Is Guess? Inc (GES) Stock Fairly Valued? An In-depth Analysis

Guess? Inc (NYSE:GES) has been the talk of the market with a daily gain of 28.91%, and a 3-month gain of 6.2%. The company's Earnings Per Share (EPS) stand at 1.89. But the question that looms large is whether the stock is fairly valued? This article delves into an in-depth analysis of the company's valuation. Let's explore.

A Snapshot of Guess? Inc (NYSE:GES)

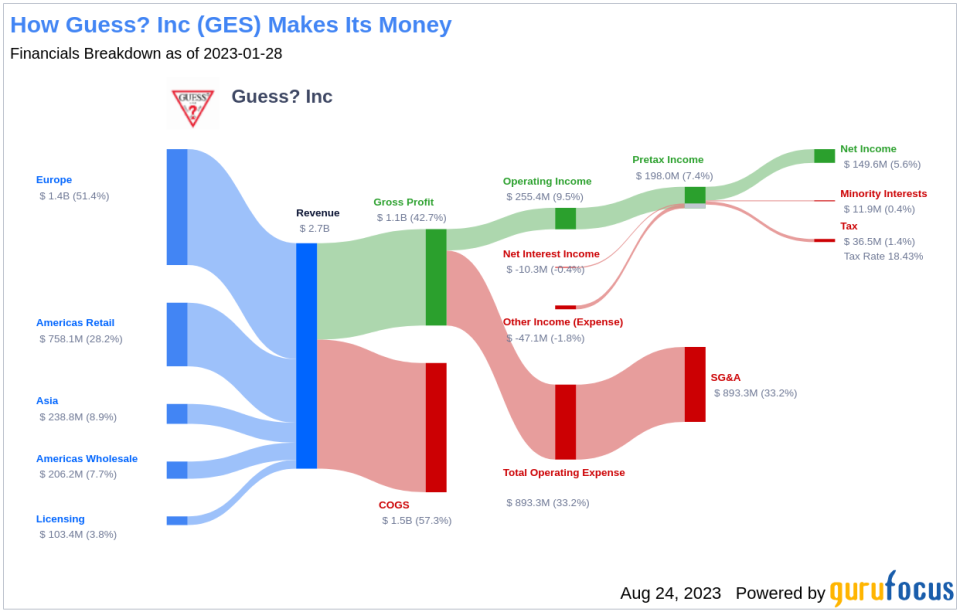

Guess? Inc is a renowned name in the fashion industry, designing, marketing, and licensing contemporary apparel and accessories. With brands like Guess, Marciano, and G by Guess under its umbrella, the company operates through five segments - Americas Retail, Americas Wholesale, Europe, Asia, and licensing. The majority of its revenue stems from the Europe segment.

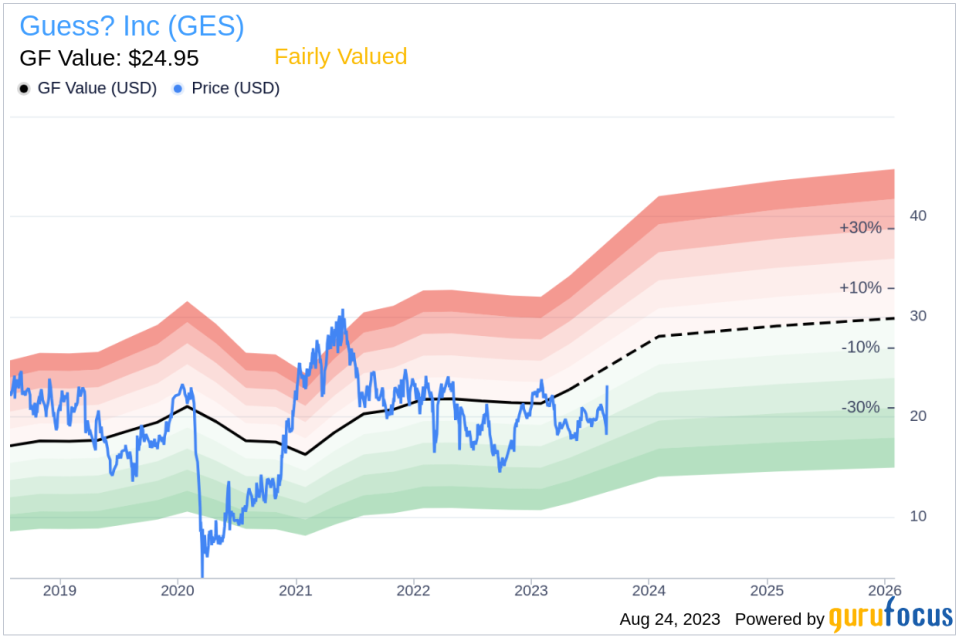

The current stock price of Guess? Inc (NYSE:GES) is $23.6, with a market cap of $1.30 billion. When compared to the GF Value of $24.95, it seems like the stock is fairly valued. But does this hold true when we delve deeper into the company's financials and growth prospects?

