Gurus Are Loving Tapestry This Valentine's Day

As lovebirds around the world prepare to celebrate Valentine's Day, investors may be interested in companies that profit from Cupid's bow and arrows.

The National Retail Federation's annual survey found the average U.S. consumer is expecting to spend approximately $185.81 on Valentine's presents for their significant others, children, teachers and classmates, coworkers, friends and even pets this year. Total spending is projected to reach $25.80 billion, which is in line with 2023 numbers.

While candy, greeting cards and flowers remain some of the most popular gifts, the survey found those celebrating the holiday plan to spend a record $6.40 billion on jewelry and $4.90 billion on an evening out.

Since jewelry is one of the largest spending categories for the day devoted to love, investors may find value opportunities among retail companies that sell luxury goods. According to the GuruFocus Aggregated Portfolio, a Premium feature based on 13F and NPORT-P filings from the third and fourth quarters, a number of luxury goods companies are favored by gurus.

Topping the list is Tapestry Inc. (NYSE:TPR).

Investors should be aware 13F and NPORT-P filings do not give a complete picture of a firm's holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

Business model and expansion plans

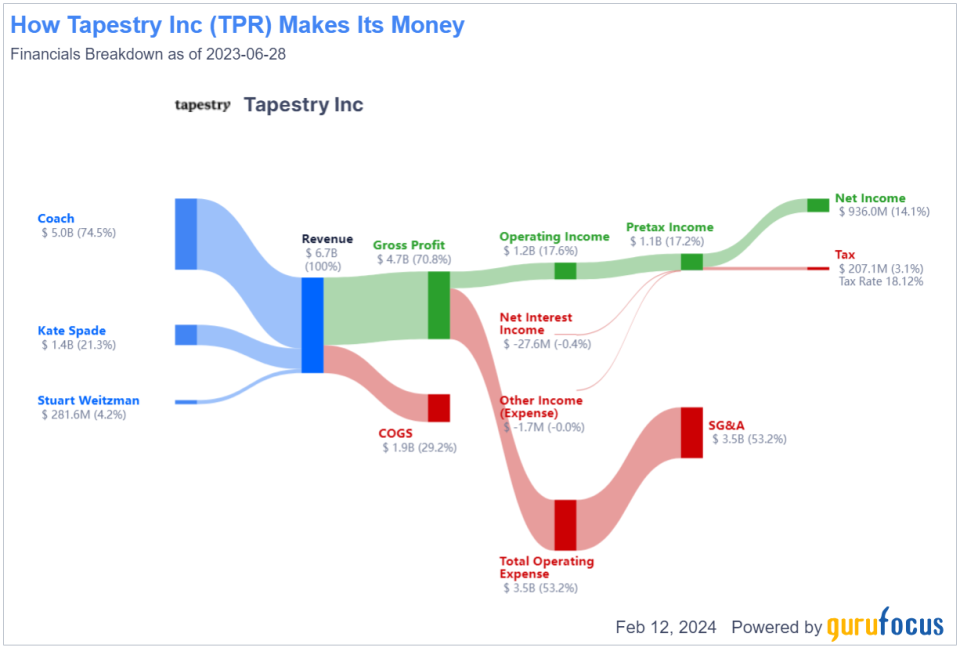

Founded in 1941, the New York-based retailer owns the Coach, Kate Spade and Stuart Weitzman fashion brands, which are known for their purses, wallets, clothing, shoes and other accessories. Of the three divisions, Coach generated the largest percentage of revenue in 2023 at 74.50%.

Tapestry is looking to expand, however, as in August of 2023 it announced it is acquiring Capri Holdings Ltd. (NYSE:CPRI) for $8.50 billion. The all-cash deal comes out to about $57 per share.

The combination with Capri, which encompasses the Michael Kors, Jimmy Choo and Versace brands, is expected to diversify the company's portfolio and reach across consumer segments, geographies and product categories. It will also generate over $200 million in run-rate cost savings within three years of the deal's close.

Pending regulatory and shareholder approval, the transaction is projected to close by the end of 2024.

Earnings and financial overview

On Feb. 8, Tapestry reported financial results for its fiscal second quarter of 2024.

