Groupon (GRPN) Q3 Earnings & Revenues Top Estimates, Fall Y/Y

Groupon, Inc. GRPN reported third-quarter 2020 non-GAAP earnings of 15 cents per share, versus the Zacks Consensus Estimate of a loss of 52 cents. The company had reported non-GAAP earnings of 27 cents in the prior-year quarter.

Revenues of $304 million beat the Zacks Consensus Estimate by 0.9%. The figure, however, declined 38.7% on a year-over-year basis (down 40.1% excluding foreign exchange effect).

Region-wise, North America revenues plunged 40.6% from the year-ago quarter’s level to $180.3 million. International revenues fell 35.6% (down 39.2% excluding foreign exchange effect) year over year to $123.7 million.

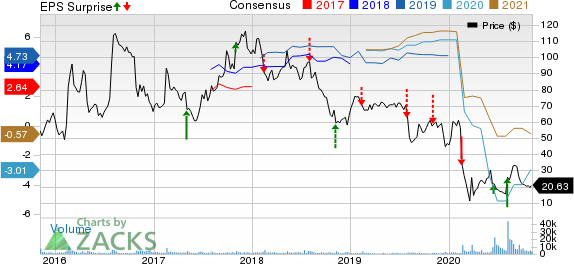

Groupon, Inc. Price, Consensus and EPS Surprise

Groupon, Inc. price-consensus-eps-surprise-chart | Groupon, Inc. Quote

Quarter Details

Service revenues (51% of revenues) were down 42.2% year over year to $155.1 million. Product revenues (49% of revenues) deteriorated 34.5% to $149 million.

Local revenues of $135.1 million declined 43.8% from the year-ago quarter. North America Local revenues declined 43.7% and International Local revenues fell 47.2%, excluding foreign exchange effect.

Goods revenues declined 31% year over year to $161 million. North America Goods revenues declined 32.9%. International Goods revenues also deteriorated 33.2%, excluding foreign exchange effect.

Travel revenues fell 63.6% year over year to $7.89 million. North America Travel revenues plunged 65.3%. International Travel revenues declined 63.2%, excluding foreign exchange effect.

In the third quarter, gross billings were $597.1 million, down 46.6%, excluding foreign exchange effect.

North America billings were $362.3 million, down 49.4% year over year. International billings were $234.8 million, down 41.4% excluding foreign exchange effect.

North America Local and Travel gross billings declined 54.9% and 67.1%, respectively, while Goods gross billings decreased 18.5% on a year-over-year basis.

International Local and Travel gross billings declined 47.7% and 44.8%, respectively while Goods gross billings decreased 30.2% on a year-over-year basis, excluding foreign exchange effect.

Owing to the coronavirus crisis-induced negative impact on demand, global units sold during the reported quarter declined 40% year over year to 21 million.

Region wise, North America units were down 13% in Goods and 50% in Local categories. International units were down 20% in Goods and 49% in Local categories.

Customer Metrics

As of Sep 30, 2020, Groupon had approximately 13.9 million active customers internationally compared with 15.3 million at the end of the previous quarter.

Moreover, as of Sep 30, 2020, the company had approximately 20.2 million active customers based in North America compared with 22.8 million at the end of the prior quarter.

Operating Details

In the third quarter, gross profit came in at $160 million, down 42.4% (down 43.5%, excluding foreign exchange effect) year over year.

International gross profit declined 44.7% year over year, excluding foreign exchange effect, to $50.3 million. Under the International segment, Local, Travel and Goods categories reported gross profit decline of 47.9%, 65.3% and 24.8%, respectively, excluding foreign exchange effect.

Coming to North America region, gross profit plunged 42.9% to $109.7 million, primarily due to negative impact of coronavirus crisis on volume. Local, Travel and Goods categories posted gross profit declines of 43.6%, 63.9% and 30.4%, respectively.

Adjusted EBITDA came in at $30.8 million compared with adjusted EBITDA of $50 million reported in the prior-year quarter.

Selling, general and administrative (SG&A) expenses fell 37.4% year over year to $124.3 million in the reported quarter. The reduction in expenses was primarily driven by lower variable compensation and reduced payroll expenditures along with restructuring initiatives.

Groupon continues to expect $140 million in cost savings under its restructuring initiatives for 2020.

In the third quarter, marketing expenses declined 58.1% year over year to $31.4 million owing to lower offline marketing investments and accelerated traffic declines.

The company incurred operating loss of $16.2 million compared with operating income of $4.6 million in the prior-year quarter.

Balance Sheet & Cash Flow

Groupon exited the quarter ending Sep 30, 2020, with cash and cash equivalents of $779.6 million, up from $784.7 million, as of Jun 30, 2020.

As of Sep 30, 2020, the company had $200 million of outstanding borrowings under revolving credit facility.

In the third quarter, the company generated $4.8 million of operating cash flow compared with $87.1 million generated in the prior quarter.

Free cash outflow came was $7 million compared with $72.8 million of free cash flow reported in the previous quarter.

Zacks Rank & Stocks to Consider

Groupon currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader sector are Himax Technologies HIMX, NVIDIA NVDA and Covetrus CVET. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Covetrus is set to report results on Nov 10, while Himax and NVIDIA are scheduled to report earnings on Nov 12 and Nov 18, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Himax Technologies, Inc. (HIMX) : Free Stock Analysis Report

Groupon, Inc. (GRPN) : Free Stock Analysis Report

Covetrus, Inc. (CVET) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research