GSK's Momelotinib Gets FDA Nod for Myelofibrosis-Related Anemia

GSK plc GSK announced that the FDA has granted approval to momelotinib to treat myelofibrosis patients with anemia.

Momelotinib is a novel, investigational JAK1/JAK2 inhibitor, which was added to GSK’s portfolio, following the acquisition of Sierra Oncology in 2022.

The drug, to be marketed by the trade name of Ojjaara, is now approved to treat intermediate or high-risk myelofibrosis, including primary myelofibrosis or secondary myelofibrosis (post-polycythaemia vera and post-essential thrombocythaemia) in adults with anemia. It became the first and the only drug approved to treat both newly diagnosed and previously treated myelofibrosis patients with anemia in the United States.

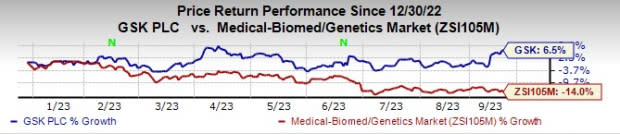

GSK’s stock has risen 6.5% so far this year against a decline of 14% for the industry.

Image Source: Zacks Investment Research

The NDA application for momelotinib was based on data from key phase III studies, including the pivotal MOMENTUM study. The MOMENTUM study evaluated momelotinib versus another anemia drug danazol for treating anemic myelofibrosis patients previously treated with an approved JAK inhibitor. In the MOMENTUM study, momelotinib achieved statistical significance in the primary and all pre-specified secondary endpoints, reporting a statistically significant benefit on symptoms, anemia and splenic size.

Myelofibrosis is a rare and fatal cancer of the bone marrow, which often leads to anemia that causes fatigue, increased risk of infection and bleeding or bruising due to reduced platelet count in patients. Almost all patients with myelofibrosis develop anemia over the course of the disease, with around 30% discontinuing treatment due to anemia. They then require blood transfusions for their treatment. This creates a significant unmet need for medicines like Ojjaara, which has the potential to become a standard-of-care treatment for myelofibrosis patients with anemia, claims GSK

We remind investors that in June, the FDA had delayed its decision on momelotinib’s new drug application by three months. A marketing authorization application by GSK is simultaneously being reviewed by the European Medicine Agency for approval in the EU.

Zacks Rank

GSK currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

GSK PLC Sponsored ADR Price and Consensus

GSK PLC Sponsored ADR price-consensus-chart | GSK PLC Sponsored ADR Quote

Some better-ranked biotech companies are Exelixis EXEL, Dynavax Technologies Corporation DVAX and Corcept Therapeutics CORT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Exelixis’ 2023 earnings per share have risen from 89 cents to 98 cents per share. During the same period, earnings per share estimates for 2024 have risen from $1.31 to $1.36. Year to date, shares of Exelixis have gained 30.8%.

Earnings of Exelixis beat estimates in three of the last four quarters, delivering an earnings surprise of 18.62% on average.

In the past 60 days, estimates for Dynavax Technologies’ 2023 loss per share have narrowed from 51 cents to 24 cents, while those for 2024 have improved from a loss of 24 cents to earnings of 2 cents. Shares of Dynavax Technologies have gained 11.9% year to date.

Earnings of Dynavax Technologies beat estimates in two of the last four quarters and missed the mark on two occasions. On average, the company witnessed an earnings surprise of 25.78% over the trailing four quarters.

In the past 60 days, the Zacks Consensus Estimate for Corcept’s earnings has gone up from 62 cents per share to 78 cents for 2023. The bottom-line estimate has also improved from 61 cents to 83 cents for 2024 during the same time frame. Shares of the company have rallied 134.7% year to date.

CORT’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average surprise of 6.99%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GSK PLC Sponsored ADR (GSK) : Free Stock Analysis Report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Exelixis, Inc. (EXEL) : Free Stock Analysis Report

Corcept Therapeutics Incorporated (CORT) : Free Stock Analysis Report