Growth Strategy Aids Verisk (VRSK) Amid Operational Risks

Verisk Analytics Inc. VRSK is benefiting from its robust growth strategy involving organic growth, product development and acquisitions. The company deals with a huge amount of data that exposes it to operational risks.

The company has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth.

Verisk reported better-than-expected first-quarter 2023 results. Adjusted earnings (excluding 92 cents from non-recurring items) were $1.29 per share, beating the Zacks Consensus Estimate by 9.3%. This was due to strong segmental revenue growth and core operating leverage. Adjusted earnings decreased 3.7% on a year-over-year basis. Total revenues of $651.6 million surpassed the consensus estimate by 3.1% and decreased 16% from the year-ago figure. The reduced top line can be correlated to the sale of the company’s environmental health and safety business ("3E") and the Financial Services segment.

Verisk has outperformed its Business Information Services market growing 28.9%, compared with its industry’s 8.1% growth and 16.5% rise in the S&P 500 composite.

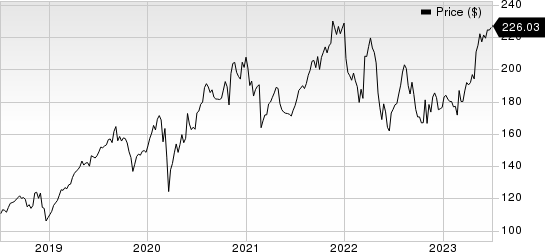

Verisk Analytics, Inc. Price

Verisk Analytics, Inc. price | Verisk Analytics, Inc. Quote

Current situation of VRSK

Verisk has a robust growth strategy that focuses on organic growth, product development and acquisitions. The company’s investment in its people, data sets, analytics and technology improves the quality of its offerings.

Acquisitions act as a catalyst of growth for the company. The March 2022 acquisition of Opta is expected to expand its footprint in the Canadian market. The acquisition of Automated Insurance Solutions is expected to increase the company’s automation capabilities in the claims ecosystem and help it expand geographically. The acquisitions help the company increase its global footprint and add to the company’s existing capacities.

VRSK has been consistent with returning value to its shareholders. In 2022, Verisk paid $195.2 million as dividends and repurchased shares worth $1.7 billion. Such moves indicate the company’s commitment to creating value for shareholders and underline its confidence in its business.

Verisk's current ratio at the end of first-quarter 2023 was pegged at 0.89, higher than the current ratio of 0.40 reported at the end of the prior quarter and 0.47 at the end of the year-ago quarter, indicating the company is unlikely to face difficulties meeting its short term debt obligations.

Some Concerning Points

Verisk’s huge database exposes it to operational risks of security breaches, computer networks, and databases, resulting in the loss of its credibility and/or customers. Data theft and misuse by third-party contractors can affect the company’s existence.

Zacks Rank and Stocks to Consider

VRSK currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.8% year over year to $338.2 million and the same for earnings indicates a 2.7% increase to 76 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% decrease to 17 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2 and a growth score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Verisk Analytics, Inc. (VRSK) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report