Groupon Inc (GRPN) Reports Q4 and Full Year 2023 Earnings: Net Income Rises Amidst Revenue Decline

Fourth Quarter Revenue: $137.7 million, down 7% year-over-year.

Full Year Revenue: $514.9 million, a 14% decrease from 2022.

Fourth Quarter Net Income: $28.5 million, compared to a net loss of $54.2 million in Q4 2022.

Full Year Net Loss: Reduced to $52.9 million from $234.4 million in 2022.

Adjusted EBITDA: Positive $26.9 million in Q4 and $55.5 million for the full year.

Operating Cash Flow: Positive $54.5 million in Q4; however, full year was negative $78.0 million.

Liquidity Improvement: Resolved going concern issue with increased liquidity and strategic actions.

On March 15, 2024, Groupon Inc (NASDAQ:GRPN) released its 8-K filing, detailing its financial performance for the fourth quarter and the full fiscal year of 2023. The company, known for connecting consumers with local merchants by offering activities, travel, goods, and services at a discount, has reported mixed results that reflect both the challenges and the progress made in its ongoing transformation efforts.

Financial Performance Overview

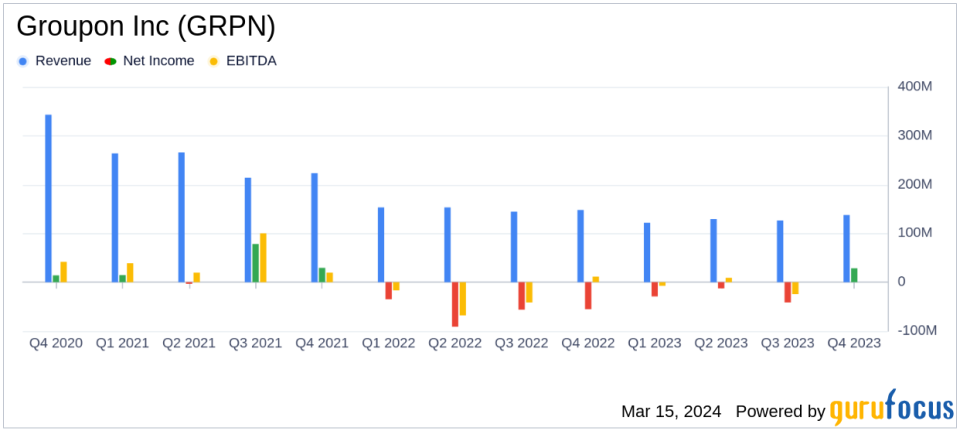

Groupon's fourth quarter revenue saw a decline of 7% year-over-year, standing at $137.7 million, with full-year revenue also down by 14% to $514.9 million. Despite the revenue downturn, the company managed to post a net income of $28.5 million in the fourth quarter, a significant improvement from the net loss of $54.2 million in the same period last year. For the full year, the net loss was considerably narrowed to $52.9 million from a loss of $234.4 million in 2022.

The company's adjusted EBITDA turned positive at $26.9 million in the fourth quarter, compared to a negative $5.3 million in Q4 2022, and reached $55.5 million for the full year, indicating a substantial improvement from a negative $15.1 million in the previous year. This positive adjusted EBITDA, along with strategic liquidity improvements, has resolved the going concern issue that was previously disclosed.

Operational Highlights and Challenges

Groupon's North America segment experienced a 6% revenue decline, primarily due to a decrease in demand for Goods categories. Excluding Goods, the segment's revenue was down by 3%. The International segment also faced challenges, with a 10% revenue decline (15% FX-neutral), again largely due to the Goods category and a general decrease in demand.

Active customer numbers in North America and International segments decreased by 9% and 17% year-over-year, respectively. Marketing expenses decreased to 28% of gross profit, down from 33% in the prior year, reflecting more efficient marketing spend.

Strategic Actions and Market Position

Throughout the year, Groupon took several actions to improve its liquidity, including an $18.9 million proceeds from the sale of a portion of its equity interest in SumUp, an oversubscribed Rights Offering that raised $80.0 million, and the prepayment and termination of its credit facility. These actions, along with improved operating cash flow, have put the company on firmer financial ground.

Interim CEO Dusan Senkypl commented on the progress, stating,

Significant improvement in our North America local and travel categories is a positive indicator that our transformation plan is working. In addition, our improved financial performance and increased liquidity resolves our going concern issue."

Looking Forward

While Groupon faces ongoing challenges, including a decline in active customers and the need to stimulate demand in its Goods category, the company's improved net income and positive cash flow in the fourth quarter are encouraging signs. The strategic actions taken to improve liquidity and the positive adjusted EBITDA reflect a company that is navigating its turnaround with focus and determination.

Value investors and potential GuruFocus.com members may find Groupon's efforts to stabilize and grow its business of interest, especially as the company continues to evolve its offerings and improve its financial position in the competitive Interactive Media industry.

For more detailed information, investors are encouraged to review the full 8-K filing and consider the implications of Groupon's financial results on their investment decisions.

Explore the complete 8-K earnings release (here) from Groupon Inc for further details.

This article first appeared on GuruFocus.