GSK Lags Q4 Earnings, Tops Sales, Issues Upbeat '24 Guidance

GSK plc GSK reported adjusted earnings of 72 cents per American depositary share (“ADS”) in fourth-quarter 2023, missing the Zacks Consensus Estimate of 76 cents. Adjusted earnings rose 12% year over year on a reported basis and 25% at a constant exchange rate (CER).

Quarterly revenues increased 9% on a reported basis and 15% on a CER basis to $10.1 billion (£8.1 billion), beating the Zacks Consensus Estimate of $9.8 billion. The upside can be attributed to rising vaccine sales, which was partially offset by the declining COVID-19 product sales.

GSK reports financial figures under three segments — Specialty Medicines, Vaccines and General Medicines.

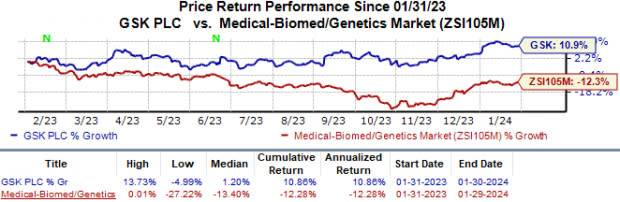

In the past year, shares of GSK have increased 10.9% against the industry’s 12.3% fall.

Image Source: Zacks Investment Research

Segment Discussion

Sales in the Specialty Medicines segment rose 12% at CER despite a steep decline in Xevudy sales. Excluding Xevudy sales, revenues from the Specialty Medicines segment were up 17% at CER. Sales growth of HIV, oncology and respiratory drugs was also strong.

Xevudy generated sales of £13 million in the fourth quarter compared with nil revenues in third-quarter 2023. GSK markets Xevudy in collaboration with Vir Biotechnology VIR. In 2022, the FDA withdrew the emergency use authorization (EUA) granted to GSK/Vir Biotechnology’s Xevudy. The withdrawal decision for the Vir Biotechnology-partnered antibody therapy was based on data that showed that it was unlikely for the Xevudy dose to be effective against the Omicron variant.

HIV sales increased 10% at CER, driven by sales of new HIV drugs — Dovato, Cabenuva, Rukobia and Apretude.

GSK generates the majority of its HIV sales from its dolutegravir franchise, comprising three-drug regimens — Triumeq and Tivicay — and two-drug regimens — Dovato and J&J (JNJ)-partnered Juluca. The launch of the two-drug regimens has been eroding sales and market share of the three-drug regimens following their launch. During the fourth quarter, GSK and J&J’s Juluca and Dovato contributed around 39% to total HIV sales.

While sales of the dolutegravir franchise were down 1% at CER in the U.S. market, they rose 4% in Europe. In International markets, sales were up 12% at CER.

Sales of Triumeq declined 13% at CER, while Tivicay sales remained flat during the quarter.

Sales of the immuno-inflammation drug Benlysta were up 25% in the quarter, reflecting growth across all regions.

Sales of the respiratory drug Nucala were up 25% at CER during the quarter, driven by growth across all regions, especially in the U.S. market.

Oncology sales were up 62% year over year, driven by the strong U.S. launch of Ojjaara and encouraging growth in Jemperli and Zejula sales. The upside was partially offset by Blenrep sales, which fell 78% during the quarter following thedrug’s withdrawal from the U.S. market in 2022.

Sales of Zejula rose 28% at CER in the quarter. Jemperli added £60 million to the top line in the fourth quarter compared to £45 million in third-quarter 2023. The uptick was driven by new patient starts in the United States.

The recently launched blood cancer drug Ojjaara, generated £29 million in product sales during the quarter, compared to £4 million in third-quarter 2023. The FDA approved the drug in September for treating myelofibrosis patients with anemia.

Sales of General Medicines were up 5% at CER during the quarter. This upside was driven by solid sales growth of respiratory drugs, Anoro Ellipta, Breo Ellipta and Trelegy Ellipta and the continued post-pandemic recovery of the antibiotic market outside the United States.

