Hallador Energy Co (HNRG) Reports Record Net Income and Adjusted EBITDA for 2023

Net Income: Soared to $44.8 million, marking a significant increase from the previous year.

Adjusted EBITDA: Achieved a record $107 million, demonstrating strong operational efficiency.

Operating Cash Flow: Increased to $59.4 million, reflecting robust cash-generating capabilities.

Coal and Power Contracts: Secured approximately $225 million in new capacity deals and $275 million in energy deals through 2028.

Restructuring: Reduced capital expenditure by $10 million and maintained high-margin coal production while reducing workforce.

Capital Raising: Successfully raised funds through ATM offerings and unsecured notes to support liquidity and strategic initiatives.

Merom Power Plant MOU: Signed to attract data centers and other high-density power users, potentially increasing margins.

On March 13, 2024, Hallador Energy Co (NASDAQ:HNRG) released its 8-K filing, announcing a record-breaking year with significant increases in net income and adjusted EBITDA. The company, a key player in the coal mining industry with operations in Indiana, USA, has demonstrated resilience and strategic acumen in navigating the challenges of the energy sector.

Financial Performance and Strategic Developments

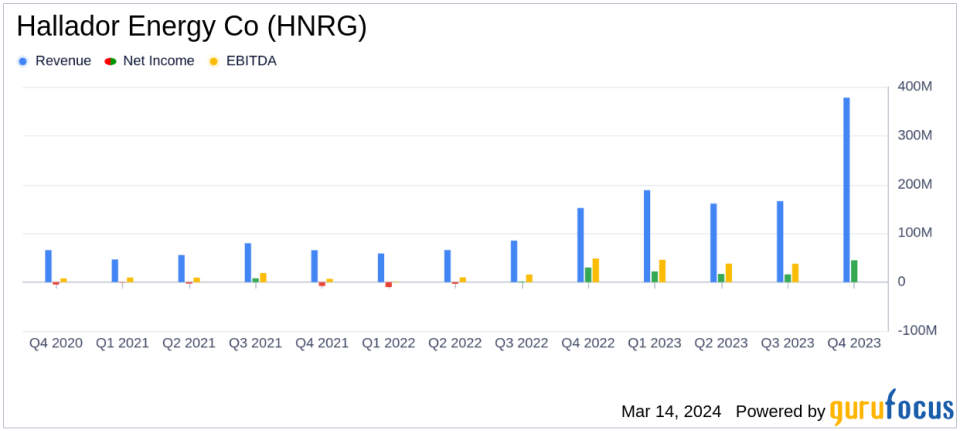

Hallador Energy Co (NASDAQ:HNRG) reported a net income of $44.8 million for the year 2023, a substantial increase from the previous year. This growth in profitability is attributed to near-record margins in the coal division and the successful integration of Hallador Power, which shows promise for future energy and capacity sales. The company's adjusted EBITDA also saw a remarkable improvement, reaching $107 million, which is approximately $51 million higher than the previous year. Operating cash flow followed suit, with an increase of about $5 million to $59.4 million for 2023.

The company's President and CEO, Brent Bilsland, highlighted the solid performance despite fourth-quarter challenges across all sectors. Hallador's restructuring efforts in the coal division and the momentum in forward power sales are expected to enhance the long-term outlook for the company. The restructuring is set to reduce capital expenditure at the Oaktown Mining Complex by $10 million while maintaining 4.5 million tons of annual production of high-margin coal. Additionally, the company reduced its employee headcount by 110 and idled its highest-cost surface mines.

Capital Raising and Future Outlook

Hallador Energy Co (NASDAQ:HNRG) has also been proactive in securing its financial position through capital raising initiatives. In December and January, the company raised $7.3 million and $6.6 million, respectively, through at-the-market (ATM) offerings. Furthermore, in March 2024, Hallador raised $5 million in unsecured one-year notes from members of its Board of Directors. These funds are intended to support liquidity and accelerate strategic initiatives.

The company has also signed a Memorandum of Understanding (MOU) with Hoosier Energy and WIN REMC to market its Merom site to data centers, AI providers, and other high-density power users. This strategic move is expected to allow more efficient operation of the plant and drive increased margins, contributing to a more resilient power grid amidst the transition to new energy sources.

Comprehensive Financial Tables and Metrics

Hallador Energy Co (NASDAQ:HNRG) has secured approximately $225 million in new capacity deals and $275 million in new energy deals through 2028, indicating a strong forward-looking revenue stream. The company's average cost per ton of coal sold was $33.67 for the year ended December 31, 2023, with a coal Capex budget of $25 million for 2024. In the power segment, the average cost per MWh sold was also $33.67 for the same period, with a power Capex budget of $18 million for 2024.

The company's strategic initiatives, including the restructuring and MOU, are not only expected to enhance profitability but also position Hallador Energy Co (NASDAQ:HNRG) favorably for future growth. With a focus on operational efficiency and strategic capital allocation, Hallador is well-equipped to navigate the dynamic energy market and continue delivering value to its stakeholders.

Investors and interested parties can join the live conference call on March 14, 2024, to discuss the company's performance and future prospects. For more detailed information on Hallador Energy Co (NASDAQ:HNRG) and its financials, visit the company's website or access the full earnings report through the provided link.

Explore the complete 8-K earnings release (here) from Hallador Energy Co for further details.

This article first appeared on GuruFocus.