GSK Gears Up for Q4 Earnings: Will It Surpass Estimates?

We expect GSK plc. GSK to beat expectations when it reports fourth-quarter and full-year 2023 results on Jan 31. In the last reported quarter, the company delivered an earnings surprise of 15.60%.

Factors to Note

GSK reports financial figures under three segments — Specialty Medicines, Vaccines and General Medicines.

In the fourth quarter, higher sales of newer products like Arexvy, Cabenuva, Dovato, Trelegy Ellipta and Shingrix are likely to have offset the decline in sales of older HIV drugs and respiratory medicines due to generic erosion and competitive pressure. Our model suggests the Respiratory sales to be around £1.88 billion for the quarter.

In HIV, the strong sales growth trend witnessed in recent quarters of the two-drug regimens, Juluca and Dovato and long-acting regimens, Cabenuva and Apretude, might have partially offset the losses in sales of the three-drug regimens during the to-be-reported quarter. Our model estimates sales from the HIV portfolio to be £1.68 billion for the quarter.

Sales of COPD inhalers Trelegy Ellipta and Breo Ellipta are likely to have contributed to fourth-quarter 2023 sales. Our model suggests Trelegy Ellipta and Breo Ellipta sales to be around £571 million and £348 million, respectively.

GSK’s key vaccine, Shingrix’s, sales showed a strong demand recovery in the United States, which — coupled with new launches in different countries — benefited sales in recent quarters. We expect this trend to have continued in the fourth quarter. Our model predicts shingles vaccine sales to be around £847 million.

Sales of meningitis and influenza vaccines have shown a strong recovery in recent quarters on the back of CDC purchases in the United States. The trend is likely to have continued in the fourth quarter. Our model suggests meningitis vaccine sales (including Bexsero) to be around £299 million, while influenza vaccine sales are expected to be around £122 million.

Last year in May, the FDA approved Arexvy, GSK’s respiratory syncytial virus (RSV) vaccine, to prevent lower respiratory tract disease (LRTD) caused by RSV in older adults. This was the first RSV vaccine for older adults to be approved worldwide. The vaccine was made available during the fall season. We expect the company to generate around £249 million from Arexvy sales.

Oncology sales are likely to have witnessed a decline due to lower Blenrep sales following the withdrawal from the U.S. market in November 2022. Our model suggests that the Oncology portfolio is likely to have generated around £133 million in sales. Sales from the recently launched blood cancer drug Ojjaara are expected to be around £4 million.

Earnings Surprise History

GSK’s earnings surpassed estimates in each of the trailing four quarters, delivering a beat of 11.02% on average.

GSK PLC Sponsored ADR Price

GSK PLC Sponsored ADR price | GSK PLC Sponsored ADR Quote

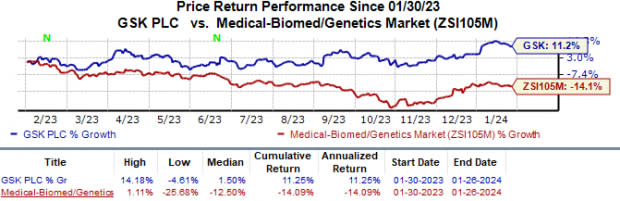

Shares of GSK have outperformed the industry in the past year. The stock has gained 11.3% against the industry’s 14.1% decline.

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts an earnings beat for GSK this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here, as you will see below. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Earnings ESP: GSK has an Earnings ESP of 0.63% as the Most Accurate Estimate is higher than the Zacks Consensus Estimate, which stands at 80 cents per ADR

Zacks Rank: GSK currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Stocks to Consider

Here are some biotech/large-cap stocks that have the right combination of elements to beat on earnings this time around:

BioMarin BMRN has an Earnings ESP of +9.45% and a Zacks Rank #1.

BioMarin’s stock has lost 20.8% in the past year. BioMarin beat earnings estimates in three of the last four quarters, while missing out on one occasion. BMRN delivered a four-quarter earnings surprise of 11.68%, on average.

AstraZeneca AZN has an Earnings ESP of +3.17% and a Zacks Rank #3.

AstraZeneca’s stock has gained 1.9% in the past year. AstraZeneca beat earnings estimates in all the last four quarters. AZN delivered a four-quarter earnings surprise of 8.30%, on average. AstraZeneca is scheduled to release its fourth-quarter results on Feb 8.

Merck MRK has an Earnings ESP of +23.45% and a Zacks Rank #3.

In the past year, Merck’s stock has risen 13.9%. Merck beat earnings estimates in all the last four quarters. MRK delivered a four-quarter earnings surprise of 5.80%, on average. Merck is scheduled to release its fourth-quarter results on Feb 1, before market opens.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

AstraZeneca PLC (AZN) : Free Stock Analysis Report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

BioMarin Pharmaceutical Inc. (BMRN) : Free Stock Analysis Report

Merck & Co., Inc. (MRK) : Free Stock Analysis Report