Halfords Group plc (LON:HFD) is largely controlled by institutional shareholders who own 89% of the company

Key Insights

Given the large stake in the stock by institutions, Halfords Group's stock price might be vulnerable to their trading decisions

The top 9 shareholders own 53% of the company

Ownership research along with analyst forecasts data help provide a good understanding of opportunities in a stock

If you want to know who really controls Halfords Group plc (LON:HFD), then you'll have to look at the makeup of its share registry. We can see that institutions own the lion's share in the company with 89% ownership. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Since institutional have access to huge amounts of capital, their market moves tend to receive a lot of scrutiny by retail or individual investors. Hence, having a considerable amount of institutional money invested in a company is often regarded as a desirable trait.

In the chart below, we zoom in on the different ownership groups of Halfords Group.

View our latest analysis for Halfords Group

What Does The Institutional Ownership Tell Us About Halfords Group?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

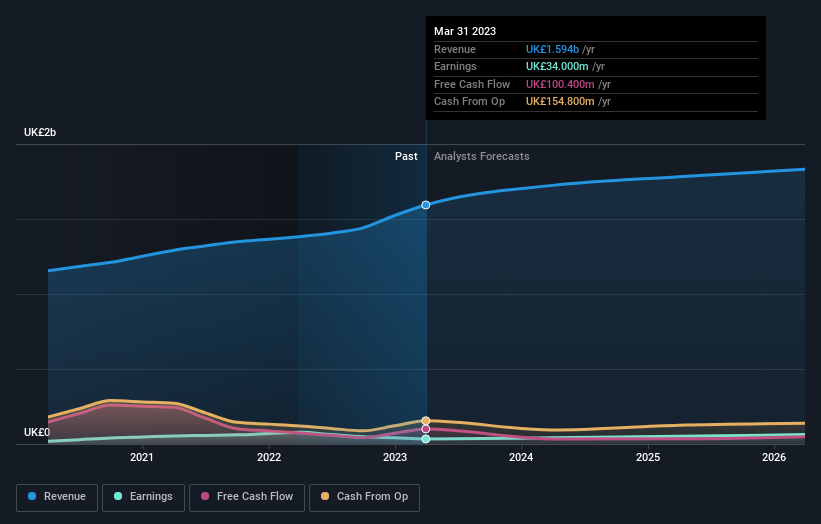

Halfords Group already has institutions on the share registry. Indeed, they own a respectable stake in the company. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Halfords Group's earnings history below. Of course, the future is what really matters.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. Halfords Group is not owned by hedge funds. Our data shows that Fidelity International Ltd is the largest shareholder with 10% of shares outstanding. For context, the second largest shareholder holds about 7.4% of the shares outstanding, followed by an ownership of 7.1% by the third-largest shareholder.

We did some more digging and found that 9 of the top shareholders account for roughly 53% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Halfords Group

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our information suggests that Halfords Group plc insiders own under 1% of the company. It has a market capitalization of just UK£421m, and the board has only UK£651k worth of shares in their own names. Many investors in smaller companies prefer to see the board more heavily invested. You can click here to see if those insiders have been buying or selling.

General Public Ownership

The general public-- including retail investors -- own 10% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 3 warning signs for Halfords Group you should be aware of.

But ultimately it is the future, not the past, that will determine how well the owners of this business will do. Therefore we think it advisable to take a look at this free report showing whether analysts are predicting a brighter future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.