H.B. Fuller Co (FUL) Reports Strong Adjusted EBITDA Growth in Q4 and FY 2023

Adjusted Earnings Per Share (EPS): Increased to $1.32, up 27% from the previous year.

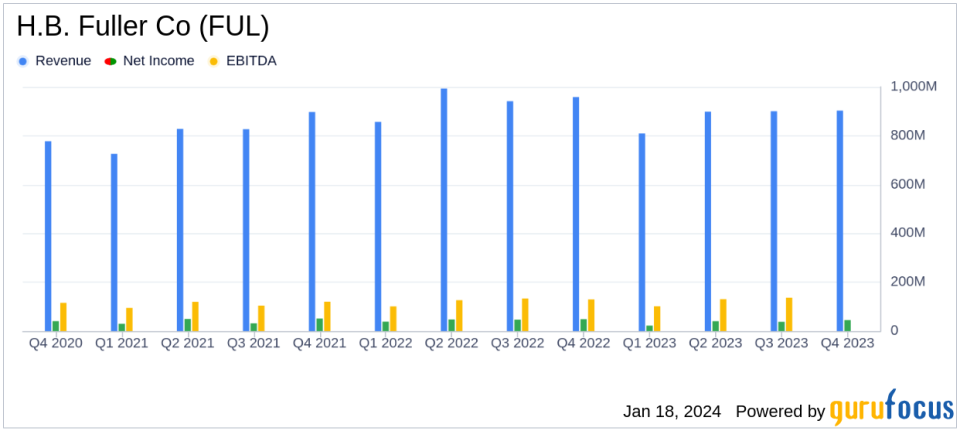

Adjusted EBITDA: Grew by 22% year-on-year, with margins expanding by 440 basis points.

Net Revenue: Declined by 5.8% in Q4, but organic revenue on a comparable 13-week basis rose by 1.2%.

Cash Flow from Operations: Improved significantly, with a 48% increase year-on-year to $378 million.

Net Debt: Decreased by $131 million sequentially and $26 million year-on-year.

Net Working Capital: Declined by $74 million sequentially and $58 million year-on-year.

On January 17, 2024, H.B. Fuller Co (NYSE:FUL) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the fiscal year 2023. The company, a prominent manufacturer and seller of adhesives, sealants, and other chemical-based products, operates through three business units: constructions, engineering, and hygiene, health and consumable adhesives. With a focus on environmentally friendly products, H.B. Fuller Co (NYSE:FUL) has been aligning with the trend of environmental, social, and governance investing.

Financial Performance and Challenges

H.B. Fuller Co (NYSE:FUL) faced a revenue decline of 5.8% in Q4 compared to the same period last year, primarily due to a 7.0% impact from having one less week in the quarter. However, on a comparable 13-week basis, net revenue actually increased by 1.2%. The company's adjusted gross profit margin saw a significant increase of 510 basis points year-on-year, reaching 31.3%. This improvement was attributed to pricing and raw material cost actions, restructuring benefits, and general cost reductions.

Despite the revenue dip, H.B. Fuller Co (NYSE:FUL) achieved a new record for Q4 and fiscal year adjusted EBITDA margin. Adjusted EBITDA for the fourth quarter was up 22%, with the margin expanding to 19.1%. The company's net income for Q4 was $45 million, translating to $0.80 per diluted share, while adjusted net income was $74 million, or $1.32 per diluted share, marking a 27% increase from the previous year. This growth in earnings is particularly important as it demonstrates the company's ability to enhance profitability even in the face of revenue challenges.

Balance Sheet and Cash Flow Highlights

The company's balance sheet reflects a robust financial position with net debt decreasing both sequentially and year-on-year. The reduction in net debt, coupled with the growth in adjusted EBITDA, resulted in a lower net debt-to-adjusted EBITDA ratio, moving from 3.3X to 2.9X sequentially. Moreover, the company's cash flow from operations saw a substantial increase, rising 48% to $378 million for the fiscal year 2023. This strong cash flow performance underscores H.B. Fuller Co (NYSE:FUL)'s operational efficiency and its ability to generate cash to fund operations, reduce debt, and potentially invest in growth opportunities.

Net working capital also saw a significant decrease, which is a positive indicator of the company's efficiency in managing its assets and liabilities. As a percentage of annualized net revenue, net working capital declined to 16.1%, reflecting a more streamlined working capital management process.

"I am proud of our leaders for exceptional execution throughout the year, as evidenced by strong profit growth and record margins. Across the organization, our teams proactively managed the changing price and raw material dynamics successfully and implemented decisive restructuring measures in the face of unprecedented customer destocking, which we believe is largely behind us, to deliver these results and position H.B. Fuller for continued future profit growth, margin expansion and strong cash flow," said Celeste Mastin, H.B. Fuller president and chief executive officer.

Looking Forward

As H.B. Fuller Co (NYSE:FUL) enters fiscal year 2024, the company remains confident in its outlook for positive organic growth and further EBITDA margin expansion. The company's strategic focus on innovation, efficient capital allocation, and achieving synergies from acquisitions positions it well for future growth and profitability.

For value investors and potential GuruFocus.com members, H.B. Fuller Co (NYSE:FUL)'s latest earnings report presents a company that is effectively navigating market challenges and improving its financial metrics. The company's focus on high-margin, high-growth market segments and its commitment to innovation and sustainability are key factors that could contribute to its long-term success.

For more detailed insights and financial analysis, interested parties are encouraged to join the company's conference call on January 18, 2024, or access the webcast and supplemental presentation through H.B. Fuller's investor relations website.

Explore the complete 8-K earnings release (here) from H.B. Fuller Co for further details.

This article first appeared on GuruFocus.