2010. Several PE execs, including Steve Pagliuca and Jonathan Lavine, both of Bain Capital, have owned stakes in the Boston Celtics for years.

This story was originally featured on Fortune.com