If You Had Bought Mammoth Energy Services (NASDAQ:TUSK) Stock A Year Ago, You Could Pocket A 115% Gain Today

Unfortunately, investing is risky - companies can and do go bankrupt. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the Mammoth Energy Services, Inc. (NASDAQ:TUSK) share price has soared 115% return in just a single year. Shareholders are also celebrating an even better 200% rise, over the last three months. Zooming out, the stock is actually down 76% in the last three years.

View our latest analysis for Mammoth Energy Services

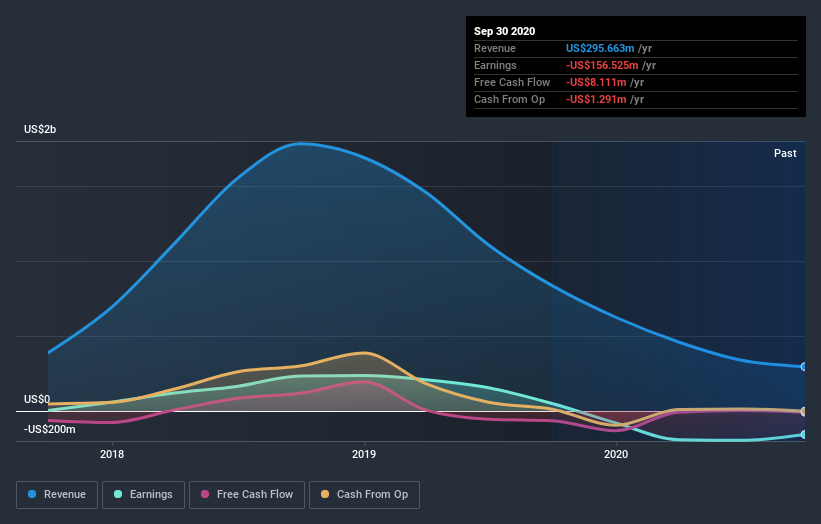

Mammoth Energy Services isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Mammoth Energy Services saw its revenue shrink by 65%. So we would not have expected the share price to rise 115%. This is a good example of how buyers can push up prices even before the fundamental metrics show much growth. Of course, it could be that the market expected this revenue drop.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on Mammoth Energy Services' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Mammoth Energy Services' total shareholder return last year was 115%. This recent result is much better than the 21% drop suffered by shareholders each year (on average) over the last three. The optimist would say this is evidence that the stock has bottomed, and better days lie ahead. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Mammoth Energy Services (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.