Hain Celestial (HAIN) Up on Q3 Earnings Beat & Raised View

The Hain Celestial Group, Inc. HAIN reported robust earnings and sales in third-quarter fiscal 2020. Both the top and the bottom line beat the Zacks Consensus Estimate and improved year over year, thanks to transformational efforts.

For the full fiscal year, management now projects all profit metrics to remain higher than the earlier-issued guidance ranges. This is due to the ongoing execution of its transformation plan and increased food-at-home consumption with respect to the coronavirus pandemic. As a result, management raised adjusted EBITDA and adjusted earnings per share view for the current fiscal year, assuming minimal supply chain disruption.

Impressively, shares of this organic and natural products company gained nearly 7.3% during the trading session on May 7. This Zacks Rank #1 (Strong Buy) stock has risen 8.5% in the past three months against the industry’s decline of 11.9%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Quarter in Detail

The company posted adjusted earnings of 28 cents a share that surpassed the Zacks Consensus Estimate of 24 cents and increased 47.4% year over year. This marked the company’s third consecutive beat. Higher sales and margins fueled the bottom line.

Net sales were $553.3 million, which outshined the Zacks Consensus Estimate of $535 million. The metric also increased 1% on reported and 2% on constant-currency basis. The top line was backed by higher sales at the company’s North America and the International segments. On adjusting for currency fluctuations, buyouts, divestitures and various other items like SKU rationalization, net sales edged up 6%.

Net sales at the North America segment increased 2% year over year to $320.4 million. On adjusting for divestitures and SKU rationalization, net sales grew 9%. Segment adjusted operating income rose a solid 44% to $38.1 million.

International net sales were flat year over year at $232.9 million. On adjusting for foreign currency fluctuations, divestitures and SKU rationalization, net sales rose 2%. Segment adjusted operating income jumped 11% to $23.2 million.

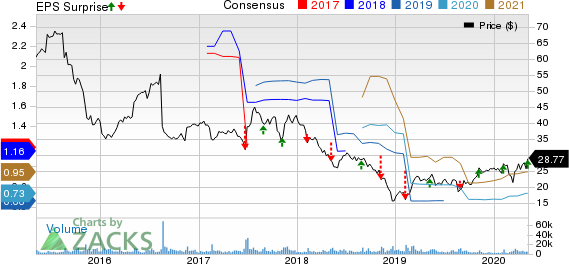

The Hain Celestial Group Inc Price, Consensus and EPS Surprise

The Hain Celestial Group Inc price-consensus-eps-surprise-chart | The Hain Celestial Group Inc Quote

Margins

Adjusted gross margin expanded 282 basis points (bps) to 24.3%, thanks to its productivity efforts that resulted in lower supply-chain expenses. However, foreign currency fluctuations impacted gross profit to the tune of $1 million in the quarter.

Adjusted operating income was $45.7 million in the quarter, up 34.4% from $34 million in the year-ago quarter. Adjusted operating margin rose 120 bps to 5.8%. Adjusted EBITDA grew 23.6% to $60.7 million, while adjusted EBITDA margin expanded 199 bps to 11%. The expansion was fueled by higher gross margin and supply-chain efficiencies.

Other Financials

The company ended the quarter with cash and cash equivalents of $41.5 million, long-term debt (excluding current portion) of $363.5 million and total shareholders’ equity of $1,439 million. Cash provided by operating activities from continuing operations totaled $46.9 million during the first nine months of fiscal 2020. The company’s operating free cash flow from continuing operations was $29.3 million for the same period. Capital expenditures were around $18 million in the fiscal third quarter.

For fiscal 2020, cash flow from operations is now anticipated at $110 million. Further, capital expenditures are expected to be roughly $65 million.

In March, management bought back 2.4 million shares for $57.4 million, excluding commissions. As of Mar 31, 2020, it had $192.6 million remaining under its share repurchase authorization.

Other Developments & Guidance

Effective May 1, 2020, Hain Celestial concluded the sale of the Rudi's Gluten Free Bakery TM and Rudi's Organic Bakery brands to an affiliate of the Promise Gluten Free. However, details of the transaction remain under wraps.

Hain Celestial now expects adjusted EBITDA growth of 15-21% to $190-$200 million compared with the earlier projection of 7-16% growth to $177-$192 million. At constant currency, adjusted EBITDA is likely to improve 18-24% to $195-$205 million. Management had earlier guided adjusted EBITDA of $179-$194 million at constant currency.

Additionally, Hain Celestial now envisions adjusted earnings per share of 75-82 cents, which suggests growth of 25-37% from fiscal 2019. Previously, management projected earnings per share of 62-72 cents, which suggested growth of 3-20%. At constant currency, adjusted earnings per share are likely to improve 30-42% to 78-85 cents. The Zacks Consensus Estimate for fiscal 2020 earnings is currently pegged at 73 cents, which is likely to witness upward revisions in the coming days.

More Solid Consumer Staples Stocks

Clorox CLX boasts an expected long-term earnings growth rate of 5.5% and a Zacks Rank #1.

General Mills GIS has an expected long-term earnings growth rate of 7.5% and a Zacks Rank #2 (Buy).

Campbell Soup CPB has an expected long-term earnings growth rate of 7.2% and a Zacks Rank #2.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hain Celestial Group Inc (HAIN) : Free Stock Analysis Report

Campbell Soup Company (CPB) : Free Stock Analysis Report

General Mills Inc (GIS) : Free Stock Analysis Report

The Clorox Company (CLX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research