Haemonetics (HAE) Q1 Earnings Top Estimates, Margins Improve

Haemonetics Corporation HAE delivered adjusted earnings per share (EPS) of 50 cents in the first quarter of fiscal 2022, reflecting 8.7% year-over-year growth. The bottom line surpassed the Zacks Consensus Estimate by 6.4%.

On a GAAP basis, net loss was 9 cents per share against the year-ago EPS of 21 cents.

Total Revenues

Revenues increased 16.8% (up 6% on an organic basis) to $228.5 million in the first quarter of fiscal 2022. The top line also surpassed the Zacks Consensus Estimate by 1.3%.

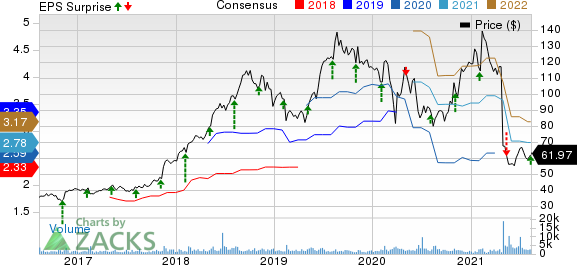

Haemonetics Corporation Price, Consensus and EPS Surprise

Haemonetics Corporation price-consensus-eps-surprise-chart | Haemonetics Corporation Quote

The year-over-year increase in revenues was supported by recovery across all businesses, especially Hospital, and the initial Plasma Persona rollouts.

Revenues by Product Categories

At Plasma, revenues of $71.8 million (accounting for 31.4% of total revenues) increased 5.3% year over year (up 6.2% on an organic basis) in the reported quarter.

Revenues at Blood Center (31.9%) fell 6.2% (down 5.9% on an organic basis) to $72.9 million.

Hospital revenues (34.3%) rose 75.1% (up 26.4% on an organic basis) to $78.5 million. Under the Hospital segment, organic revenue growth in the Hemostasis Management product line was 34.3% in the first quarter of fiscal 2022 on strong capital sales in North America and EMEA.

Service revenues (2.3%) rose 10.7% (up 3.7% on an organic basis) to $5.2 million.

Margins

The company-adjusted gross margin was 54.7%, up 750 basis points (bps) year over year. The primary drivers of this improvement were the addition of Vascular Closure from the acquisition of Cardiva Medical, Inc. (Cardiva), productivity savings from the Operational Excellence Program, favorable product mix and improved operating efficiency, partially offset by the impact of previous divestitures and price adjustments.

Adjusted operating expenses in the first quarter of fiscal 2022 were $87.1 million, up 36.7% from the year-ago quarter. The increase was primarily driven by a rise in variable compensation and the acquisition of Cardiva Medical, an increase in variable compensation and continued investments.

The company-adjusted operating income was $37.9 million in the quarter under discussion, up 32.9% year over year. Adjusted operating margin was 16.6%, up 200 bps compared to the year-ago quarter.

Financial Position

Haemonetics exited the first quarter of fiscal 2022 with cash and cash equivalents of $173.5 million compared with $192.3 million at the end of fourth-quarter 2020. Long-term debt at the end of the first quarter of fiscal 2022 was $767.3 million, up from $690.6 million at the end of fourth-quarter 2021.

Cumulative net cash flow used in operating activities at the end of first-quarter fiscal 2022 was $1.7 million compared with $11.8 million net cash flow provided from operating activities a year ago.

Cumulative capital expenses (net of proceeds from sale of property, plant and equipment) incurred by the company were $13.9 million, up from the year-ago $7.7 million. It also reported free cash flow (before restructuring and turnaround costs) of $1.8 million during the same period, down 83.1% from $10.9 million a year ago.

2022 Guidance

Haemonetics has reinstated its full-year 2022 financial guidance. The company expects GAAP total revenue growth in the range of 13-18% on a reported basis (organic growth projection in the range of 8-12%). The Zacks Consensus Estimate for 2022 revenues is pegged at $1 billion.

The company expects full-year adjusted earnings per share in the band of $2.60-$3.00. The Zacks Consensus Estimate for the same is pegged at $2.78.

Our Take

Haemonetics exited the first quarter of fiscal 2022 with better-than-expected results. The company registered year-over-year growth in revenues driven by recovery across business, mainly at Hospital and the initial Plasma Persona rollouts. The company’s Hospital business was robust along with uptick in the Hemostasis Management product line. Strong customer end-market demand for NexSys PCS system with Persona technology buoys optimism. Expansion of both margins buoys optimism. The company has also reinstated its full-year 2022 guidance, which is encouraging. On the flip side, the company’s sluggish Blood Center businesses due to the pandemic-led business disruptions is concerning. The rise in company’s restructuring related costs is building pressure on the bottom line. Economic uncertainty and stiff competition remain concerns.

Zacks Rank and Key Picks

The company currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader medical space that have announced their quarterly results are Encompass Health Corporation EHC, West Pharmaceutical Services, Inc. WST and Henry Schein, Inc. HSIC.

Encompass Health, carrying a Zacks Rank #1 (Strong Buy), reported second-quarter 2021 adjusted EPS of $1.17, which beat the Zacks Consensus Estimate by 15.8%. Revenues of $1.3 billion outpaced the consensus mark by 1.5%. You can see the complete list of today’s Zacks #1 Rank stocks here.

West Pharmaceutical, carrying a Zacks Rank #2 (Buy), reported second-quarter 2021 adjusted EPS of $2.46, which surpassed the Zacks Consensus Estimate by 41.4%. Revenues of $723.6 million outpaced the Zacks Consensus Estimate by 8.7%.

Henry Schein, carrying a Zacks Rank #2, reported second-quarter 2021 adjusted EPS of $1.11, surpassing the Zacks Consensus Estimate by 16.8%. Revenues of $2.97 billion surpassed the Zacks Consensus Estimate by 2.7%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Henry Schein, Inc. (HSIC) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST) : Free Stock Analysis Report

Encompass Health Corporation (EHC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research