Guidewire Software Inc (GWRE) Reports Q2 Fiscal Year 2024 Earnings with Increased ARR and ...

Annual Recurring Revenue (ARR): Increased to $800 million as of January 31, 2024, from $763 million as of July 31, 2023.

Subscription and Support Revenue: Grew by 24% year-over-year to $131.6 million.

GAAP Net Income: Turned positive at $9.7 million, or $0.12 per share, compared to a net loss in the same quarter last year.

Non-GAAP Income from Operations: Improved to $25.7 million, up from $15.1 million in the same quarter of the previous fiscal year.

Liquidity: Cash, cash equivalents, and investments totaled $932.7 million at the end of the quarter.

Business Outlook: For Q3 FY 2024, ARR is projected to be between $815 million and $820 million, with total revenue expected between $228 million and $234 million.

On March 7, 2024, Guidewire Software Inc (NYSE:GWRE) released its 8-K filing, announcing financial results for the second quarter of fiscal year 2024. The company, known for its software solutions for property and casualty insurers, including its flagship product InsuranceSuite, reported a solid quarter with significant growth in its cloud-based offerings.

Financial Performance and Challenges

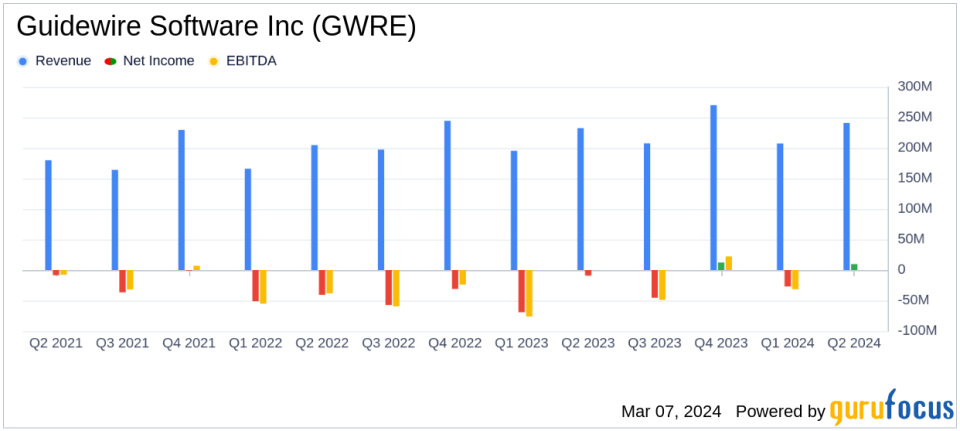

Guidewire's total revenue for the quarter was $240.9 million, a 4% increase from the same period last year. This growth was primarily driven by a 24% increase in subscription and support revenue, which reached $131.6 million. However, services revenue saw a decrease of 29% to $38.2 million, and license revenue slightly declined by 3% to $71.1 million. The company's ARR also saw a healthy increase to $800 million, up from $763 million six months prior.

Despite the lower services revenue, which the company attributes to the success of its System Integrator (SI) partners leading more cloud engagements, Guidewire maintained its profitability outlook. This confidence is supported by strong subscription and support gross margin and disciplined operating expenses.

Profitability and Financial Achievements

Guidewire's profitability saw significant improvements, with a GAAP net income of $9.7 million, or $0.12 per share, compared to a GAAP net loss of $9.2 million, or $0.11 per share, in the same quarter of the previous fiscal year. Non-GAAP income from operations was $25.7 million, a substantial increase from $15.1 million year-over-year. These figures are particularly important for a software company like Guidewire, as they reflect the successful transition to a subscription-based model, which is increasingly becoming the industry standard for software companies.

Key Financial Metrics

Guidewire's balance sheet remains strong, with $932.7 million in cash, cash equivalents, and investments. The company used $2.8 million in cash from operations during the six months ended January 31, 2024. The company's focus on cloud-based solutions is evident in its financials, with the cloud platform driving growth and profitability.

"Our strong performance in the second quarter was marked by eleven cloud deals, including a healthy mix of migrations, expansions, and net-new customers," said Mike Rosenbaum, CEO of Guidewire. "The enthusiasm and interest weve seen around Guidewire Cloud Platform is testament to our teams hard work and our commitment to innovation and excellence."

"We are pleased with the continued cloud momentum, enabling us to beat and raise our ARR outlook and deliver 65% non-GAAP subscription and support gross margins in the quarter," added Jeff Cooper, CFO of Guidewire.

Analysis of Company's Performance

Guidewire's performance in the second quarter of fiscal year 2024 indicates a strategic shift towards cloud-based services, which is resonating well with customers. The company's ability to secure new cloud deals and migrate existing customers to its cloud platform is a positive sign for future growth. However, the decline in services revenue suggests a transition phase where Guidewire is increasingly relying on its partners for service engagements.

The company's updated outlook for fiscal year 2024 reflects confidence in its cloud strategy, with an expected ARR between $852 million and $862 million and total revenue between $957 million and $967 million. The projected operating cash flow between $120 million and $140 million further underscores the company's solid financial position.

Guidewire's commitment to innovation and customer success is evident in its financial results and strategic direction. As the company continues to evolve its offerings and expand its cloud platform, investors and customers alike can anticipate continued growth and efficiency gains.

For more detailed analysis and up-to-date financial news, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Guidewire Software Inc for further details.

This article first appeared on GuruFocus.