Is Groupon's Stock Significantly Overvalued?

As of August 24, 2023, Groupon Inc (NASDAQ:GRPN) experienced a daily gain of 12.65%, and a remarkable 3-month gain of 200.23%. Despite this impressive performance, the company reported a Loss Per Share of 5.04. This raises the question, is Groupon's stock significantly overvalued? To answer this, we delve into a comprehensive valuation analysis of the company.

Company Overview

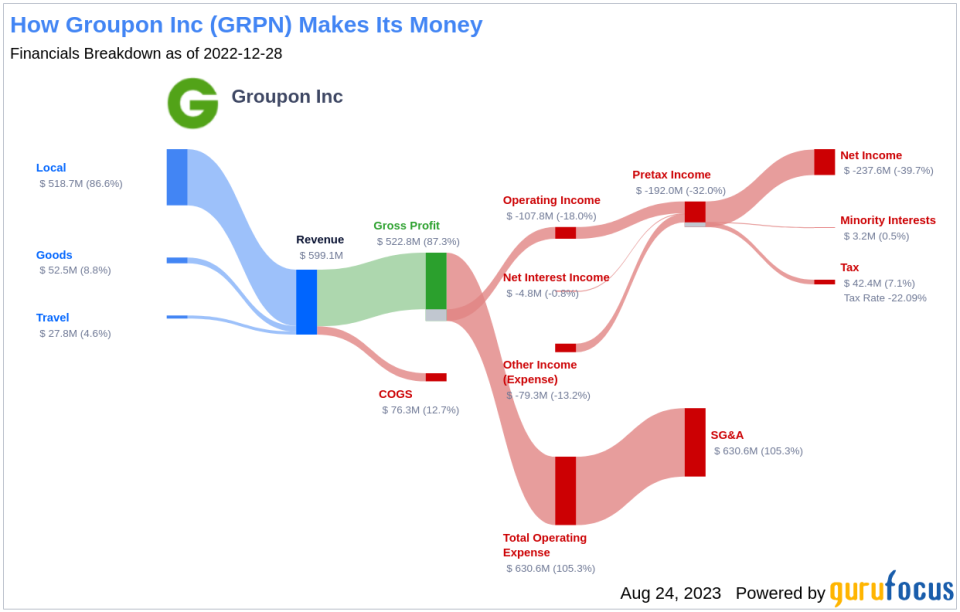

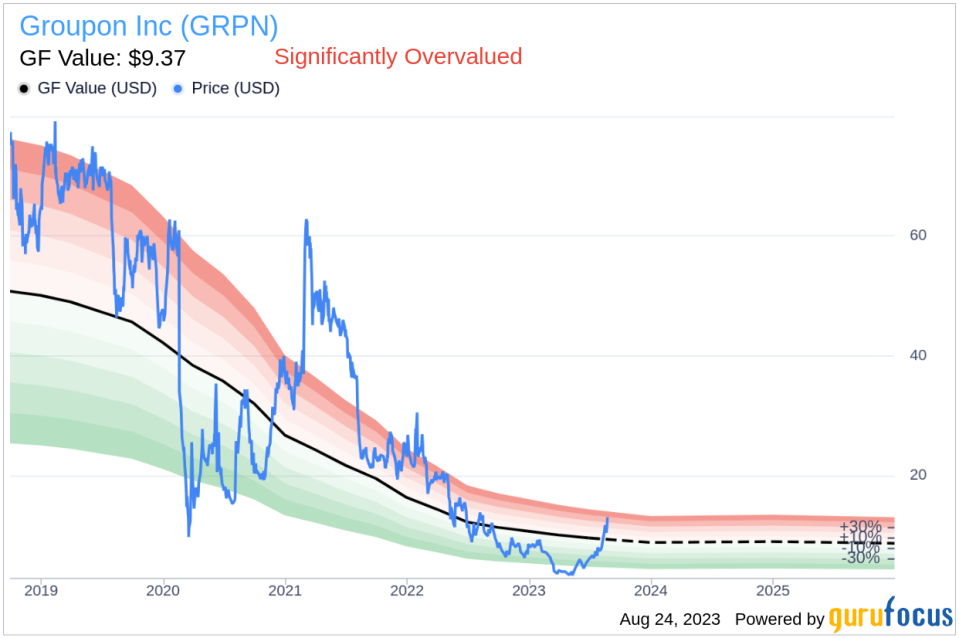

Groupon Inc (NASDAQ:GRPN) acts as a bridge between consumers and merchants, offering a variety of products and services at discounts via its online store. It generates revenue from the take rate on vouchers' purchase and/or usage, with more than 60% of its revenue coming from North America. The company's stock price stands at $13.27, a figure significantly higher than its GF Value of $9.37. This discrepancy prompts a deeper exploration of the company's valuation.

Understanding GF Value

The GF Value represents the current intrinsic value of a stock, calculated based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. Conversely, if it is significantly below the GF Value Line, its future return will likely be higher.

According to GuruFocus' valuation method, Groupon's stock is significantly overvalued. This is based on its current price of $13.27 per share, which is much higher than its GF Value. As a result, the long-term return of its stock is likely to be much lower than its future business growth.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

Examining the financial strength of a company is crucial before investing in its stock. Groupon's cash-to-debt ratio of 0.4 is worse than 84.91% of 550 companies in the Interactive Media industry. This results in an overall financial strength of 3 out of 10, indicating that Groupon's financial strength is poor.

Profitability and Growth

Investing in profitable companies is less risky, especially those with consistent profitability over the long term. Over the past 10 years, Groupon has been profitable 3 times. However, its operating margin of -15.45% ranks worse than 69.11% of 586 companies in the Interactive Media industry, leading to a profitability rank of 4 out of 10.

Growth is a crucial factor in a company's valuation. Groupon's average annual revenue growth is -36.7%, ranking worse than 95.14% of 514 companies in the Interactive Media industry. Its 3-year average earnings decline is 107.7%, which ranks worse than 95.17% of 390 companies in the Interactive Media industry.

Comparing ROIC and WACC

Comparing a company's return on invested capital (ROIC) to its weighted average cost of capital (WACC) is another way to evaluate its profitability. Over the past 12 months, Groupon's ROIC was -18.14, while its WACC came in at 9.38.

Conclusion

In conclusion, Groupon's stock is estimated to be significantly overvalued. The company's financial condition is poor, its profitability is poor, and its growth ranks worse than 0% of 390 companies in the Interactive Media industry. To learn more about Groupon's stock, you can check out its 30-Year Financials here.

To find high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.