Haleon PLC's Dividend Analysis

Scrutinizing the Upcoming Dividend Payout and Historical Performance of Haleon PLC

Haleon PLC (NYSE:HLN) recently announced a dividend of $0.11 per share, payable on 2024-05-16, with the ex-dividend date set for 2024-03-14. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Haleon PLC's dividend performance and assess its sustainability.

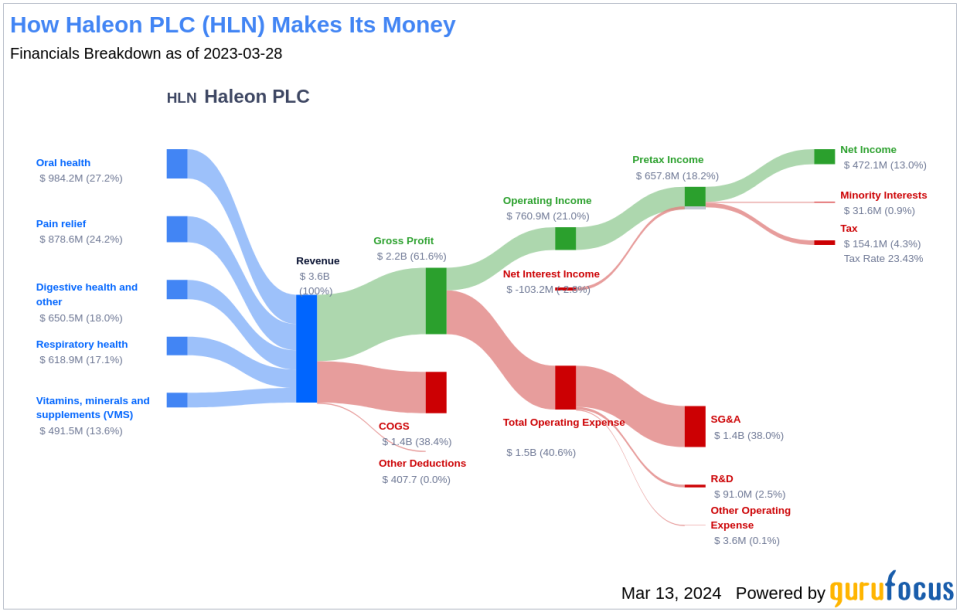

What Does Haleon PLC Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Haleon is one of the largest consumer health companies in the world. Formed by a combination of consumer health divisions of GSK, Pfizer, and Novartis, Haleon separated from GSK and went public in July 2022. The firm generates 60% of sales from global power brands including Sensodyne, Advil, Centrum, and Poligrip, that play in many geographies and are often leaders in their respective categories. It also has a number of local brands, including Emergen-C, Eno, Tums, and Caltrate, that are more tailored to regional needs and have strong local brand equity. Overall, Haleon's brands tackle a variety of silos within consumer health including oral care, digestive health, pain relief, and nutrition.

A Glimpse at Haleon PLC's Dividend History

Haleon PLC has maintained a consistent dividend payment record since 2023. Dividends are currently distributed on a bi-annually basis.

Haleon PLC has increased its dividend each year since -. The stock is thus listed as a dividend king, an honor that is given to companies that have increased their dividend each year for at least the past 2024 years. Below is a chart showing annual Dividends Per Share for tracking historical trends.

