If You Had Bought Hans Energy (HKG:554) Shares Five Years Ago You'd Have Made 39%

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Hans Energy Company Limited (HKG:554) share price is up 39% in the last 5 years, clearly besting the market return of around -1.7% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 14%.

Check out our latest analysis for Hans Energy

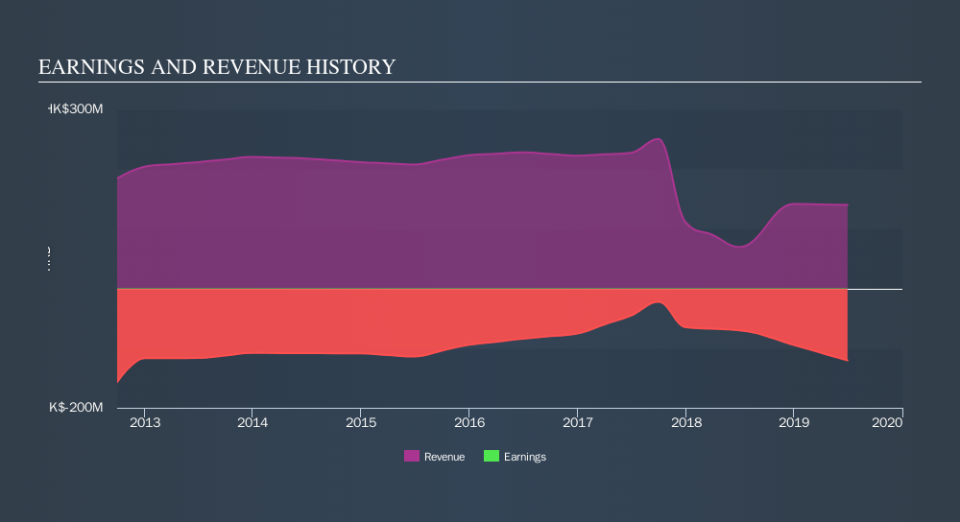

Given that Hans Energy didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last half decade Hans Energy's revenue has actually been trending down at about 12% per year. Even though revenue hasn't increased, the stock actually gained 6.8%, per year, during the same period. To us that suggests that there probably isn't a lot of correlation between the past revenue performance and the share price, but a closer look at analyst forecasts and the bottom line may well explain a lot.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Hans Energy stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's nice to see that Hans Energy shareholders have received a total shareholder return of 14% over the last year. That gain is better than the annual TSR over five years, which is 6.8%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.