H&E Equipment (HEES) Inks Deal to Acquire Precision Rentals

H&E Equipment Services HEES has entered into an agreement to acquire Phoenix, AZ-based Precision Rentals. The company continues to expand its branch network both organically as well as through acquisitions, with 17 branches already integrated in November. This current deal will add two branches on closing.

The deal is expected to close during the first quarter of 2024, following regulatory approvals and other customary closing conditions.

Since 2006, Precision Rentals has grown its equipment rental business and offers reliability, fleet diversity and exceptional customer service. Precision Rentals brings to HEES a mix of general rental assets with a total fleet size (as measured by original equipment cost) of approximately $70 million and an attractive average fleet age of 37 months.

The company’s branch operations in Phoenix, Aurora and Colorado are in cities with strong construction activity and solid potential, including several mega projects.

Branch expansion and fleet growth have been contributing to H&E Equipment's earnings performance in the past few quarters. The company’s adjusted EBITDA was a record $189.1 million in the third quarter of 2023, marking an increase of 36.2% year over year.

Average rental rates increased 4.9% compared with the third quarter of 2022 and 1.2% compared with the second quarter of 2023. In the nine months ended Sep 30, 2023, HEES’ rental rates increased 7.0% year over year.

The company's fleet investment in the first nine months of 2023 was a record $595.2 million. Its fleet size was higher than $2.7 billion as of Sep 30, 2023. It boasts the youngest fleet in the industry, with an average rental fleet age of 41.1 months as of Sep 30, 2023 (versus the industry’s 49.2 months).

To capitalize on the solid customer demand, HEES has raised its gross fleet investment target to a range of $650 million to $700 million for 2023, up from the previously stated range of $600 million to $650 million.

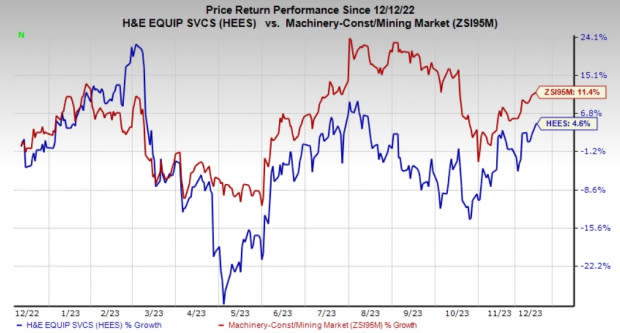

Price Performance

Shares of the company have gained 4.8% in the past year compared with the industry’s 11.4% growth.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Industrial Products sector are Crane Company CR, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

CR currently sports a Zacks Rank #1 (Strong Buy) and AIT and AOS each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Crane Company’s 2023 earnings per share is pegged at $4.18. The consensus estimate for 2023 earnings has remained unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 29.8%. Shares of CR have rallied 33.7% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 27.2% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 29.4% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

H&E Equipment Services, Inc. (HEES) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report