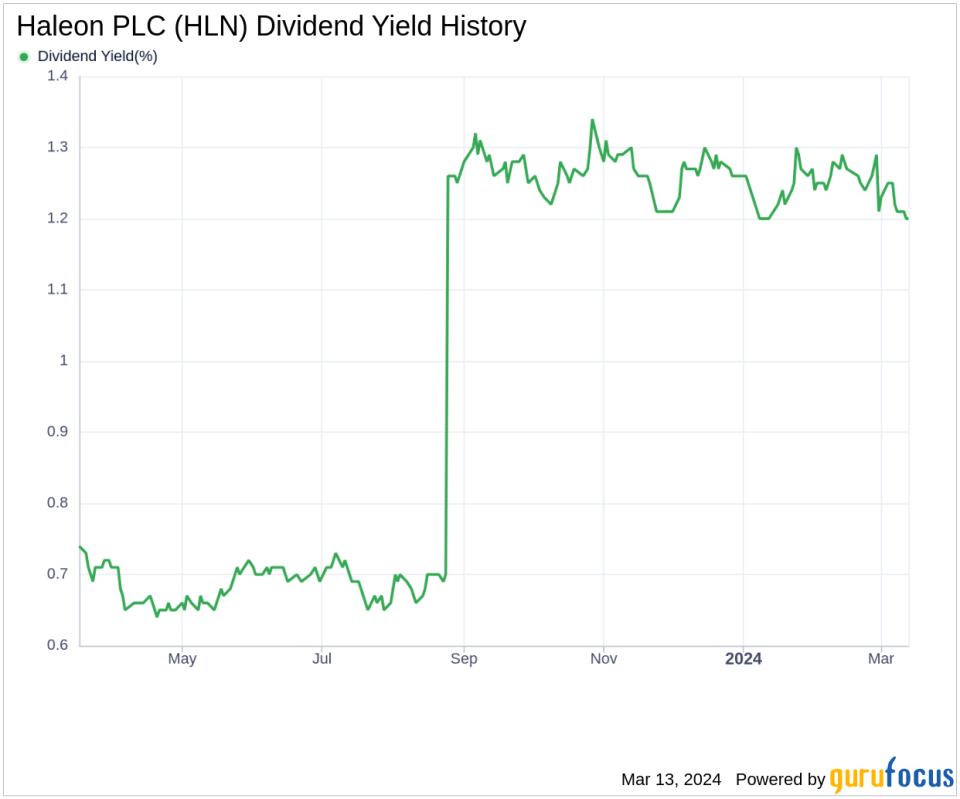

Breaking Down Haleon PLC's Dividend Yield and Growth

As of today, Haleon PLC currently has a 12-month trailing dividend yield of 1.20% and a 12-month forward dividend yield of 2.44%. This suggests an expectation of increased dividend payments over the next 12 months. Based on Haleon PLC's dividend yield and five-year growth rate, the 5-year yield on cost of Haleon PLC stock as of today is approximately 1.20%.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, one needs to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, thereby ensuring the availability of funds for future growth and unexpected downturns. As of 2023-12-31, Haleon PLC's dividend payout ratio is 0.36.

Haleon PLC's profitability rank, offers an understanding of the company's earnings prowess relative to its peers. GuruFocus ranks Haleon PLC's profitability 5 out of 10 as of 2023-12-31, suggesting fair profitability. The company has reported net profit in 5 years out of the past 10 years.

Growth Metrics: The Future Outlook

To ensure the sustainability of dividends, a company must have robust growth metrics. Haleon PLC's growth rank of 5 out of 10 suggests that the company has a fair growth outlook. Revenue is the lifeblood of any company, and Haleon PLC's revenue per share, combined with the 3-year revenue growth rate, indicates a strong revenue model. Haleon PLC's revenue has increased by approximately 4.40% per year on average, a rate that underperforms approximately 56.78% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Haleon PLC's earnings increased by approximately 1.20% per year on average, a rate that underperforms approximately 64.99% of global competitors.

Next Steps

Considering Haleon PLC's recent dividend announcement, the company's commitment to returning value to shareholders remains evident. The consistent dividend growth, albeit with a relatively short history, is a positive sign. However, the moderate payout ratio and profitability rank, alongside the growth metrics, suggest a cautious optimism for the future sustainability of Haleon PLC's dividends. Investors should consider these factors in conjunction with their own investment thesis and risk tolerance. For those seeking additional high-dividend yield opportunities, GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.