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line on our summary page provides an overview of the stock's fair trading value.

According to GuruFocus Value calculation, Guess? is fairly valued. At its current price of $23.6 per share, the stock appears to be trading close to its fair value. This suggests that the long-term return of Guess? stock is likely to be close to the rate of its business growth.

Link: These companies may deliver higher future returns at reduced risk.

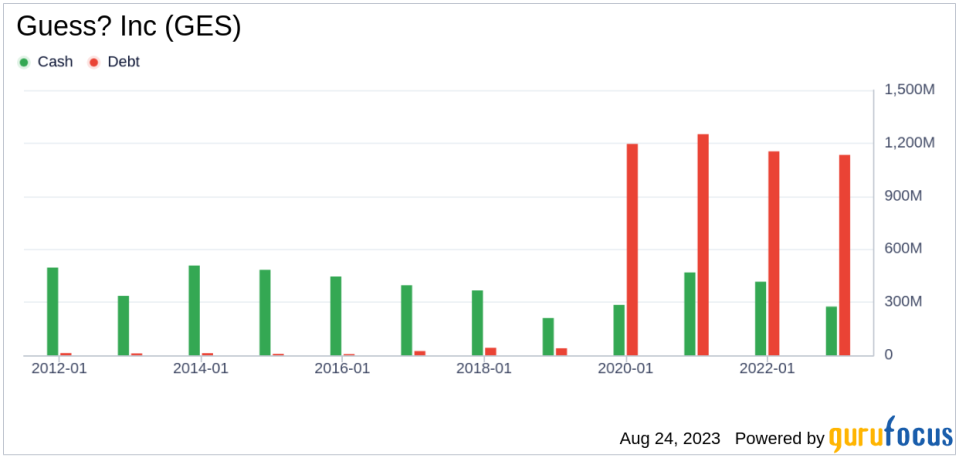

Assessing Financial Strength

Before investing in a company, it's crucial to assess its financial strength. A company with poor financial strength has a higher risk of permanent loss. Guess? has a cash-to-debt ratio of 0.23, which is worse than 65.26% of 1088 companies in the Retail - Cyclical industry. The overall financial strength of Guess? is 5 out of 10, indicating fair financial strength.

Profitability and Growth

Investing in profitable companies, especially those with consistent profitability over the long term, is generally less risky. Guess? has been profitable 8 times over the past 10 years. The company's operating margin is 8.23%, ranking better than 71.64% of 1093 companies in the Retail - Cyclical industry. Overall, the profitability of Guess? is ranked 7 out of 10, indicating fair profitability.

Growth is a crucial factor in a company's valuation. The 3-year average annual revenue growth of Guess? is 0.9%, ranking worse than 59.39% of 1044 companies in the Retail - Cyclical industry. However, the 3-year average EBITDA growth rate is 9.6%, ranking better than 53.83% of 901 companies in the same industry.

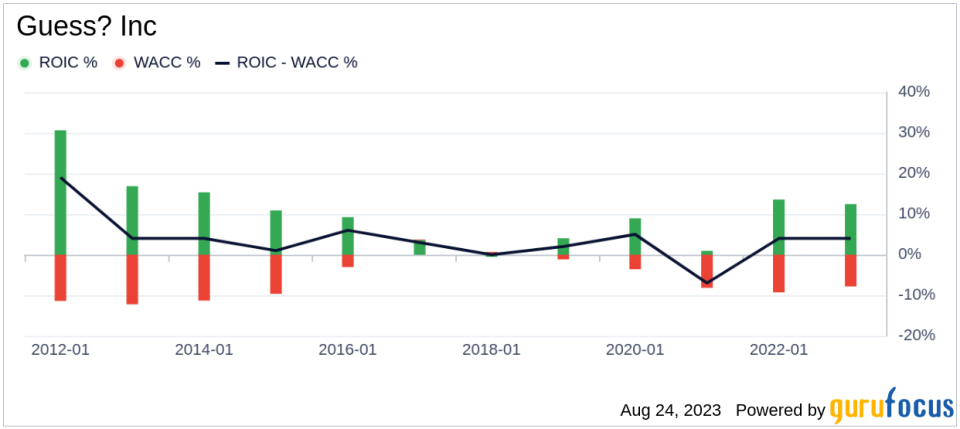

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. Over the past 12 months, Guess?'s ROIC was 11.28, while its WACC came in at 5.11. This indicates that the company is creating value for shareholders.

Conclusion

In conclusion, the stock of Guess? (NYSE:GES) appears to be fairly valued. The company's financial condition and profitability are fair, and its growth ranks better than 53.83% of 901 companies in the Retail - Cyclical industry. To learn more about Guess? stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.