Halozyme (HALO) Q3 Earnings Top Estimates, Revenues Lag

Halozyme Therapeutics, Inc. HALO delivered third-quarter 2023 adjusted earnings of 75 cents per share, which beat the Zacks Consensus Estimate of 71 cents. The company had recorded earnings of 74 cents per share in the year-ago period.

Total revenues increased 3.4% year over year to $216 million in the third quarter. This was primarily driven by continued growth in Xyosted and Halozyme’s proprietary Enhanze technology, with an increase in royalty revenues.

The addition of product sales following the acquisition of Antares Pharma in May 2022 and higher royalty payments from J&J JNJ for subcutaneous Darzalex (daratumumab) and Roche’s RHHBY Phesgo also boosted the top line in the third quarter.

Revenues, however, missed the Zacks Consensus Estimate of $219 million in the third quarter of 2023.

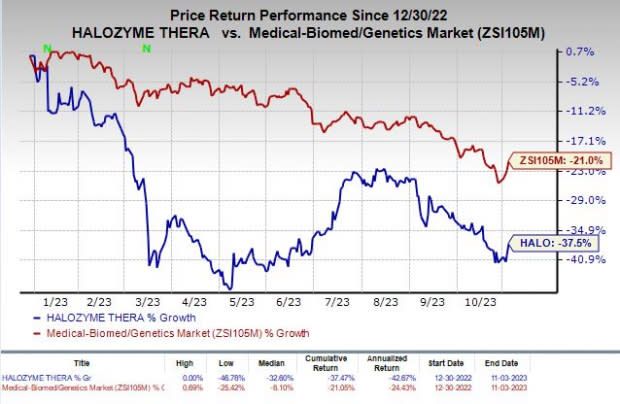

Shares of Halozyme have plunged 37.5% in the year-to-date period compared with the industry’s decline of 21%.

Image Source: Zacks Investment Research

Quarterly Highlights

Halozyme’s top line comprises product sales, royalties and revenues under collaborative agreements.

Several companies use HALO’s Enhanze technology to develop a subcutaneous formulation of their currently marketed drugs. Halozyme now has six marketed partnered drugs based on this technology, including the subcutaneous formulation of J&J’s Darzalex and Roche’s Phesgo.

Royalty revenues totaled $114.4 million in the third quarter, up almost 15% from the year-ago quarter’s level. This was mainly due to robust demand for JNJ’s subcutaneous Darzalexand RHHBY’s Phesgo. Royalty revenues accounted for nearly 53% of the company’s total revenues during the reported quarter. Royalty revenues missed our model estimate of $115.7 million.

Product sales came in at $86.6 million, about 41% higher than the year-ago quarter’s figure. HALO supplies API to ENHANZE partners like JNJ and RHHBY, contributing to product revenues. Product sales beat our model estimate of $70.5 million.

Revenues under collaborative agreements were $15 million, down almost 68.7% from the year-ago quarter’s level. Collaboration revenues fell short of our model estimate of $37.1 million.

Adjusted EBITDA was $114.9 million in the third quarter, marking a 4.3% increase from the prior-year quarter.

Adjusted net income decreased 2.7% to $100.5 million in the reported quarter.

Halozyme had cash, cash equivalents and marketable securities of $483.3 million as of Sep 30, 2023, compared with $348.3 million as of Jun 30, 2023.

2023 Guidance Updated

Halozyme maintained its previously issued revenue guidance for full-year 2023.

The company continues to expect total revenues in the range of $825-$845 million for 2023.

Revenues from royalties are anticipated in the range of $445-$455 million (unchanged).

However, the EBITDA projection has been raised to $430-$445 million from $420-$440 million, excluding amortization costs, implying year-over-year growth of 37% to 41%.

The company expects adjusted earnings in the range of $2.70-$2.80 per share, up from $2.65-$2.75 per share (excluding stock-based compensation expenses), indicating an improvement of 22% to 27% year over year. Halozyme’s earnings per share guidance does not consider the impact of potential future share repurchases.

Recent Updates

In October 2023, Bristol Myers BMY announced positive data from its late-stage study evaluating the efficacy of its subcutaneous (SC) formulation of Opdivo (nivolumab) compared with intravenous Opdivo in patients with advanced or metastatic clear cell renal cell carcinoma who have received prior systemic therapy.

BMY’s Opdivo SC is co-formulated with Halozyme’s drug delivery technology, Enhanze.

Opdivo, Bristol Myers’ PD-1 immune checkpoint inhibitor, is currently approved both as a monotherapy and in combination with Yervoy to treat a plethora of cancer indications in many countries, including the United States and the EU.

In September 2023, Roche announced that there could be a delay in the potential approval of SC Tecentriq (atezolizumab) as the company would need to update the chemistry, manufacturing, and controls processes for the product. As a result, Tecentriq SC’s potential launch in the United States is now expected in 2024.

Halozyme Therapeutics, Inc. Price, Consensus and EPS Surprise

Halozyme Therapeutics, Inc. price-consensus-eps-surprise-chart | Halozyme Therapeutics, Inc. Quote

Zacks Rank

Halozyme currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Bristol Myers Squibb Company (BMY) : Free Stock Analysis Report

Johnson & Johnson (JNJ) : Free Stock Analysis Report

Halozyme Therapeutics, Inc. (HALO) : Free Stock Analysis Report