Can Its Growth Efforts Aid Colgate (CL) Amid Cost Woes?

Colgate-Palmolive Company CL has been gaining from pricing actions, accelerated revenue growth management plans, product innovation and expansion efforts. This led to the impressive second-quarter 2023 results, wherein the top and bottom lines beat the Zacks Consensus Estimate. The company registered growth in all divisions and all four categories.

On a Base Business basis (non-GAAP basis), earnings were 77 cents per share, up 7% from the prior-year period. Net sales of $4,822 million increased 7.5% from the year-ago quarter. On an organic basis, the company’s sales advanced 8%, with improvements in all divisions and categories. This marked the 18th successive quarter of organic sales growth at or above its long-term target of 3-5% growth. The metric grew in all six divisions, with mid-single-digit or higher growth in each of its categories.

CL’s gross margin expanded 80 basis points (bps) to 57.8% on GAAP and an adjusted basis, up from our estimate of 57.1%. This was mainly driven by continued strong pricing, and the benefits of funding growth and other productivity initiatives. For the rest of the year, the company expects top and bottom-line growth, with a gross profit margin expansion. For 2023, it foresees adjusted gross profit margin expansion and increased advertising investment.

Driven by the impressive results, management raised its sales and profit forecast for 2023. It anticipates net sales growth of 5-8% compared with the prior stated 3-6%, in sync with our estimate of 5.7%. The current projection indicates gains from the acquisitions of pet food businesses, offset by a low-single-digit adverse currency impact.

The company anticipates full-year organic sales growth between 5% and 7% compared with the earlier disclosed 4-6% and in line with our estimate of 7%. Management expects adjusted earnings per share to increase at the high-end of mid-single digits compared with the prior stated mid-single-digit growth, in line with our estimate of 5.9%.

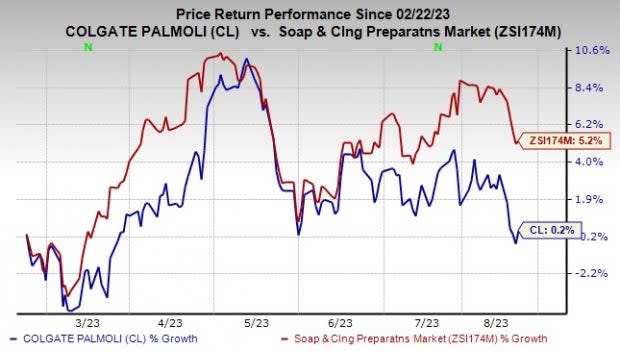

Shares of this Zacks Rank #3 (Hold) have gained 0.2% in the past six months compared with the industry’s growth of 5.2%.

Image Source: Zacks Investment Research

That said, let’s delve deeper into the factors driving the stock.

Growth Factors

The company’s innovation strategy is focused on growing in adjacent categories and product segments. Its innovation efforts are highlighted by the recent relaunch of the Soupline business in France and the launch of Suavitel — the Soupline Hearts. The company is on track with the relaunch of Sanex across Europe. Its Oral Care business has also been performing well, particularly in Africa.

Some other notable efforts include the continued expansion of the Naturals and Therapeutics divisions, as well as the Hello Products LLC buyout. The company partnered with Philips to introduce electric toothbrushes in Latin America, where the use of electric toothbrushes is low. Also, its at-home whitening and professional whitening products bode well.

CL is aggressively expanding into faster growth channels, while extending the geographic footprint of its brands. In 2019, the company expanded its portfolio by introducing pharmacy brands like elmex and meridol to newer markets. Colgate has been witnessing positive customer feedback for its elmex and meridol brands, driven by increased investment. The expansion of its premium skincare portfolio with the buyout of the Filorga skincare business also acts as a major growth driver.

Also, Colgate’s Hill's business continues to witness sales momentum in the second quarter, with sales growth (22% of the total sales) of 16% from the year-ago quarter on a reported basis and 10.5% on an organic basis. Results gained from a 13.5% increase in pricing and volume growth of 4% on a reported basis, partly offset by a 3% decline in organic volume and a 1.5% adverse currency impact.

Organic sales were aided by gains in the United States and Europe, partly offset by softness in Australia. The company’s newly launched Prescription Diet Derm Complete has been gaining market share and is likely to be rolled out internationally in the coming quarters. Colgate is also focused on expanding the availability of its products through the e-commerce channel, as more consumers are using online services for their essential needs.

Headwinds to Overcome

Despite the gradual recovery in cost inflation, Colgate’s additional pricing increases are likely to affect volumes. The continued rise in raw and packaging material costs also acts as a deterrent. Nevertheless, countries like Turkey, Argentina and Pakistan continue to witness high inflation.

The company anticipates a slightly heightened promotional environment in the back half of the year. Also, unfavorable currency continues to act as a headwind.

Wrapping Up

Although the aforementioned headwinds are likely to persist in the near term, product innovation, pricing efforts and expansion plans raise optimism in the stock. The Zacks Consensus Estimate for CL’s 2023 sales and earnings per share suggests year-over-year growth of 7.9% and 6.7%, respectively.

The PEG ratio for Colgate is just 3.17, a level that is far lower than the industry average of 3.46. The PEG ratio is a modified PE ratio that takes into account the stock’s earnings growth rate. Clearly, CL is a solid choice on the value front from multiple angles. Topping it, a Growth Score of B and a long-term earnings growth rate of 7.4% reflect its inherent strength.

Stocks to Consider

We have highlighted some better-ranked stocks from the broader Consumer Staples space, namely TreeHouse Foods THS, Associated British Foods ASBFY and Celsius Holdings CELH.

TreeHouse Foods, a manufacturer of packaged foods and beverages, currently sports a Zacks Rank #1 (Strong Buy). THS has a trailing four-quarter earnings surprise of 49.3%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TreeHouse Foods’ current financial year’s sales suggests a decline of 12.4% from the year-ago reported number.

Associated British Foods is a diversified international food, ingredients and retail group, which currently flaunts a Zacks Rank #1. ASBFY’s expected EPS growth rate for three to five years is 7%.

The Zacks Consensus Estimate for Associated British Foods’ current financial-year sales and earnings suggests growth of 30.4% and 4.2%, respectively, from the year-ago reported figures.

Celsius Holdings currently carries a Zacks Rank #2 (Buy). CELH specializes in commercializing healthier, nutritional functional foods, beverages and dietary supplements.

The Zacks Consensus Estimate for CELH’s current financial-year sales indicates 67.9% growth from the year-ago reported figure, and the same for EPS implies a 154% rise. The company had an earnings surprise of 81.8% in the last reported quarter.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Colgate-Palmolive Company (CL) : Free Stock Analysis Report

TreeHouse Foods, Inc. (THS) : Free Stock Analysis Report

Associated British Foods PLC (ASBFY) : Free Stock Analysis Report

Celsius Holdings Inc. (CELH) : Free Stock Analysis Report