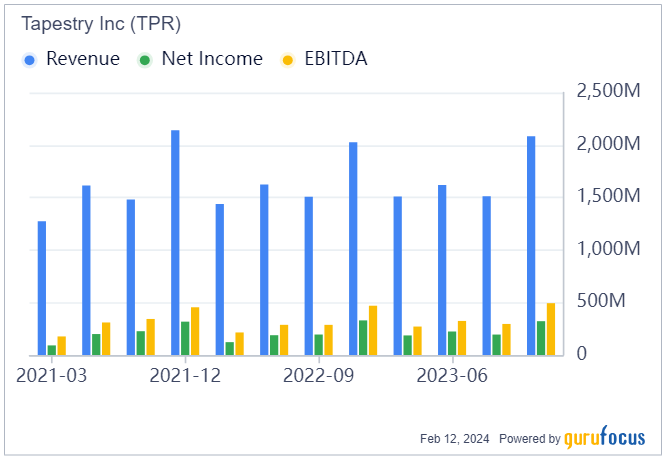

For the three months ended Dec. 31, the company posted record revenue of $2.10 billion and net income of $322 million. Both figures were an improvement from the prior-year quarter.

Adjusted earnings per share came in at $1.63, which were also up from a year ago. Ebitda was $494 million.

In a statement, CEO Joanne Crevoiserat said the company's performance exceeded expectations, highlighting the power of brand building and disciplined execution.

Moving forward, we have an unwavering commitment to deliver sustainable growth and shareholder value, she said. We will continue to put the consumer at the center of everything we do, building our brands for the future and harnessing our data-driven, customer engagement platform to enhance creativity, speed, and agility. We are confident in our vision and our ability to realize it, with significant runway for long-term growth.

On the back of these strong results, the company raised its earnings per share outlook for the year to between $4.20 and $4.25.

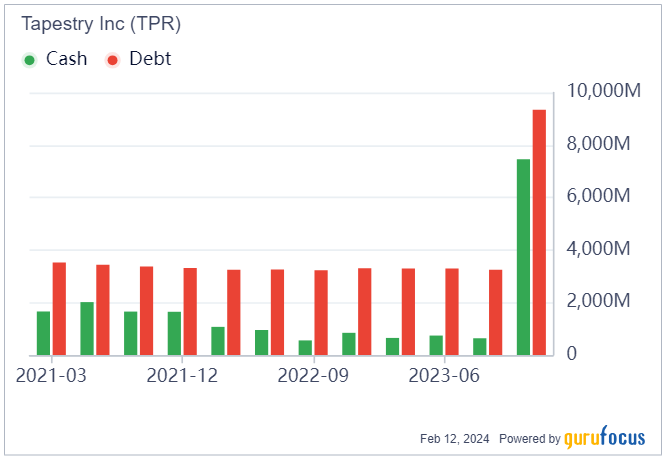

However, on the balance sheet, the company recorded $7.46 billion in cash, cash equivalents and short-term investments and $9.34 billion in debt. While its cash-to-debt ratio of 0.20 indicates Tapestry is unable to pay off its debt using cash on hand, it has a high interest coverage ratio of 34.96.

Further, GuruFocus has found that while the Altman Z-Score of 2.72 implies the company is under some pressure, the Piotroski F-Score of 8 out of 9 means its operations are healthy.

The company's board of directors also declared a quarterly dividend of 35 cents per share, which will be distributed on March 25 to shareholders of record as of March 8. The dividend yield is 3.10% and the payout ratio is 0.31.

Guru and insider interest

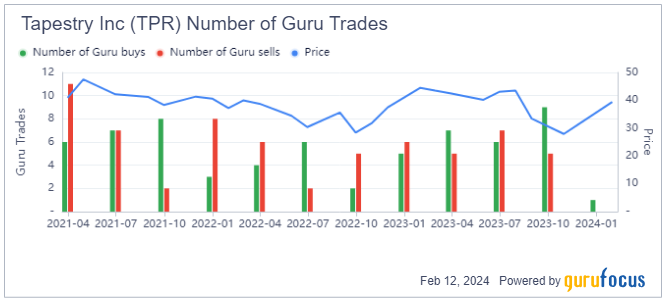

While Tapestry's financials and dividend are fairly appealing, the pending acquisition is more likely what has recently attracted gurus to the stock.

As of the third and fourth quarters, the Aggregated Portfolio shows 12 gurus were invested in Tapestry with a combined equity portfolio weight of 2.48%. Notable shareholders include Ray Dalio (Trades, Portfolio)'s Bridgewater Associates, Jeff Auxier (Trades, Portfolio), Paul Tudor Jones (Trades, Portfolio) and Steven Cohen (Trades, Portfolio).

