Hain Celestial Group Inc (HAIN) Faces Mixed Fiscal Q2 2024 Results Amid Strategic Transformation

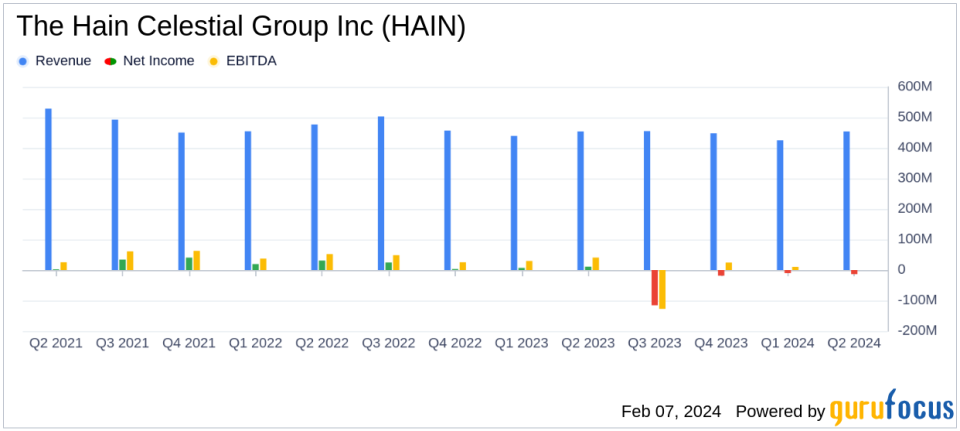

Net Sales: Reported flat year-over-year at $454.1 million.

Organic Net Sales: Slight increase of 0.2% year-over-year.

Gross Profit Margin: Decreased by 40 basis points to 22.5%.

Net Loss: Posted a net loss of $13.5 million compared to net income of $11.0 million in the prior year.

Adjusted EBITDA: Declined to $47.1 million from $49.8 million year-over-year.

Free Cash Flow: Improved to $14.8 million from negative free cash flow of $4.4 million in the prior year.

Debt Reduction: Total debt reduced to $809.2 million from $828.7 million at the beginning of the fiscal year.

The Hain Celestial Group Inc (NASDAQ:HAIN) released its 8-K filing on February 7, 2024, detailing its financial results for the fiscal second quarter ended December 31, 2023. The company, known for its better-for-you natural and organic food and personal-care products, has shown resilience in a challenging macroeconomic environment, delivering on its promise of sequential improvement and fuel generation through its Hain Reimagined strategy.

President and CEO Wendy Davidson expressed satisfaction with the company's progress, particularly in generating fuel through working capital management and productivity savings. Despite flat net sales compared to the previous year, organic net sales saw a slight uptick, benefiting from foreign exchange. However, the company reported a net loss of $13.5 million, contrasting with the net income of $11.0 million in the prior year period. Adjusted net income also fell to $10.9 million from $18.3 million year-over-year.

Financial Performance and Challenges

The company's gross profit margin experienced a slight decrease, primarily due to a 40-basis point drop to 22.5%. Adjusted gross profit margin, however, improved by 60 basis points. The adjusted EBITDA margin saw a 60-basis point decrease, reflecting the impact of inflation and lower sales volume, partially offset by pricing and productivity.

On the balance sheet, Hain Celestial managed to reduce its total debt and ended the quarter with a net secured leverage ratio of 4.2x, a slight improvement from the beginning of the fiscal year. The company's cash flow situation improved significantly, with net cash provided by operating activities increasing to $20.7 million from $2.5 million in the prior year period.

Segment Highlights and Outlook

The North America segment faced a 5.2% decrease in net sales, while the International segment continued to demonstrate strength with an 8.5% increase. Adjusted EBITDA for North America decreased by 18.9%, whereas the International segment saw a 35.0% increase.

Looking ahead, Hain Celestial has revised its fiscal 2024 guidance, anticipating organic net sales growth of approximately 1% or more, adjusted EBITDA between $155 million and $160 million, and free cash flow of $40 to $45 million. These adjustments reflect a more conservative outlook due to portfolio and channel mix improvements and a reduced foreign exchange tailwind.

The company's strategic initiatives, including the Hain Reimagined program, aim to transform the business into a sustainable and profitable growth model. Despite the mixed results, Hain Celestial's efforts to navigate the complex market dynamics and position itself for future growth are evident.

For more detailed information, investors and analysts can access the conference call and webcast hosted by Hain Celestial to discuss the results and business outlook.

Value investors and potential GuruFocus.com members interested in the Consumer Packaged Goods industry may find Hain Celestial's journey through its transformation strategy a compelling case to follow, as the company strives to balance growth, profitability, and the challenges of a dynamic market environment.

Explore the complete 8-K earnings release (here) from The Hain Celestial Group Inc for further details.

This article first appeared on GuruFocus.