If You Had Bought Macro Enterprises (CVE:MCR) Stock Three Years Ago, You Could Pocket A 132% Gain Today

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But in contrast you can make much more than 100% if the company does well. For instance the Macro Enterprises Inc. (CVE:MCR) share price is 132% higher than it was three years ago. That sort of return is as solid as granite. In the last week the share price is up 1.3%.

Check out our latest analysis for Macro Enterprises

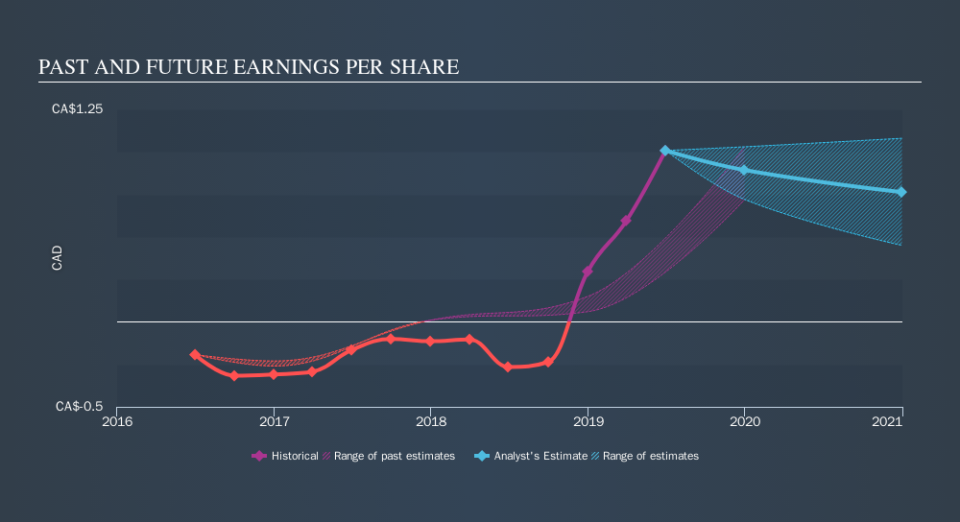

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Macro Enterprises became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It is of course excellent to see how Macro Enterprises has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Macro Enterprises stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Macro Enterprises shareholders have received a total shareholder return of 33% over one year. That gain is better than the annual TSR over five years, which is 10%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.