GSA Capital Partners LLP Acquires Stake in T2 Biosystems Inc

On July 7, 2023, GSA Capital Partners LLP, a London-based investment firm, added 799,572 shares of T2 Biosystems Inc (NASDAQ:TTOO) to its portfolio. This article provides an in-depth analysis of the transaction, the profiles of the firm and the traded company, and the potential impact on the stock market.

Details of the Transaction

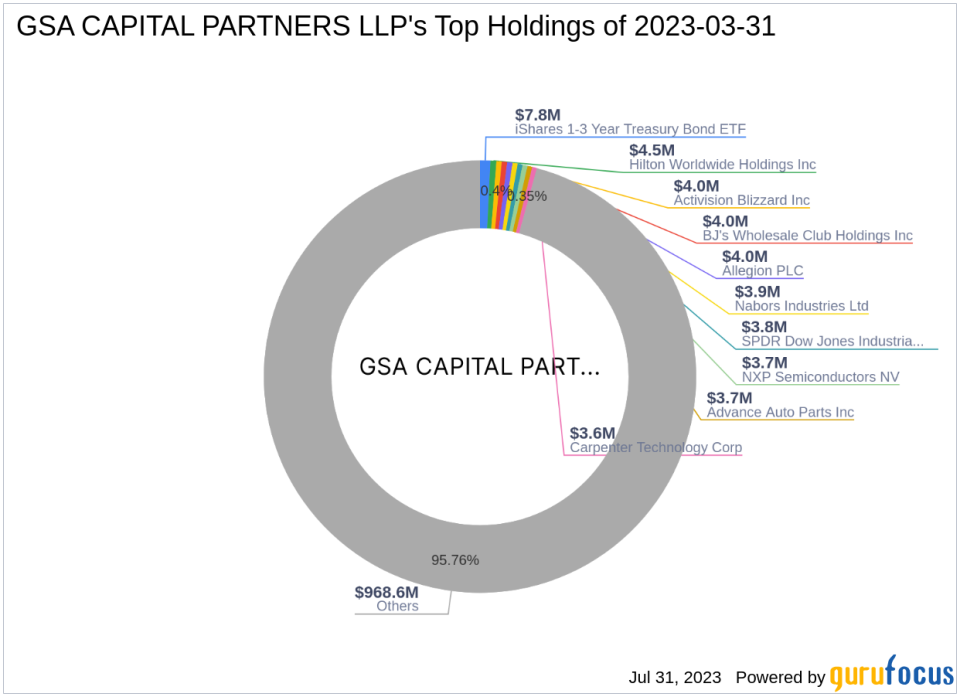

The transaction involved the acquisition of 799,572 shares of T2 Biosystems Inc at a traded price of $0.115 per share. This addition increased GSA Capital Partners LLP's total holdings in T2 Biosystems Inc to 4,599,059 shares, representing 1.50% of the company's total shares and 0.05% of the firm's portfolio. The transaction had a minor impact of 0.01% on the firm's portfolio.

Profile of GSA Capital Partners LLP

GSA Capital Partners LLP is a London-based investment firm with a portfolio of 1430 stocks, primarily in the technology and consumer cyclical sectors. The firm's top holdings include iShares 1-3 Year Treasury Bond ETF (NASDAQ:SHY), Activision Blizzard Inc (NASDAQ:ATVI), Allegion PLC (NYSE:ALLE), Hilton Worldwide Holdings Inc (NYSE:HLT), and BJ's Wholesale Club Holdings Inc (NYSE:BJ). The firm's equity stands at $1.01 billion.

