Guess? (GES) Benefits From Strategic Plan & Online Business

Focus on the strategic business plan is working well for Guess? Inc. GES. The apparel and accessories company is benefiting from growing online business. Strength in the Europe & Asia businesses has been aiding the top line — as seen in the first quarter of fiscal 2024.

The Zacks Rank #2 (Buy) company’s Europe segment revenues increased 2%, backed by solid retail store performance (including new stores) in the fiscal first quarter. Revenues from its Asia unit jumped 26%, driven by business strength in South Korea and the Greater China region due to increased consumer activity.

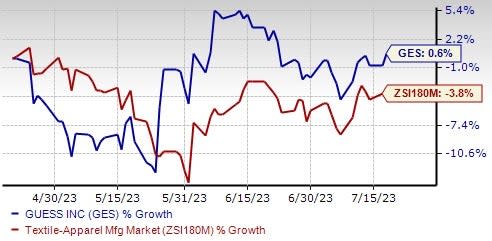

Encouragingly, management anticipates revenues to grow 2-4% in fiscal 2024. The company expects fiscal 2024 adjusted earnings per share (EPS) of $2.60-$2.90 compared with $2.74 recorded in fiscal 2023. GES’s stock has inched up 0.6% in the past three months against the industry’s decline of 3.8%.

Image Source: Zacks Investment Research

Factors Working Well for Guess?

Guess? is committed to its six key strategies and has been making significant progress with regard to each of them. The company’s core strategies include organization and culture, functional capacities, brand relevance with consumer groups, customer focus, product brilliance and an international footprint. The company is focused on a brand-elevation strategy that includes enhancing product quality, visual merchandising and boosting customers’ shopping experiences across stores and online.

Guess? is committed to improving its customers’ experiences by implementing various upgrades to its store and e-commerce infrastructure to increase customer conversion. With respect to its salesforce and omnichannel capacity rollout, Guess? implemented Customer 360, which is a solution developed by salesforce for personalized marketing, customer data optimization and customers’ journey engagement among other.

GES is on track to progress in its customer-centric initiatives, including omnichannel capabilities and advanced data analytics and customer segmentation. Guess? has been on track with its digital-first initiative and has been investing in brand building through social media platforms. Further, the company is concentrating on linking brick-and-mortar stores, e-commerce and mobile sales to improve its online operations.

Guess? has also improved e-commerce operations by undertaking efforts such as better data capture, improved customer profiling, personalized marketing and relationship management. These efforts are expected to help the company enhance its customer base and enrich experience, which in turn is likely to aid sales.

Management is on track to streamline its cost structure to enhance operating model and reduce SG&A expenses. Well, cost-saving efforts and the aforementioned upsides are likely to keep Guess?’s growth story going.

Other Stocks to Consider

Some other top-ranked companies from the Consumer Discretionary sector are GIII Apparel Group GIII, lululemon athletica LULU and Ralph Lauren RL.

GIII Apparel, which is a manufacturer, designer and distributor of apparel and accessories, sports a Zacks Rank #1 (Strong Buy) at present. The company has an expected EPS growth rate of 15% for three to five years.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales and earnings suggests growth of 1.9% and 0.4% from the year-ago period’s actuals. GIII has a trailing four-quarter earnings surprise of 47.4%, on average.

lululemon, which is a yoga-inspired athletic apparel company, currently carries a Zacks Rank #2. The company has an expected EPS growth rate of 20% for three to five years.

The Zacks Consensus Estimate for lululemon’s current financial-year sales and earnings suggests growth of 17.1% and 18.4%, respectively, from the year-ago period’s reported figures. LULU has a trailing four-quarter earnings surprise of 9.9%, on average.

Ralph Lauren presently carries a Zacks Rank #2. The company has a trailing four-quarter earnings surprise of 28.7%, on average. RL has an expected EPS growth rate of 13.8% for three to five years.

The Zacks Consensus Estimate for Ralph Lauren’s current financial-year sales and earnings suggests growth of 2.8% and 13.1%, respectively, from the year-ago period’s reported figures. RL has a trailing four-quarter earnings surprise of 17.4%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ralph Lauren Corporation (RL) : Free Stock Analysis Report

Guess?, Inc. (GES) : Free Stock Analysis Report

lululemon athletica inc. (LULU) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report