Guardant Health Inc (GH) Reports 25% Revenue Growth in Full Year 2023

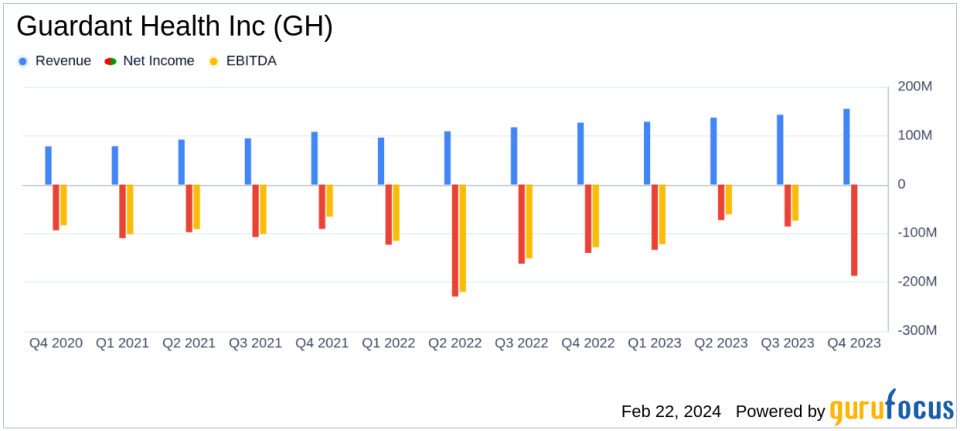

Revenue Growth: Full year 2023 revenue increased by 25% to $563.9 million, driven by a 39% growth in clinical test volume.

Q4 Performance: Fourth quarter revenue rose 22% to $155.1 million with test volumes to clinical customers up by 29%.

Operating Expenses: Full year 2023 operating expenses were reduced, contributing to improved free cash flow compared to 2022.

Net Loss: Despite revenue growth, GH reported a net loss of $187.0 million in Q4 and $479.4 million for the full year 2023.

2024 Outlook: GH expects full year 2024 revenue to be in the range of $655 to $670 million, with a non-GAAP gross margin of 60% to 62%.

On February 22, 2024, Guardant Health Inc (NASDAQ:GH) released its 8-K filing, detailing the financial results for the fourth quarter and full year ended December 31, 2023. The company, a leader in precision oncology, has reported a significant revenue increase, attributing the growth to a surge in clinical test volumes. Guardant Health's product portfolio includes the Guardant360 LDT, Guardant360 CDx, Guardant OMNI, and the recently launched Reveal and Shield tests.

Financial Performance and Challenges

Guardant Health's revenue for the full year 2023 reached $563.9 million, marking a 25% increase from the previous year. The fourth quarter alone saw revenues of $155.1 million, a 22% rise from the fourth quarter of 2022. This growth was primarily driven by a 39% increase in clinical test volumes, indicating strong demand for the company's testing services. However, despite the revenue growth, GH faced a net loss of $187.0 million in the fourth quarter and $479.4 million for the full year. The net loss per share for 2023 was $4.28, an improvement from $6.41 in the previous year.

The company's financial achievements are critical in the Medical Diagnostics & Research industry, as they reflect the company's ability to scale its operations and meet the growing demand for precision oncology tests. However, the reported net losses highlight the challenges GH faces in terms of high operating expenses and the costs associated with expanding its product offerings.

Key Financial Metrics

Guardant Health ended the year with a strong balance sheet, boasting $1.2 billion in cash, cash equivalents, and marketable debt securities. The gross margin for the full year stood at 60%, although this was a decrease from 65% in the previous year, primarily due to changes in product mix and the cost of processing Shield LDT tests. Operating expenses for the full year 2023 were slightly reduced to $818.2 million from $837.6 million in 2022, contributing to an improved free cash flow of negative $345.5 million, compared to negative $386.9 million for the previous year.

These metrics are important as they provide insights into the company's operational efficiency and financial health. A strong cash position enables GH to invest in research and development, as well as market expansion, while free cash flow improvements suggest better financial management and potential for future investments.

2024 Outlook and Commentary

Looking ahead, Guardant Health expects full year 2024 revenue to be in the range of $655 to $670 million, representing growth of 16% to 19% compared to full year 2023. The company also anticipates a non-GAAP gross margin excluding screening to be between 60% and 62%. Total non-GAAP operating expenses are expected to be in the range of $740 to $750 million, with free cash flow projected to be between negative $320 to $330 million, indicating an improvement over the full year 2023.

"2023 marked another strong year for Guardant. This was underscored by our teams exceptional execution to deliver strong clinical volumes, which grew nearly 40%," said Helmy Eltoukhy, co-founder and co-CEO. "Looking ahead to 2024, we are well positioned for continued growth across our oncology product portfolio and have a strong foundation to deliver long-term shareholder value."

Guardant Health's performance in 2023 demonstrates its ability to grow revenue and manage expenses effectively. The company's focus on expanding its product portfolio and improving operational efficiencies positions it for continued success in the precision oncology market. Investors and stakeholders will be watching closely to see if GH can maintain its growth trajectory and achieve profitability in the coming years.

Explore the complete 8-K earnings release (here) from Guardant Health Inc for further details.

This article first appeared on GuruFocus.