Overview of T2 Biosystems Inc

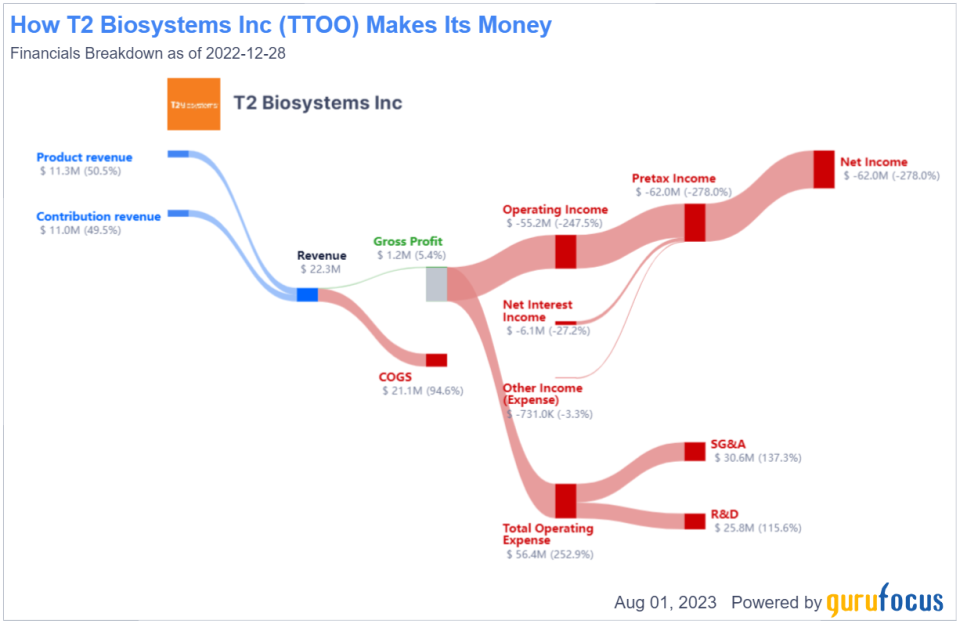

T2 Biosystems Inc, a US-based company, provides rapid in vitro diagnostic tests to hospitals and laboratories. Its core technology, T2 Magnetic Resonance (T2MR), can detect a variety of molecular targets directly from whole blood. The company's segments include contribution revenue and product revenue. As of the transaction date, the company's market capitalization was $3.67 million, and its stock price was $0.1472. The company's PE percentage was not applicable as it was operating at a loss.

Analysis of T2 Biosystems Inc's Stock

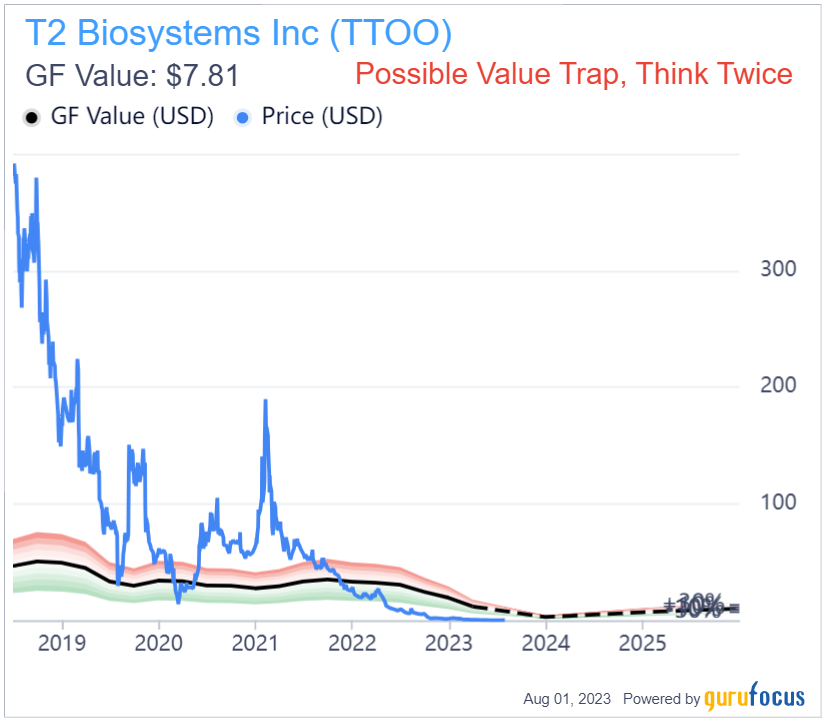

The GF Value of T2 Biosystems Inc's stock was 7.84, indicating a price to GF Value of 0.02. However, GuruFocus' GF Value line labeled the stock a possible value trap due to several warning signs, including a low Piotroski F-score of 1 out of 9. Since the transaction, the stock's price has increased by 28%. However, since its IPO in 2014, the stock's price has decreased by 99.98%.

