Guild Holdings Co Reports Mixed Results Amid Market Challenges

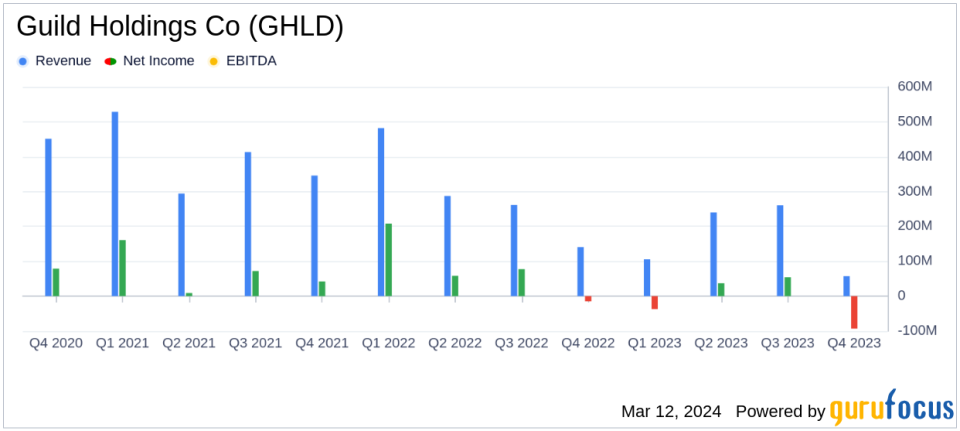

Net Revenue: Guild Holdings Co reported net revenue of $0.7 billion for 2023, with $57.2 million in the fourth quarter.

Net Loss: The company experienced a net loss of $39.1 million in 2023, including a significant $93.1 million loss in the fourth quarter.

Adjusted Net Income: Adjusted net income stood at $48.0 million for the year, with $12.5 million in Q4.

Origination Volume: Total in-house originations reached $15.0 billion in 2023, with a 93% focus on purchase originations in Q4.

Servicing Portfolio Growth: The unpaid principal balance of the servicing portfolio grew by 8% to $85.0 billion as of year-end.

Market Share Expansion: Post-quarter, GHLD acquired Academy Mortgage, becoming the 8th largest non-bank retail mortgage lender.

Share Repurchase Program: GHLD extended its share repurchase program, with $11.2 million remaining available for repurchase.

Guild Holdings Co (NYSE:GHLD), a growth-oriented mortgage company, released its 8-K filing on March 12, 2024, detailing its financial performance for the fourth quarter and full year ended December 31, 2023. GHLD operates through two segments: origination, responsible for loan origination, acquisition, and sale activities, and servicing, which provides cash flow and client relationship support for the origination segment.

The company's 2023 results reflect a challenging environment, with a net loss of $39.1 million for the year, including a substantial $93.1 million loss in the fourth quarter. Despite these losses, GHLD reported an adjusted net income of $48.0 million for the year and $12.5 million for the fourth quarter, showcasing the company's ability to adjust to market conditions. The return on equity was negative at (3.2%), but the adjusted return on equity was positive at 3.9% for the year.

Financial Performance and Challenges

GHLD's origination segment faced headwinds, with net revenue declining by 27% quarter-over-quarter to $119.2 million in Q4, and a net loss allocated to origination of $26.8 million. The servicing segment also reported a net loss of $72.1 million in Q4, primarily due to valuation adjustments of mortgage servicing rights (MSRs). Despite these challenges, the company's servicing portfolio unpaid principal balance grew to $85.0 billion, a testament to its robust servicing operations.

The company's focus on purchase originations, which comprised 93% of its closed loan origination volume in the fourth quarter, is notable in an industry where the Mortgage Bankers Association estimated only 81% purchase originations. This strategic focus, coupled with the acquisition of Academy Mortgage, positions GHLD to capitalize on market share gains when the cycle turns.

Strategic Acquisitions and Share Repurchase Program

Guild Holdings Co's strategic acquisitions, including the recent addition of Academy Mortgage, have expanded its market share and increased origination volume. The company's disciplined approach to maintaining a robust capital position has enabled these strategic moves, which are expected to create long-term value for shareholders.

In addition to acquisitions, GHLD has demonstrated confidence in its stock through an extended share repurchase program. During the fourth quarter of 2023, the company repurchased and retired 97,557 shares at an average price of $11.69 per share, with $11.2 million remaining available for repurchase under the program.

Conclusion

While Guild Holdings Co faced significant challenges in 2023, resulting in a net loss, the company's strategic focus on purchase originations and market share expansion through acquisitions provides a foundation for future growth. The extended share repurchase program further reflects GHLD's commitment to shareholder value. Investors and stakeholders will be watching closely to see how the company's strategies unfold in the evolving mortgage market landscape.

For a more detailed analysis of Guild Holdings Co's financial performance and strategic initiatives, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Guild Holdings Co for further details.

This article first appeared on GuruFocus.