Trelegy Ellipta sales surged 35% year over year, owing to strong growth in all regions. Sales of Anoro Ellipta were up 16% at CER during the fourth quarter. Key established drug Advair/Seretide sales were down 12% year over year. Sales on Revlar/Breo Ellipta were up 27% at CER year over year.

Vaccine Sales Rise

GSK’s fourth-quarter vaccine sales increased 29% at CER, driven by the successful launch of the RSV vaccine Arexvy in the United States and strong uptake for the Shingrix vaccine in ex-U.S. markets. GSK also recorded sales of £7 million from the COVID-19 booster vaccine co-developed in partnership with Sanofi, all of which were generated from outside the United States.

The first approved RSV vaccine for older adults, Arexvy generated £529 million during the quarter, compared to £709 million in third-quarter 2023 sales, driven by strong demand.Per management, Arexvy achieved more than two-thirds of the share of retail vaccinations in the quarter.

Shingrix sales rose 23% at CER during the quarter, driven by strong private uptake and public funding expansion in ex-U.S. markets.

In Meningitis vaccines, Bexsero sales rose 21%, while sales of Menveo rose 19%. Sales of the influenza vaccine, Fluarix, were down 64% at CER. Sales of Established vaccines were up 8% year over year.

Operating Expenses

Adjusted selling, general and administration (SG&A) costs increased 12% year over year at CER to £2.59 billion. The upside in SG&A costs was due to the launch of products in the Specialty Medicines and Vaccines segments.

Research and development (R&D) expenses rose 20% year over year at CER to £1.78 billion due to continued investment by management for pipeline advancement.

2024 Guidance

GSK issued its guidance for 2024. The company expects sales to increase 5% to 7% in 2024.

Management expects sales of specialty medicines to increase by a low single-digit percentage at CER in 2024, while vaccine sales are expected to grow in high single-digit to low double-digit percentage at CER. However, management expects a mid-single-digit decline in turnover for the General Medicines segment.

The company expects adjusted operating profit growth to increase between 7% to 10% at CER. GSK also guided its adjusted EPS, which is anticipated to grow in the range of 6-9%.

The above guidance excludes any revenues from its COVID-related products. If management were to add COVID sales, it expects a growth of approximately 1% in turnover and 2% growth in adjusted operating profit. Management does not expect any further COVID-19-related sales in 2024.

Our Take

GSK’s Q4 results were mixed, as it beat estimates for sales but missed the mark on earnings. While sales grew across all segments, the growth was dominated by Shingrix and RSV vaccines. The company’s oncology portfolio, which has been facing a steep decline due to lower Blenrep sales in recent quarters, registered impressive growth on the back of rising Jemperli sales and the newly-launched Ojjaara.

Based on the rising product sales and future commercial launches, GSK also raised its long-term outlook. For the period between 2021 and 2026, GSK now expects sales to increase by a CAGR of more than 7% and adjusted operating profit to increase by more than 11%. In 2021, management had guided for more than 5% and more than 10%, respectively.

Management also hiked its 2031 sales forecast as it now expects to generate sales of more than £38 billion. This marks an increase of £5 billion over the forecast issued in 2021.

GSK PLC Sponsored ADR Price

GSK PLC Sponsored ADR price | GSK PLC Sponsored ADR Quote

Zacks Rank & A Key Pick

GSK currently has a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is Anavex Life Sciences AVXL, which sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 30 days, estimates for Anavex Life Sciences’ 2023 loss per share have improved from 57 cents to 53 cents. Shares of Anavex lost 42.1% in the year-to-date period.

Anavex beat earnings estimates in each of the last four quarters, delivering an earnings surprise of 15.80% on average. In the last reported quarter, Anavex’s earnings beat estimates by 25.00%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Anavex Life Sciences Corp. (AVXL) : Free Stock Analysis Report

Vir Biotechnology, Inc. (VIR) : Free Stock Analysis Report