Guess? (GES) Gains From Business Strength Amid Headwinds

Guess? Inc. GES has been benefiting from its growing online business. The company is experiencing strength in its businesses across Europe and Asia, supported by strong demand in retail end markets. Of late, increased consumer activity in South Korea and the Greater China region has also been driving its Asia unit’s performance.

In first-quarter fiscal 2024, revenues from Guess?’s Europe segment increased 2%, driven by solid retail store performance (including new stores). The apparel and accessories company’s Asia unit revenues also jumped 26% in the quarter. Driven by business strength, management expects revenues to increase by 2-4% in fiscal 2024. The company also anticipates fiscal 2024 adjusted earnings per share (EPS) of $2.60-$2.90 compared with $2.74 recorded in fiscal 2023.

GES remains focused on improving its customers’ experiences by implementing upgrades to its store and e-commerce infrastructure to increase customer conversion. For instance, it recently upgraded its store infrastructure, including the implementation of mobile point-of-sale check-out, Salesforce Customer 360 and a real-time inventory and sales dashboard. Customer 360 is a solution developed by Salesforce for personalized marketing, customer data optimization and customers’ journey engagement, among other features.

Guess? is on track with its customer-centric initiatives, including omnichannel capabilities, advanced data analytics and customer segmentation. With respect to its digital-first initiative, the company has been investing in brand-building through social media platforms. The company is concentrating on linking brick-and-mortar stores, e-commerce and mobile sales to improve its online operations.

GES has also been streamlining its cost structure to boost its operating model and reduce operating expenses. These cost savings are likely to be reinvested in amplifying the company’s marketing and omnichannel capabilities.

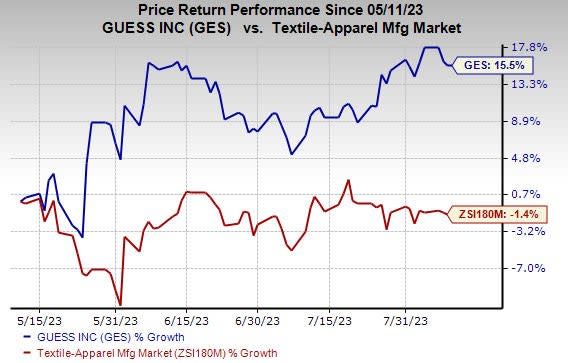

Image Source: Zacks Investment Research

In the past three months, this Zacks Rank #3 (Hold) stock has gained 15.5% against the industry’s decline of 1.4%.

However, Guess? has been experiencing softness in its Americas retail business. In the fiscal first quarter, revenues from this business dipped 14% on a year-over-year basis. The decline was attributable to reduced customer traffic and conversion amid a soft consumer spending environment. For second-quarter fiscal 2024, GES anticipates its revenues to be within the break-even level to 1.5% decline range.

Also, rising costs and expenses have remained a concern for the company as of late. In the fiscal first quarter, its adjusted selling, general and administrative costs surged 12% to $231 million due to higher store selling expenses and increased investments in its infrastructure in Europe. In the quarter, gross margin contracted 90 basis points year-over-year to 40.7%.

Stocks to Consider

Some better-ranked companies from the Consumer Discretionary sector are GIII Apparel Group GIII, Alto Ingredients ALTO and Prestige Consumer Healthcare PBH.

GIII Apparel, a manufacturer, designer and distributor of apparel and accessories, carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for GIII Apparel’s current financial-year sales and earnings suggests growth of 1.9% and 0.4% from the year-ago period’s actuals. GIII has a trailing four-quarter earnings surprise of 47.4%, on average.

Alto Ingredients, a producer of specialty alcohols and essential ingredients, currently carries a Zacks Rank #2. The Zacks Consensus Estimate for ALTO’s current financial-year earnings suggests growth of 78.3% from the year-ago period’s reported figure. ALTO has an earnings surprise of 242.9% in the last reported quarter.

Prestige Consumer provides healthcare and household cleaning products and presently carries a Zacks Rank #2. PBH has an expected EPS growth rate of 8% for the next three to five years. The Zacks Consensus Estimate for Prestige Consumer’s current financial-year sales and earnings suggests growth of 0.7% and 2.4%, respectively, from the year-ago period’s reported figures. PBH has a trailing four-quarter earnings surprise of 3.2%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Guess?, Inc. (GES) : Free Stock Analysis Report

G-III Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Prestige Consumer Healthcare Inc. (PBH) : Free Stock Analysis Report

Alto Ingredients, Inc. (ALTO) : Free Stock Analysis Report