Halliburton Co (HAL) Reports Solid 2023 Financial Results with Increased Dividend

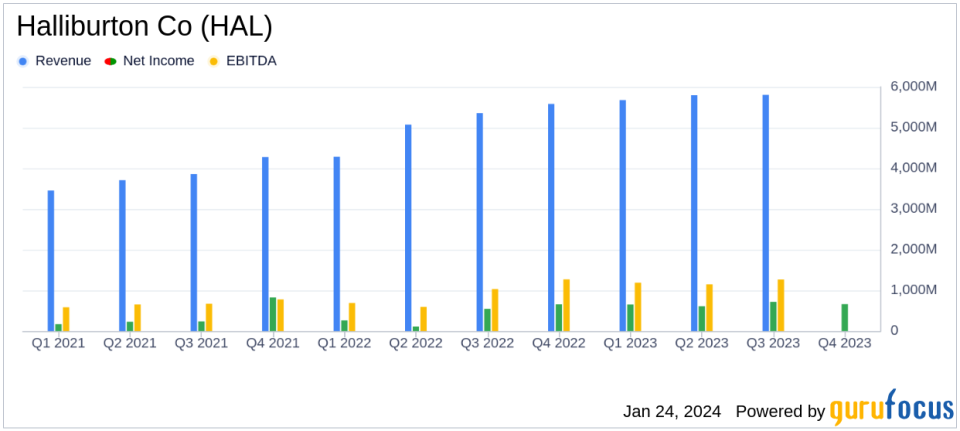

Revenue: Reported flat at $5.7 billion for Q4 2023 compared to Q3 2023.

Net Income: $661 million in Q4, with adjusted net income at $769 million excluding Argentina currency devaluation losses.

Earnings Per Share (EPS): $0.74 per diluted share, adjusted EPS at $0.86.

Free Cash Flow: Generated $1.1 billion in Q4, contributing to $2.3 billion for the full year.

Dividend: Increased to $0.17 per share for Q1 2024, up from $0.16.

Operating Margin: Improved to 18% in Q4, reflecting robust operational performance.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 23, 2024, Halliburton Co (NYSE:HAL) released its 8-K filing, detailing its fourth-quarter and full-year financial performance for 2023. The company, a global leader in oilfield services, demonstrated resilience in a challenging market, posting a net income of $661 million, or $0.74 per diluted share, for the fourth quarter. Adjusted for specific items, the net income was $769 million, or $0.86 per diluted share.

Company Overview

Halliburton is one of the world's largest providers of products and services to the energy industry. With a history dating back to 1919, Halliburton has been at the forefront of innovation in oilfield services, including hydraulic fracturing, and is the largest pressure pumper in North America.

Financial Performance and Challenges

The company's fourth-quarter revenue held steady at $5.7 billion, mirroring the previous quarter, while operating income saw a slight increase of 2% to $1.1 billion. For the full year of 2023, Halliburton reported a revenue increase of 13% to $23.0 billion, with operating income jumping to $4.1 billion from $2.7 billion in the previous year. These figures underscore Halliburton's ability to navigate market fluctuations and maintain profitability.

Despite these strong results, Halliburton faced challenges, including a decrease in stimulation activity in U.S. land and Mexico, lower artificial lift activity in U.S. land, and decreased completion tool sales in Latin America. However, these were partially offset by higher completion tool sales in other regions and improved software sales.

Financial Achievements

Halliburton's financial achievements in 2023 are significant for the oil and gas industry, which is characterized by cyclical demand and price volatility. The company's ability to generate substantial free cash flow, retire debt, and return cash to shareholders through dividends and stock repurchases is a testament to its operational efficiency and strategic financial management.

Key Financial Metrics

Key financial metrics from Halliburton's earnings report include:

"We generated about $2.3 billion of free cash flow during the year, retired approximately $300 million of debt, and returned $1.4 billion of cash to shareholders through stock repurchases and dividends, which represents over 60% of our free cash flow."

This commentary from Jeff Miller, Chairman, President, and CEO of Halliburton, highlights the company's commitment to shareholder value and financial discipline.

Analysis of Performance

Halliburton's performance in 2023 reflects a strategic focus on maximizing operational efficiency and capitalizing on market opportunities. The company's increased dividend signals confidence in its financial stability and future prospects. However, the challenges faced in certain segments and geographic regions indicate the need for ongoing adaptability in a dynamic energy market.

For detailed financial tables and further information, readers are encouraged to view the full 8-K filing.

Investors and stakeholders can expect Halliburton to continue leveraging its expertise and innovation to drive growth and profitability in the evolving energy landscape.

Explore the complete 8-K earnings release (here) from Halliburton Co for further details.

This article first appeared on GuruFocus.