However, while nine gurus either added to their holdings or entered a position in recent months, four cut back or sold out of their stakes entirely. Regardless, the overall sentiment in recent quarters has been more bullish.

Insiders of the company, on the other hand, appear to not be making any indication of where they think the stock is going. There has not been an insider transaction since December of 2022.

Valuation

Sporting a $9.63 billion market cap, shares of Tapestry traded around $42.52 on Monday with a price-earnings ratio of 10.61, a price-book ratio of 3.98 and price-sales ratio of 1.50.

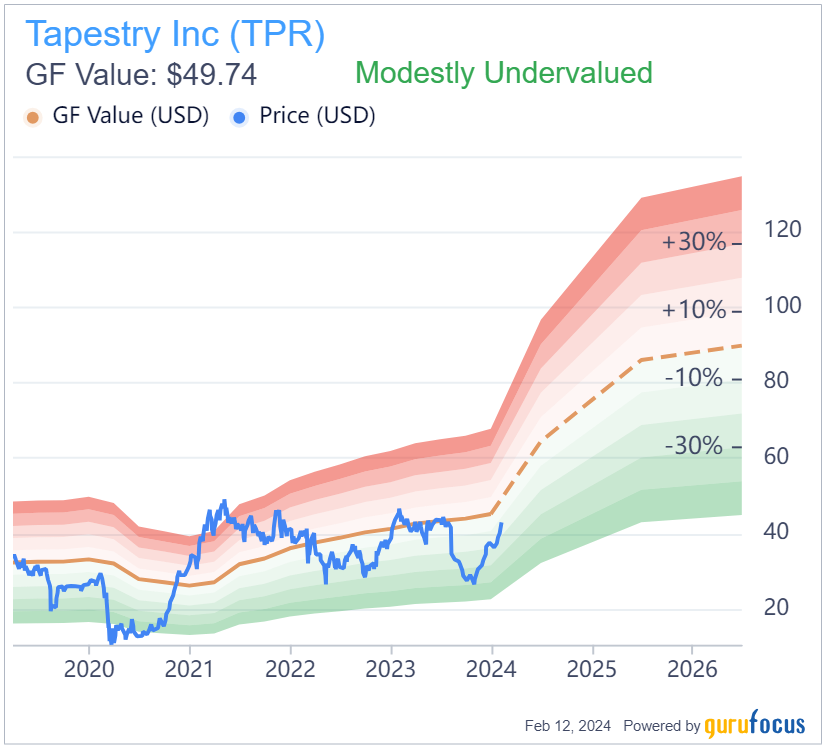

The GF Value Line suggests the stock is modestly undervalued currently based on its historical ratios, past financial performance and analysts' future earnings projections.

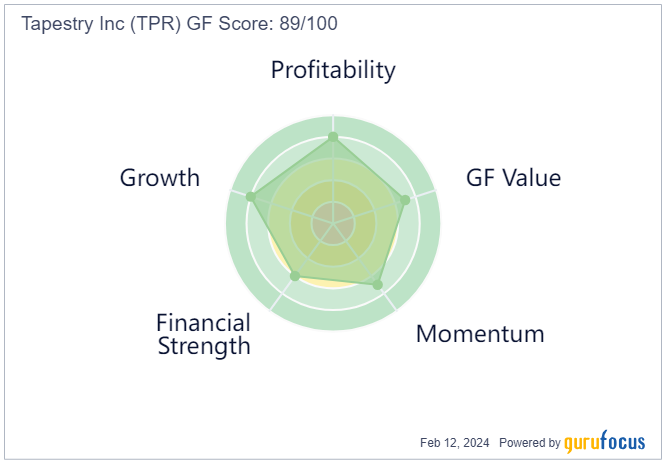

Further, the GF Score of 89 out of 100 indicates the company has good outperformance potential on the back of high ratings for profitability, value, growth and momentum and a more moderate financial strength rank.

Final Thoughts

While the stock initially fell in the months following the acquisition announcement, shares have recovered slightly year to date on the back of strong earnings results and the progress made in gaining regulatory approval. As such, it may be a good opportunity for investors to benefit from the pending Capri deal and enter a position in Tapestry.

This article first appeared on GuruFocus.