Guidewire (NYSE:GWRE) Posts Q2 Sales In Line With Estimates But Stock Drops

Insurance industry-focused software maker Guidewire (NYSE:GWRE) reported results in line with analysts' expectations in Q2 FY2024, with revenue up 3.6% year on year to $240.9 million. On the other hand, next quarter's revenue guidance of $231 million was less impressive, coming in 1.6% below analysts' estimates. It made a non-GAAP profit of $0.46 per share, improving from its loss of $0.21 per share in the same quarter last year.

Is now the time to buy Guidewire? Find out by accessing our full research report, it's free.

Guidewire (GWRE) Q2 FY2024 Highlights:

Revenue: $240.9 million vs analyst estimates of $241.8 million (small miss)

EPS (non-GAAP): $0.46 vs analyst estimates of $0.23 ($0.23 beat)

Revenue Guidance for Q3 2024 is $231 million at the midpoint, below analyst estimates of $234.9 million

The company dropped its revenue guidance for the full year from $981 million to $962 million at the midpoint, a 1.9% decrease

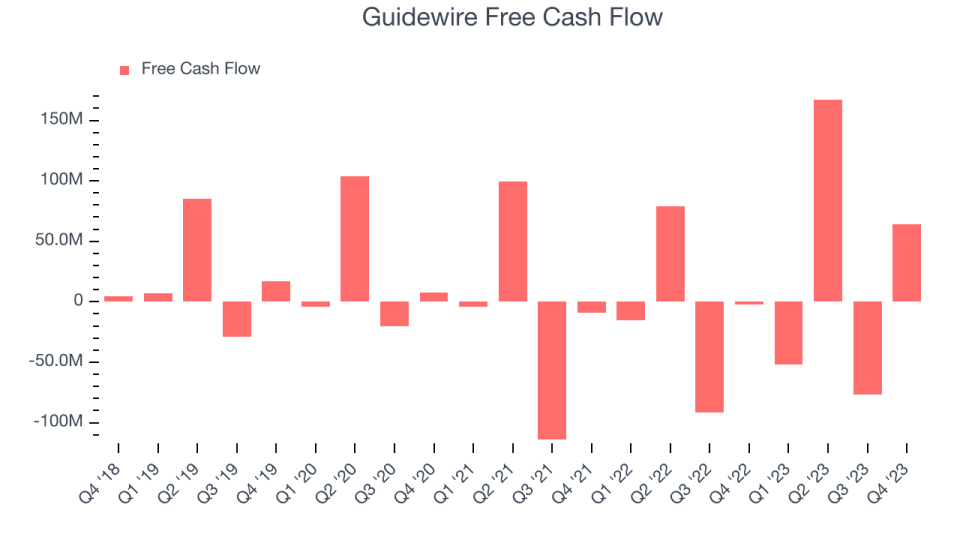

Free Cash Flow of $63.89 million is up from -$76.77 million in the previous quarter

Gross Margin (GAAP): 59.1%, up from 53.1% in the same quarter last year

Market Capitalization: $9.44 billion

“Our strong performance in the second quarter was marked by eleven cloud deals, including a healthy mix of migrations, expansions, and net-new customers,” said Mike Rosenbaum, chief executive officer, Guidewire.

Founded by two individuals involved in the development of leading procurement software Ariba, Guidewire (NYSE:GWRE) offers insurance companies a software-as-a-service platform to help sell their products and manage their workflows.

Vertical Software

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

Sales Growth

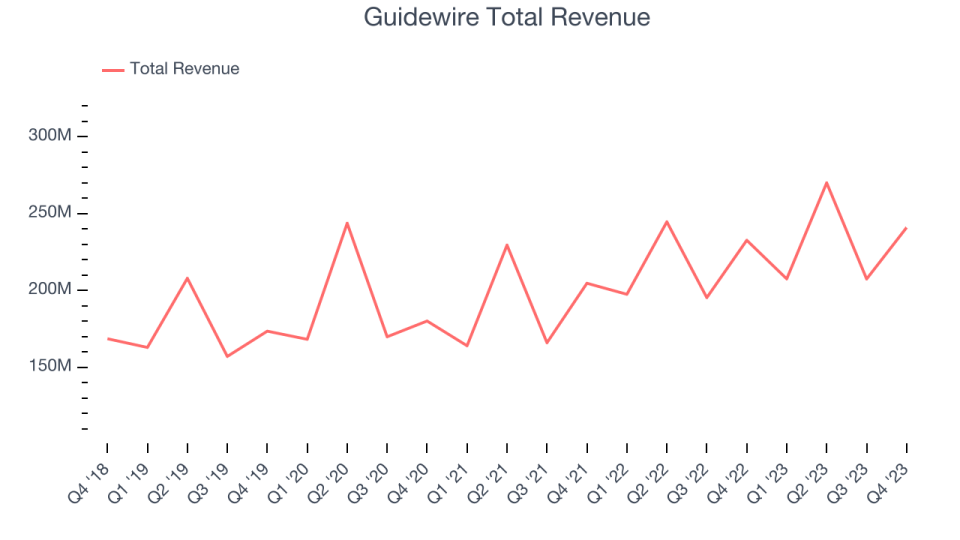

As you can see below, Guidewire's revenue growth has been unremarkable over the last two years, growing from $204.6 million in Q2 FY2022 to $240.9 million this quarter.

Guidewire's quarterly revenue was only up 3.6% year on year, which might disappoint some shareholders. However, its revenue increased $33.49 million quarter on quarter, a strong improvement from the $62.55 million decrease in Q1 2024. This is a sign of acceleration of growth and very nice to see indeed.

Next quarter's guidance suggests that Guidewire is expecting revenue to grow 11.3% year on year to $231 million, improving on the 5.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 13% over the next 12 months before the earnings results announcement.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Guidewire's free cash flow came in at $63.89 million in Q2, turning positive over the last year.

Guidewire has generated $102.4 million in free cash flow over the last 12 months, or 11.1% of revenue. This FCF margin stems from its asset-lite business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Guidewire's Q2 Results

It was good to see Guidewire's positive free cash flow. We were also glad its gross margin improved. On the other hand, its full-year revenue guidance was below expectations. Overall, the results could have been better. The company is down 5.7% on the results and currently trades at $110.2 per share.

Guidewire may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.