Performance and Ranking of T2 Biosystems Inc's Stock

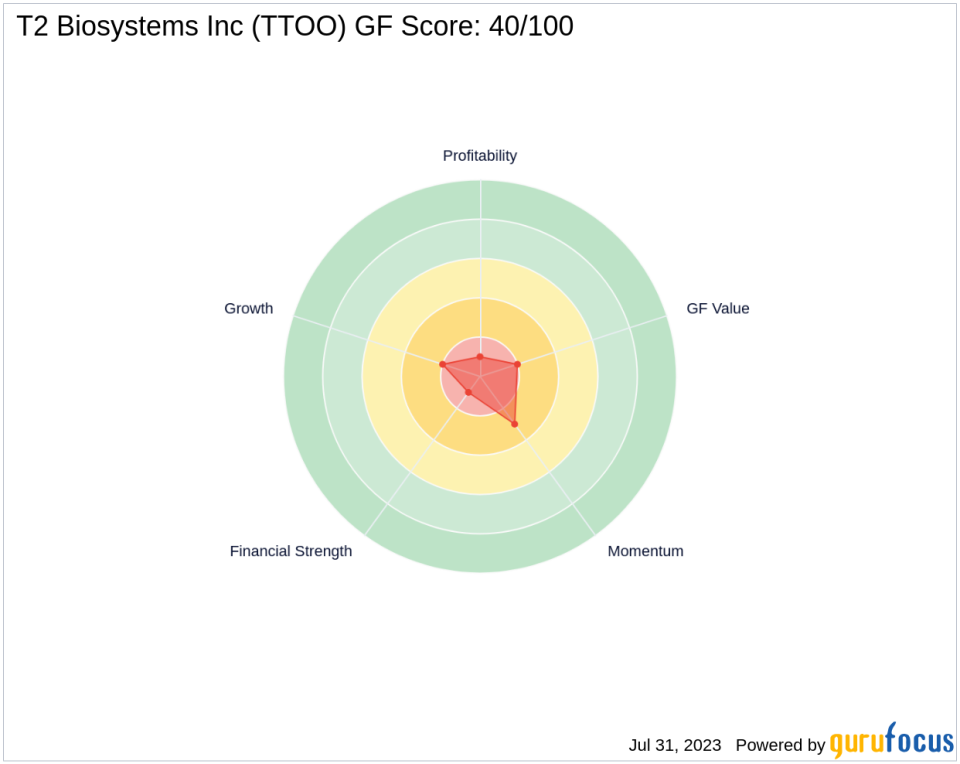

The GF Score of T2 Biosystems Inc's stock was 40 out of 100, indicating poor future performance potential. The stock's Balance Sheet Rank, Profitability Rank, and Growth Rank were 1/10, 1/10, and 2/10, respectively. The stock's F Score was 1, and its Z Score was -28.83, indicating a high bankruptcy risk. The stock's Cash to Debt ratio was 0.17, ranking 198th in the industry.

T2 Biosystems Inc's Industry and Financial Health

T2 Biosystems Inc operates in the Medical Diagnostics & Research industry. The company's interest coverage was not applicable as it does not have the income to cover its interest expense. The company's return on equity was not applicable as it was operating at a loss, and its return on assets was -158.96. The company's gross margin growth was not applicable as it had no gross profit.

T2 Biosystems Inc's Growth and Momentum

Over the past three years, T2 Biosystems Inc's revenue decline averaged 21.80% per year over the past three years although EBITDA growth averaged 41.60% per year over the same period. The company's earning growth was 42.70%. The company's RSI 5 Day, RSI 9 Day, and RSI 14 Day were 61.32, 57.03, and 52.61, respectively. The company's Momentum Index 6 - 1 Month and Momentum Index 12 - 1 Month were -95.89 and -98.88, respectively.

Transaction Analysis

The acquisition of T2 Biosystems Inc's shares by GSA Capital Partners LLP could be seen as a strategic move by the firm to diversify its portfolio and potentially capitalize on the undervalued stock. However, given T2 Biosystems Inc's poor financial health and performance indicators, the transaction's impact on the stock and the firm's portfolio remains uncertain.

All data and rankings are accurate as of August 1, 2023, and are based on the provided relative data.

This article first appeared on GuruFocus.