H&E Equipment Services Inc. Reports Record Expansion and Revenue Growth in Q4 and Full Year 2023

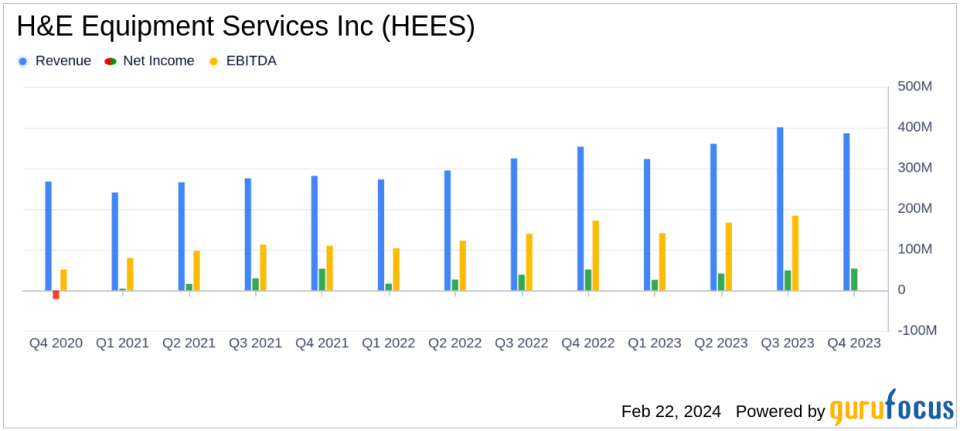

Revenue Growth: Q4 revenues increased by 9.3% to $385.8 million, with full-year revenues reaching nearly $1.5 billion, an 18.1% increase year-over-year.

Net Income: Q4 net income rose to $53.5 million, with a lower effective tax rate of 19.4% compared to 26.1% in the same quarter last year.

Rental Revenue Surge: Equipment rental revenues grew by 14.9% in Q4, with rental revenues up 14.5% and sales of rental equipment jumping 34.3%.

Gross Margin Improvement: Gross margin improved to 48.3% in Q4, with rental gross margins increasing to 54.2%.

Fleet Investment and Expansion: Record gross fleet investment of $737 million in 2023, with an 18.3% increase in fleet original equipment cost (OEC).

Strategic Branch Additions: A record 14 new branches added in 2023, expanding the company's footprint and competitive position.

On February 22, 2024, H&E Equipment Services Inc (NASDAQ:HEES) announced its fourth quarter and full-year results for the period ending December 31, 2023, showcasing record strategic expansion and revenue growth. The company released its 8-K filing, highlighting a year of record financial performance despite the divestiture of its crane and Komatsu earthmoving distribution businesses.

H&E Equipment Services Inc is an integrated equipment services company, focusing on heavy construction and industrial equipment. It operates across five principal business activities: equipment rentals, new equipment sales, used equipment sales, parts sales, and repair and maintenance services. The majority of its revenue is derived from the equipment rentals segment, which saw significant growth in the reported period.

Financial Performance and Challenges

The company's performance in the fourth quarter was marked by a 9.3% increase in revenues to $385.8 million, compared to $353.1 million in the same period last year. Net income also increased to $53.5 million, up from $51.2 million. This growth is particularly noteworthy considering the sale of the crane business and the Komatsu earthmoving distribution business, which could have posed challenges to revenue streams. However, the company's strategic initiatives and resilient non-residential activity have led to healthy financial metrics throughout the year.

Strategic Achievements and Industry Outlook

CEO Brad Barber highlighted the company's strong execution of strategic initiatives, which resulted in a record gross fleet investment of $737 million in 2023, surpassing the revised target range for the year. The company ended the year with a fleet OEC of approximately $2.8 billion, an 18.3% increase from the previous year. The average fleet age of 39.7 months remains among the youngest in the industry, which is a competitive advantage.

Barber also noted the impressive pace of branch expansion, with a record 14 branch additions in 2023. This expansion has increased the company's exposure to new projects and improved its competitive position. Looking ahead to 2024, the company plans to moderate its gross fleet expenditures and continue its branch expansion program with 12 to 15 new locations expected.

The outlook for the equipment rental industry remains positive, with customer commentary supporting a stable to modestly higher non-residential and industrial activity. Construction starts are projected to grow year-over-year, bolstered by mega projects and increased infrastructure spending.

Financial Tables and Analysis

The company's balance sheet reflects a strong financial position, with total assets of $2.64 billion and stockholders' equity of $534.3 million as of December 31, 2023. Total debt stands at $1.43 billion, which includes senior unsecured notes, senior secured credit facility, and finance lease obligations.

Overall, H&E Equipment Services Inc's performance in 2023 demonstrates the company's ability to navigate market changes and execute a growth strategy effectively. The company's focus on expanding its rental fleet and branch network, along with a favorable industry outlook, positions it well for continued success in the coming year.

For more detailed financial information and the full earnings report, please refer to the company's 8-K filing.

Explore the complete 8-K earnings release (here) from H&E Equipment Services Inc for further details.

This article first appeared on GuruFocus.