If You Had Bought FreightCar America (NASDAQ:RAIL) Stock Five Years Ago, You'd Be Sitting On A 86% Loss, Today

Some stocks are best avoided. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held FreightCar America, Inc. (NASDAQ:RAIL) for five years would be nursing their metaphorical wounds since the share price dropped 86% in that time. And it's not just long term holders hurting, because the stock is down 70% in the last year. Furthermore, it's down 15% in about a quarter. That's not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Check out our latest analysis for FreightCar America

FreightCar America isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

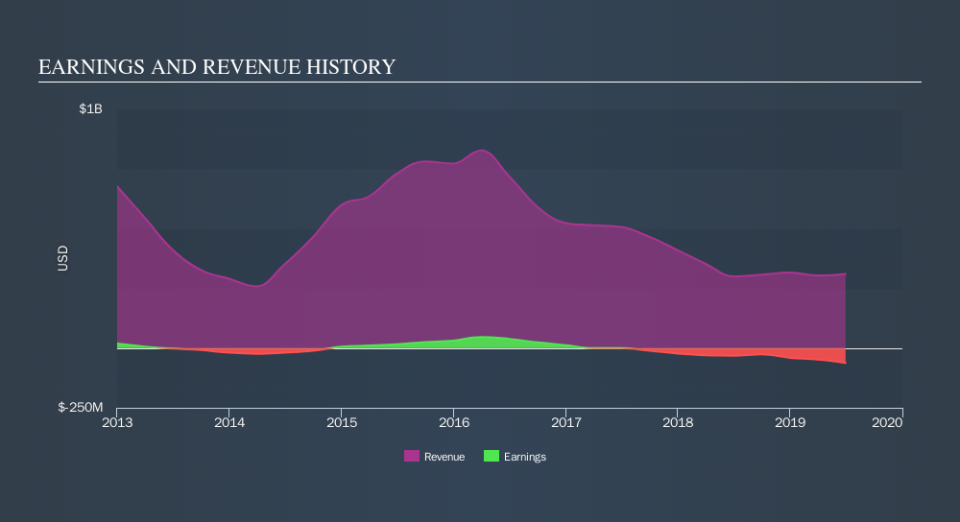

In the last five years FreightCar America saw its revenue shrink by 14% per year. That's definitely a weaker result than most pre-profit companies report. So it's not altogether surprising to see the share price down 33% per year in the same time period. This kind of price performance makes us very wary, especially when combined with falling revenue. Of course, the poor performance could mean the market has been too severe selling down. That can happen.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. If you are thinking of buying or selling FreightCar America stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Investors in FreightCar America had a tough year, with a total loss of 70%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 32% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

FreightCar America is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.