GSK Gears Up for Q2 Earnings: Will It Surpass Estimates?

We expect GSK plc. GSK to beat expectations when it reports second-quarter 2023 results on Jul 26. In the last reported quarter, the company delivered an earnings surprise of 5.88%.

Factors to Note

GSK reports financial figures under three segments — Specialty Medicines, Vaccines and General Medicines.

In the second quarter, higher sales of newer products like Cabenuva, Dovato, Breo Ellipta, Shingrix and Bexsero are likely to have been offset by the decline in sales of older HIV drugs and respiratory medicines due to generic erosion and competitive pressure. Our model suggests the Respiratory sales to be around £1.65 billion for the quarter.

In HIV, the strong sales growth trend witnessed in recent quarters of the two-drug regimens, Juluca and Dovato, and long-acting regimens, Cabenuva and Apretude, might have partially offset the losses in sales of the three-drug regimens during the to-be-reported quarter. Our model estimates sales from the HIV portfolio to be £1.36 billion for the quarter.

Sales of COPD inhalers Trelegy Ellipta and Breo Ellipta are likely to have been an important contributor to second-quarter 2023 sales. Our model suggests Trelegy Ellipta and Breo Ellipta sales to stand at around £449 million and £310 million, respectively.

GSK’s key vaccine, Shingrix’s sales showed a strong demand recovery in the United States, which — coupled with new launches in different countries — benefited sales in recent quarters. We expect this trend to have continued in the second quarter. Our model predicts shingles vaccine sales to be around £937 million.

Sales of meningitis and influenza vaccines have shown a strong recovery in recent quarters on the back of CDC purchases in the United States. The trend is likely to have continued in the second quarter. Our model suggests meningitis vaccine sales (including Bexsero) to be around £317 million, while influenza vaccine sales are expected to be around £21 million.

Oncology sales are likely to have witnessed a decline due to lower Blenrep sales, following withdrawal from the U.S. market last November. Our model suggests that the Oncology portfolio is likely to have generated around £134 million in sales.

Key Development in Q2

In May 2023, the FDA granted approval to Arexvy, GSK’s respiratory syncytial virus (RSV) vaccine, for the prevention of lower respiratory tract disease (LRTD) caused by RSV in older adults. This was the first RSV vaccine for older adults to be approved anywhere in the world. The U.S. US Centers for Disease Control and Prevention (CDC) has also recommended using the RSV vaccines and the same is expected to be available in the upcoming fall season.

Arexvy also received marketing authorization in the European Union last month. A commercial rollout for the vaccine has been planned ahead of the upcoming RSV season, which usually starts in the autumn.

Earnings Surprise History

GSK’s earnings surpassed estimates in each of the trailing four quarters, delivering a beat of 12.48% on average.

GSK PLC Sponsored ADR Price and EPS Surprise

GSK PLC Sponsored ADR price-eps-surprise | GSK PLC Sponsored ADR Quote

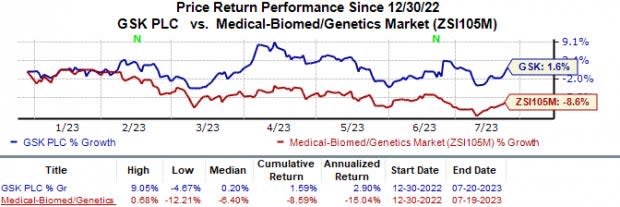

Shares of GSK have outperformed the industry in the year so far. The stock has gained 1.6% against the industry’s 8.6% decline.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts an earnings beat for GSK this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: GSK has an Earnings ESP of 0.59% as the Most Accurate Estimate of 86 cents per ADR is higher than the Zacks Consensus Estimate of 85 cents.

Zacks Rank: GSK currently carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are some biotech stocks that have the right combination of elements to beat on earnings this time around:

Acadia Pharmaceuticals ACAD has an Earnings ESP of +38.26% and a Zacks Rank #2.

Acadia’s stock has surged 96.4% in the year-to-date period. ACAD beat earnings estimates in two of the last four quarters while missing the mark on the other two occasions. Acadia reported a negative earnings surprise of 14.29%, on average. The company will report its second-quarter results on Aug 2, after market close.

ADC Therapeutics ADCT has an Earnings ESP of +52.73% and a Zacks Rank #2.

In the year so far, ADC Therapeutics’ stock has lost 60.9%. ADCT beat earnings estimates in three of the last four quarters while missing the mark on one occasion. ADC Therapeutics delivered an earnings surprise of 10.70%, on average.

Moderna MRNA has an Earnings ESP of +2.83% and a Zacks Rank #3.

Moderna’s stock has declined 31.7% this year so far. MRNA beat earnings estimates in two of the last four quarters while missing in the other two. Moderna has a four-quarter earnings surprise of 21.97%, on average. The company is scheduled to release its second-quarter results on Aug 3, before the opening bell.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Moderna, Inc. (MRNA) : Free Stock Analysis Report

ADC Therapeutics SA (ADCT) : Free Stock Analysis Report

ACADIA Pharmaceuticals Inc. (ACAD) : Free Stock Analysis Report