Hamilton Lane Inc Reports Robust Growth in Management Fees and AUM in Q3 Fiscal 2024

Revenue: Management and advisory fees rose by 17% year-over-year.

Assets Under Management (AUM): AUM grew by 12% to $120.0 billion.

Earnings Per Share (EPS): GAAP EPS was $0.51, reflecting stable profitability.

Dividend: A quarterly dividend of $0.445 per share was declared, up 11% from the previous year.

Carried Interest: Unrealized carried interest balance increased by 18% year-over-year.

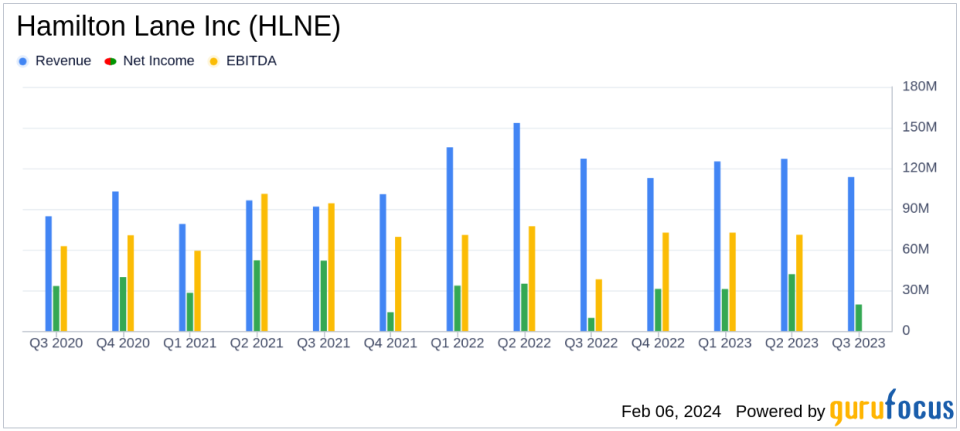

On February 6, 2024, Hamilton Lane Inc (NASDAQ:HLNE) released its 8-K filing, detailing the financial results for the third fiscal quarter ended December 31, 2023. The company, a global leader in private markets asset management, reported significant growth in both management and advisory fees, which increased by 17% to $113.6 million, and total assets under management, which saw a 12% increase to $120.0 billion. This growth underscores the firm's successful expansion and the increasing demand for its private market investment solutions.

Hamilton Lane specializes in providing a comprehensive range of investment solutions across private markets, including private equity, private credit, real estate, infrastructure, natural resources, growth equity, and venture capital. With nearly 700 professionals operating worldwide, the company's expertise in building flexible investment programs has been a key driver of its growth.

The company's financial achievements, particularly the growth in management and advisory fees, are critical in the asset management industry as they represent a stable and recurring revenue stream. The increase in unrealized carried interest balance, which rose to approximately $1.1 billion, up 18% from the previous year, also highlights the potential for future realized earnings. Additionally, the declared dividend increase reflects the company's confidence in its financial health and commitment to shareholder returns.

Financial Performance Analysis

Hamilton Lane's performance for the third quarter of fiscal 2024 was marked by several key financial metrics:

Key Financial Metrics | Q3 FY24 | Year-over-Year Change |

|---|---|---|

Management and Advisory Fees | $113.6 million | 17% |

GAAP Net Income | $19.5 million | 19% |

GAAP EPS | $0.51 | 11% |

Adjusted Net Income | $38.4 million | 7% |

Fee-Related Earnings | $45.3 million | 16% |

Adjusted EBITDA | $58.2 million | (11)% |

Hamilton Lane's Co-CEO Erik Hirsch commented on the results, stating, "Our commitment to excellence, innovation, and growth in the private markets has resulted in another strong quarter for Hamilton Lane. Calendar 2023 was a tremendous year for the firm across our customized separate accounts, specialized funds and tech partnerships, and we look forward to what lies ahead for 2024.

Our commitment to excellence, innovation, and growth in the private markets has resulted in another strong quarter for Hamilton Lane. Calendar 2023 was a tremendous year for the firm across our customized separate accounts, specialized funds and tech partnerships, and we look forward to what lies ahead for 2024.

The company's balance sheet remains robust, with a strong cash position and modest leverage. The total investment balance consisted primarily of approximately $392 million in investments in funds and about $212 million in technology-related and other investments. Hamilton Lane's strategic investments in its own products and controlled leverage reflect a prudent approach to capital management.

Overall, Hamilton Lane's third-quarter fiscal 2024 results demonstrate the firm's solid position in the private markets and its ability to generate growth in key financial areas. The company's focus on expanding its AUM and maintaining a diversified revenue base positions it well for continued success in the competitive asset management industry.

For more detailed information on Hamilton Lane's third-quarter fiscal 2024 results, please visit the company's website.

Explore the complete 8-K earnings release (here) from Hamilton Lane Inc for further details.

This article first appeared on GuruFocus.